海外研报

筛选

CARRY TRADE HARD LANDING?

Japan’s balance sheet is hugely distorted by the years of excess accommodation. It was always a toss-up as to which fragility was going to break first – maturity or currency mismatch. In the end,

海外研报

2024年08月06日

The Bear Traps Report With Larry McDonald

“The beast inside the market now has the Fed in its grip. The serpent will demand FAR more

海外研报

2024年08月06日

PANIC STATIONS!

1. Global recession risk, with CBs (perceived to be) behind the curve2. The unwind of the Yen carry trade (did BoJ hawkishness mark the top of

海外研报

2024年08月06日

MARKETS CAN TAKE WEEKS TO REBOUND FROM A VOLATILITY SPIKE

Friday’s weak NFP print put recession risks front and centre. However, one disappointing payrolls release is notenough to declare one: (1) 114k new jobs are consistent with economic expansion; (2) cyclical sectors are still

海外研报

2024年08月06日

GS Utilities Daily: ENWL sale has positive read across to SSE

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result,investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this

海外研报

2024年08月06日

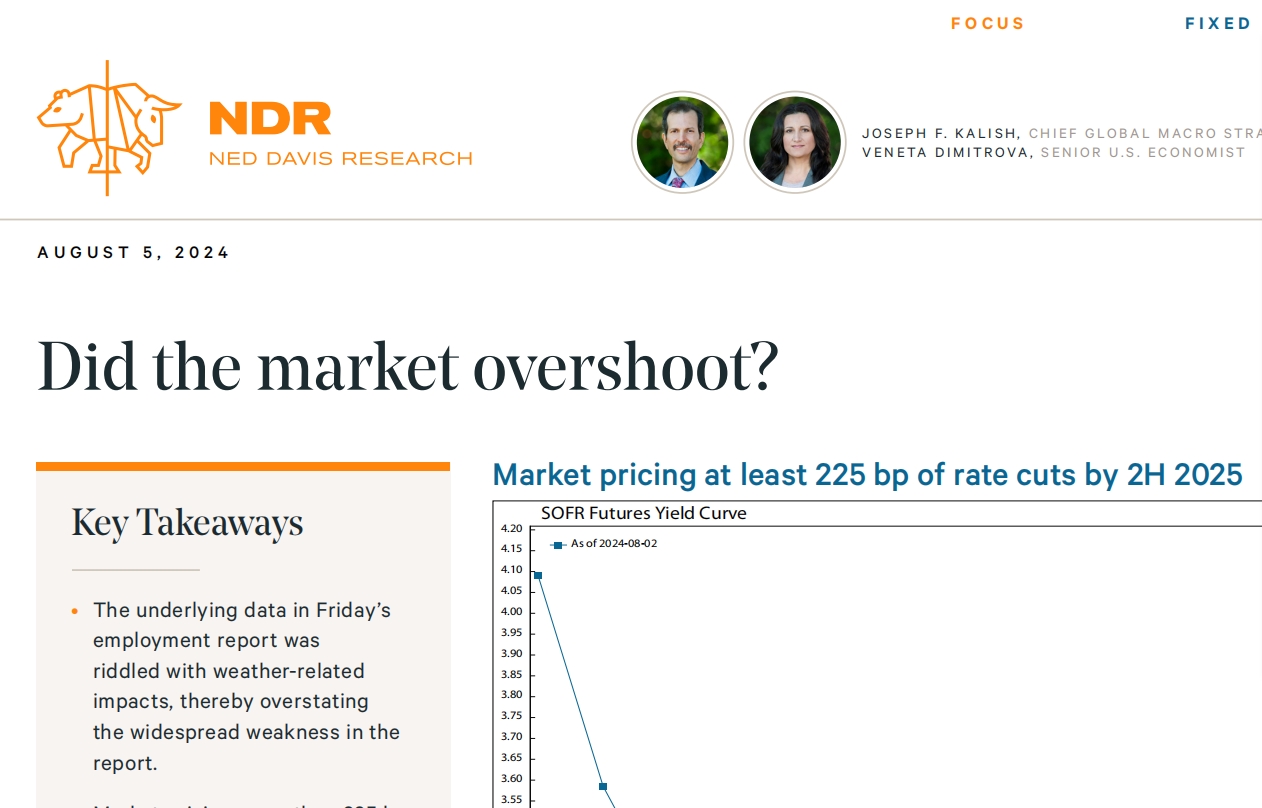

US July jobs report: Broad-based weakening risks steeper cuts

• A sizable deceleration in payrolls and the fourth consecutive increase in the unemployment rate (which triggered the Sahm Rule) point

海外研报

2024年08月06日

Healthcare Pulse: Oh August... Investor sentiment

Considerations for the XLV @ 10k Feet. Macronarratives got turned on their head yet again with the

海外研报

2024年08月06日