海外研报

筛选

The Weekly Worldview: The cycles advance

Last week was marked by three key central bank decisions. The BoJ hiked for the first time after ending negative interest rate policy (and specified a plan to reduce

海外研报

2024年08月12日

Japan Equities and the Yen

Incoming economic data may drive a further unwinding of JPY carry trades/FXhedged activity from overseas equity investors. We retain a bullish JPY skew.

海外研报

2024年08月12日

Global Data Watch

Recent discussion in these pages has focused on the shifting risk bias around our global narrative of sustained growth resilience, sticky inflation, and shallow

海外研报

2024年08月12日

Flows & Liquidity Where have we seen most unwinding?

Momentum-driven investors such as CTAs saw a sharp unwind of long equity positions, short yen and short 10y Bund and JGB positions, while

海外研报

2024年08月12日

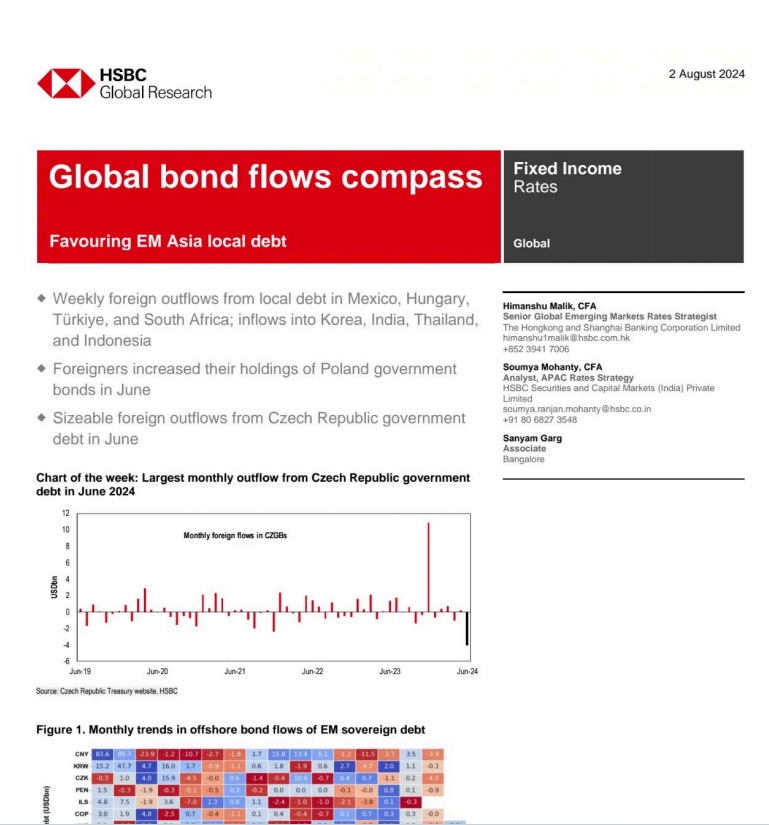

Global bond flows compass

Weekly foreign outflows from local debt in Mexico, HungaryT¼rkiye, and South Africa; inflows into Korea, India, Thailan?and

海外研报

2024年08月12日

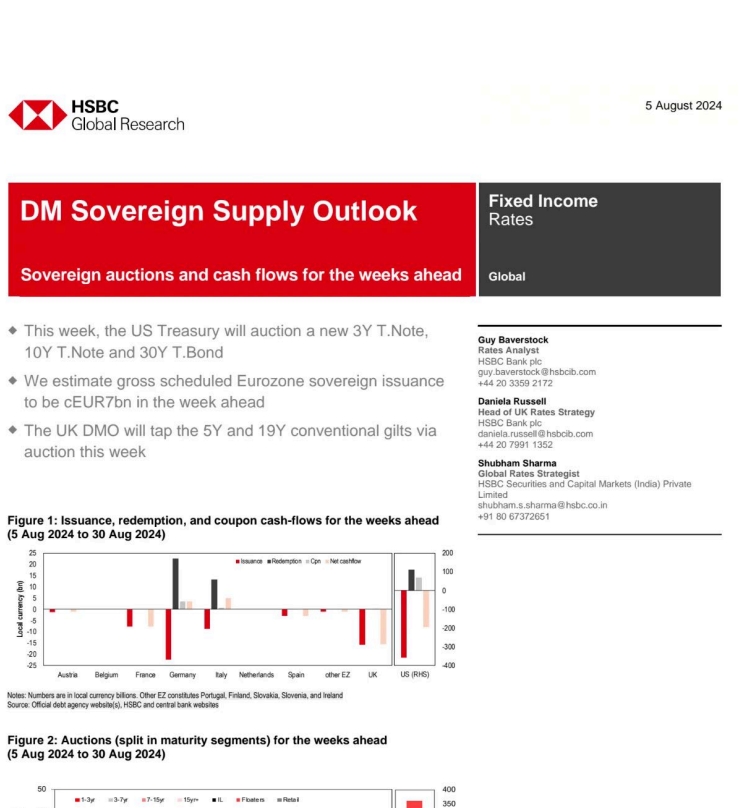

DM Sovereign Supply Outlook

This week, the US Treasury will auction a new 3Y T.Note.10Y T.Note and 30Y T.Bond

海外研报

2024年08月12日

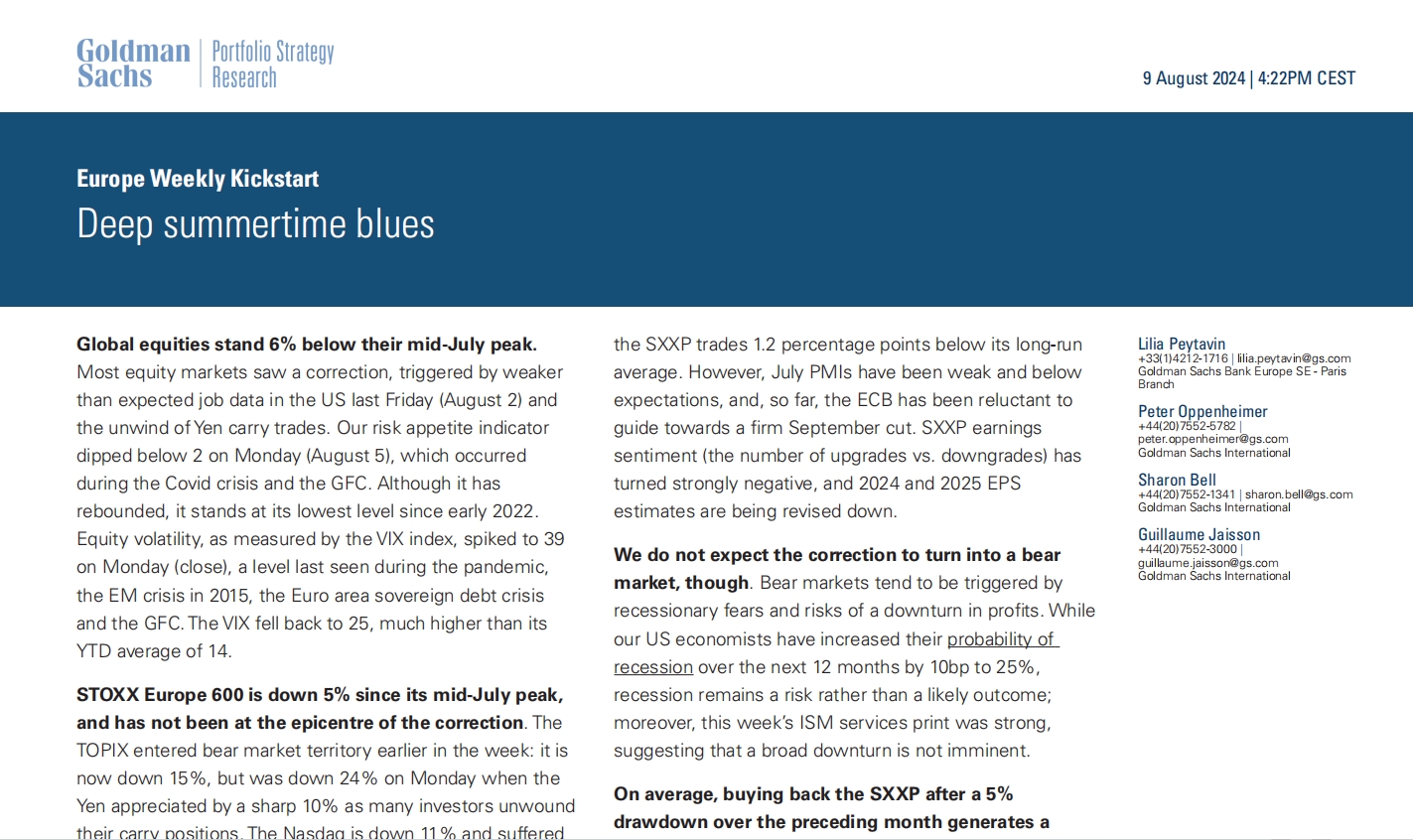

Europe Weekly Kickstart Deep summertime blues

Global equities stand 6% below their mid-July peak.Most equity markets saw a correction, triggered by weaker

海外研报

2024年08月12日

EM FX portfolio update: exiting COP and PHP underweights

We have exited our COP positions and PHP underweight positions (at USD/COP reference spot of 4047.55 and USD/PHP 57.29 respectively),

海外研报

2024年08月12日

Next week...this week

The JulyCPl reportin theUSdueWednesdaywillbe amongthekeyreleasesfornextweek ahead of the Fed's Jackson Hole symposium on August 22-24. Our USeconomistsexpectboth headlineandcore torise +0.20%MoMvs-0.1%and +0.1%MoM pace

海外研报

2024年08月12日

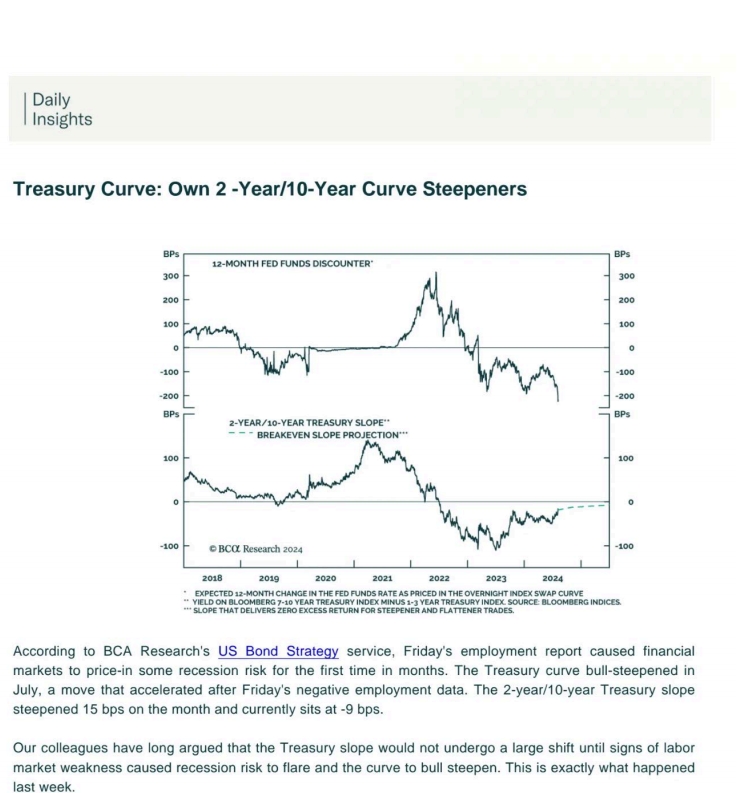

Treasury Curve: Own 2 -Year/10-Year Curve Steepeners

According to BCA Research's US Bond Strategy service, Friday's employment report caused financiamarkets to price-in some .

海外研报

2024年08月12日