海外研报

筛选

Indonesia_ BI cuts rates and signals further easing

Bank Indonesia cut its benchmark policy rate by 25bps to 6.00% in September.The deposit facility rate and lending facility rate were also lowered to 5.25% and

海外研报

2024年09月20日

GS Healthcare_ Contextualizing the Cut

On the back of yesterday’s FOMC meeting, GS economists see 50bp as the nright move in light of the good inflation news and the risk of further labor market

海外研报

2024年09月20日

GS--Buy Merck KGaA | Utilities REStart | EU Communacopia | New FOMC Forecasts | PayPal

Merck KGaA – initiate at Buy – We initiate coverage of Merck KGaA at Buy with a12m price target of €205. While we see a bumpy end to 2024, we believe the Life

海外研报

2024年09月20日

GS--Ukraine: NBU Keeps Policy Rate Unchanged (As Expected)

Bottom line: The NBU Board kept its policy rate unchanged at 13%, in line withexpectations and consistent with the Bank’s prior guidance, emphasizing the recent

海外研报

2024年09月20日

GS--Turkey: TCMB Remains on Hold and Cautiously Adjusts its Forward Guidance

In line with a unanimous consensus, the TCMB kept its policy rate unchanged at50.00%. The Committee acknowledged the lack of a notable slowdown in core

海外研报

2024年09月20日

GS-- Global RT volumes remain +ve through August, helped by steady developments in Europe

Europe growth supports global PC/LT RT volumes to +2% in August, offsetpartially by China and NA declines - Michelin released its latest market data for

海外研报

2024年09月20日

DeskTalk - FOMC risk rally at big levels

DXY Index is once again major support at 100.42-100.79 (200w MA, December 2023 low, Feb & March 2023 lows)while our trader's watching 1.1200-55 in EURUSD. We wait for the weekly close, Global FX Strategy argues Fed rate

海外研报

2024年09月20日

Commodities Weekly--All systems go in the commodities complex as the Fed begins its easing cycle

Global commodities: Commodities are relishing. In the last seven trading days lead-up to yesterday’s FOMC meeting, the Bloomberg Commodities (BCOM) index

海外研报

2024年09月20日

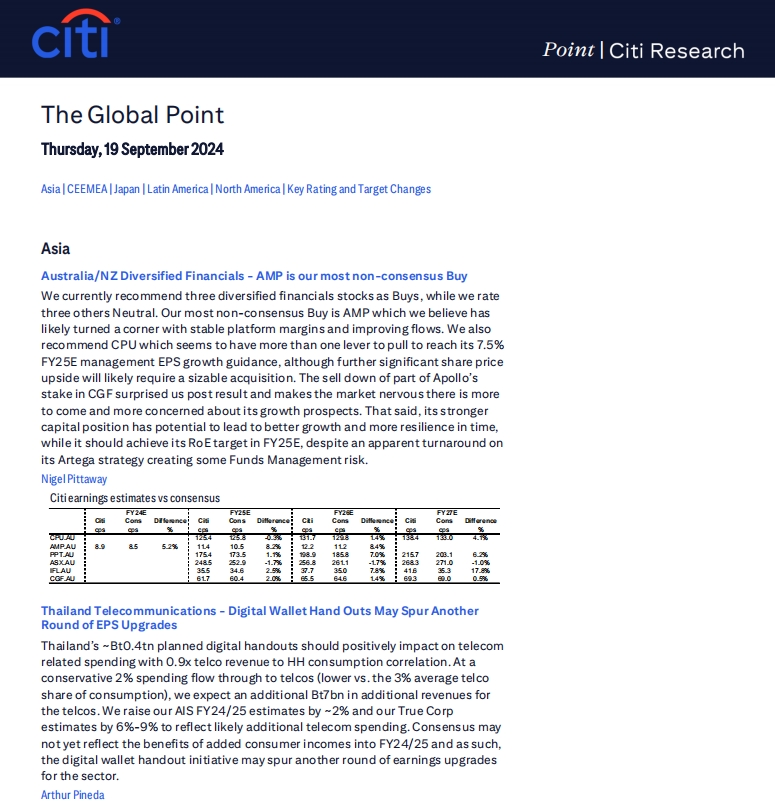

Citi_The Global Point Thursday, 19 September 2024

Australia/NZ Diversified Financials - AMP is our most non-consensus BuyWe currently recommend three diversified financials stocks as Buys, while we rate

海外研报

2024年09月20日

CB Views_ September 2024 FOMC Recap

The FOMC kicked off the start of its easing cycle with a 50bp cut, bringing the Fed Funds target range to 4.75-5.00%. The jumbo cut was

海外研报

2024年09月20日