海外研报

筛选

GD--NAVIGATING THE US SOFT PATCH

A deepening US soft patch and tech spillover weigh on EM risk sentiment◼ Local debt will fare well provided the dollar remains relatively benign

海外研报

2024年09月10日

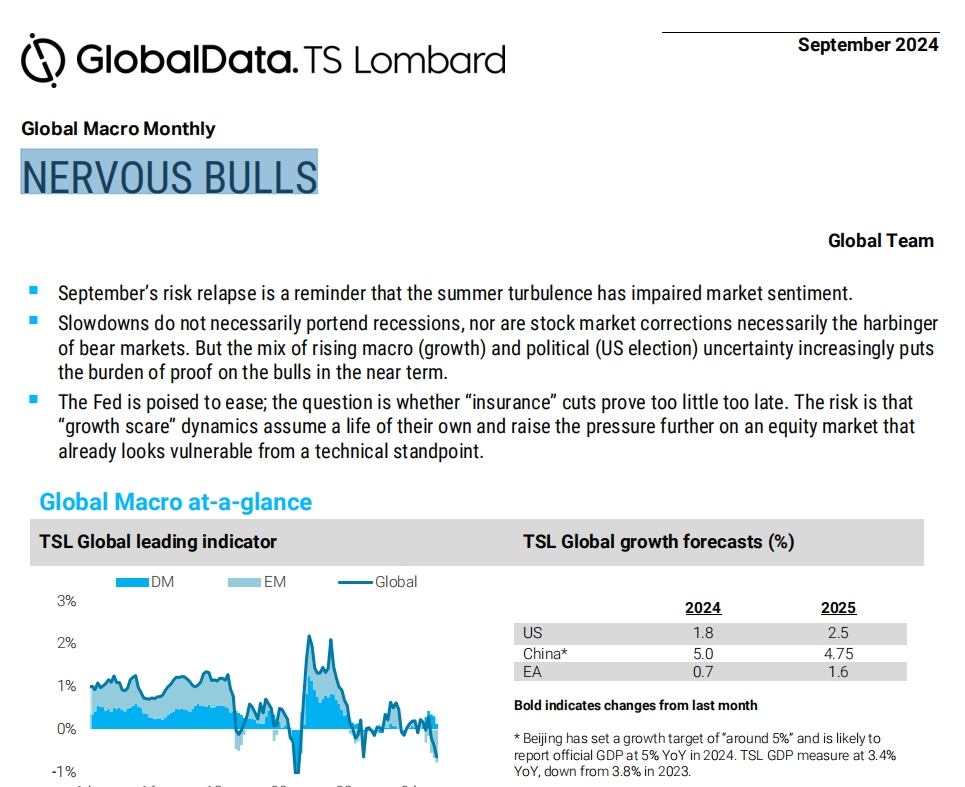

GD--NERVOUS BULLS

September’s risk relapse is a reminder that the summer turbulence has impaired market sentiment. ▪ Slowdowns do not necessarily portend recessions, nor are stock market corrections necessarily the harbinger

海外研报

2024年09月10日

Barclays - Global Rates Weekly_ Decision time

In the US, strength in income and underlying activity suggeststhat neutral is higher than currently priced in. We recommend

海外研报

2024年09月10日

Barclays_Barclays Equity Factor Insights_ September

We maintain Positive view on Growth and Negative view onValue across both regions, despite the recent weakness in US

海外研报

2024年09月10日

BNPP_GLOBAL OUTLOOK Q4 2024 CUTTING IT FINE

Central bank easing in the US and across most developed markets will helpstabilise growth in what we would continue to characterise as a soft landing.

海外研报

2024年09月10日

CR--Market comments

Friday’s US payrolls report was supposed to settle the question of whether the Fed would be cutting by 25bps next week, or 50. On Thursday of last week the OIS futures had 33.8bps of cuts

海外研报

2024年09月10日

GS--China Consumer Staples: Expert call takeaways

On Sept 3, we hosted a virtual conference with a large-scale Spirits and F&Bdistributor located in Hunan province. Key highlights include: 1) Spirits: The

海外研报

2024年09月10日

GS--Earnings matters: 10 key takeaways from 6000+ companies’ 2Q/1H24 results

Offshore led A-shares. 1H24 profit growth came in at 12%/0% forMXCN/CSI300. 41% of market cap beat expectations while 35% missed.

海外研报

2024年09月10日

CT--Global Economics Global Indicators August Chartbook: The World in Pictures

CITI'S TAKE Our global indicators chartbook shows ongoing resilience in services

海外研报

2024年09月10日

DU--CitiFX Wire - DeskTalk

USD, US equities and front-end yields are higher. We think price action reflects unwinds/exhaustion after a frustratingFriday and going into this week's events. This could continue on benign growth data (and potentially tighter polls) but

海外研报

2024年09月10日