海外研报

筛选

Final Destination--Global Daily

Yesterday, stocks were mostly down, but Nividia was up after refuting its DOJ subpoena story; oillower after an aborted rally; Treasury yields down as the US curve disinverted; and JPY up.

海外研报

2024年09月06日

Taiwan: August Inflation Inches Down

Taiwan’s headline CPI inflation inched down to 2.4% yoy in August from 2.5% theprevious month after three months of acceleration. The outcome was above

海外研报

2024年09月06日

The Harris Bounce--US special 01

With Kamala Harris on top of the Democratic ticket, the odds for the Democrats have dramatically improved. After weeks of media hype and her nomination at the Democratic

海外研报

2024年09月06日

Short long summer

Risks remain balanced for EUAs, although we think a move towards (and potentially below) our fair-value 3Q24 price of €70/t is most likely. We think the risks for this

海外研报

2024年09月06日

Macro & Strategy

In line with our Group’s vision to be the bank for Europe’s future, we continue to focus on product innovation and service excellence.

海外研报

2024年09月06日

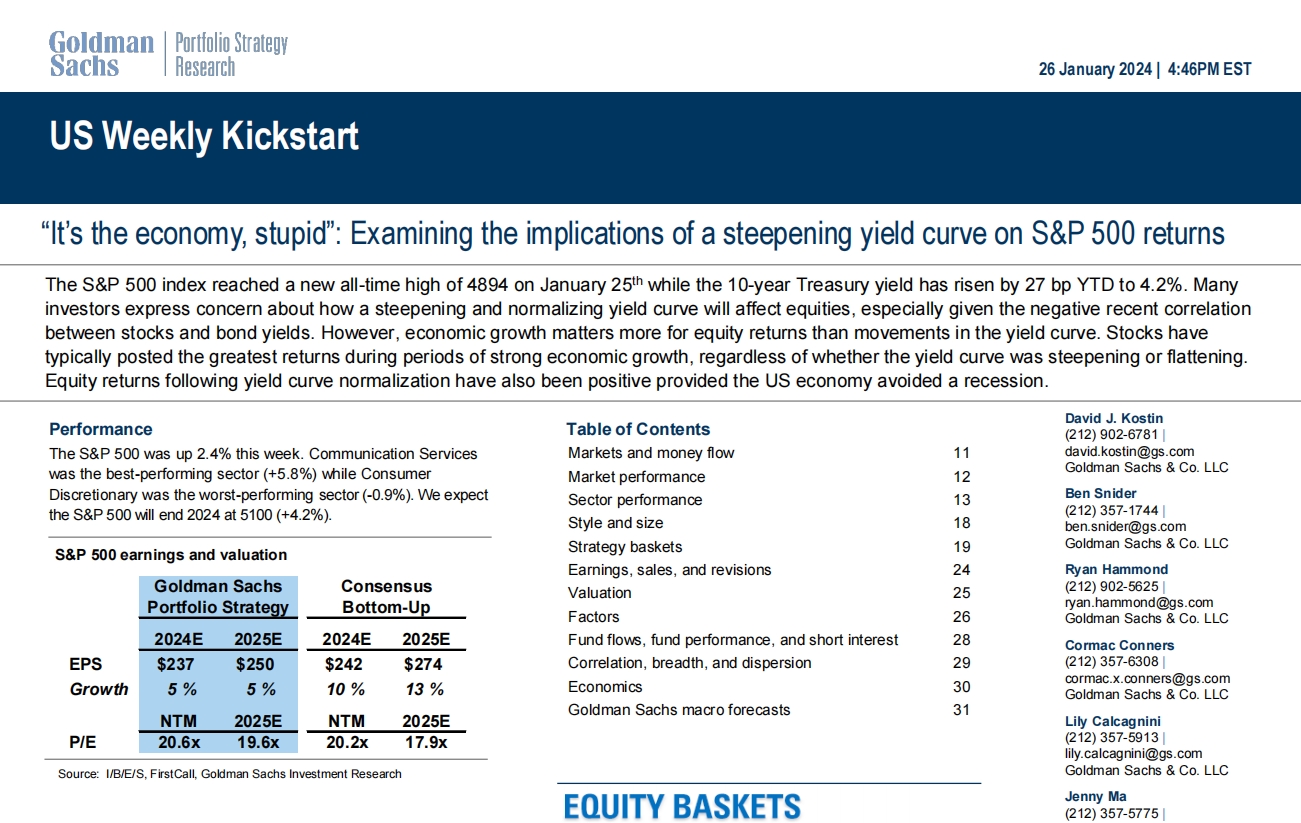

US Weekly Kickstart

The S&P 500 index reached a new all-time high of 4894 on January 25th while the 10-year Treasury yield has risen by 27 bp YTD to 4.2%. Many

海外研报

2024年09月06日

ADP Employment Below Expectations

BOTTOM LINE: According to the ADP report, private sector employment increasedby 99k in August, below consensus expectations, and employment in July was

海外研报

2024年09月06日

CitiFX Wire | Linear Trading

The market seems to still have an appetite to sell USD on the basis that unless Friday’s number is a super strongoutcome, then the August narrative can reassert itself, and the unwind of 2024’s dollar long overhang can continue. (For

海外研报

2024年09月06日

GD-August Employment Data Will Keep Fed At 25 But It Should Not

August employment data continue the portrayal of an economy running out the string, nearing an inflection point.Yes, August was an uptick from June and July, but given the combined 86,000 downward revision to those months,

海外研报

2024年09月09日

Barclays_Global Economics Weekly Easing time has come

Easing time has comeWhile the US jobs report did not bring final clarity on the size

海外研报

2024年09月09日