海外研报

筛选

ECB HAWKS TRYING TO MANAGE CUT EXPECTATIONS

Headline HICP at 2.2%, softer wages, worsening EA growth and stalling new hiring finally overshadow concerns about service inflation – a September cut is coming

海外研报

2024年09月06日

VOLATILE MARKETS FAVOUR EM CREDIT

EM equity investors will remain cautious about re-entering the market. EM equity indices have fully made up the ground lost in the global market rout at the start of last month, but many

海外研报

2024年09月06日

AN ECONOMIST’S GUIDE TO NVIDIA

It is a sad state of affairs (for economists, anyway) when the latest earnings report from asingle stock name is a much bigger deal than the US CPI or non-farm payrolls. But tha

海外研报

2024年09月06日

BULL MARKET CRACKING?

Markets have rebounded sharply after the vol spike in early August and the equal weight S&P 500 had marked a new all-time high. Our pro risk trades have paid off, with the longs on the equal

海外研报

2024年09月06日

FOREIGN INVESTORS SKIP A HIGH GROWTH STORY

Despite India’s relatively fast-paced GDP growth and stable macroeconomic parameters, foreign investment has been lacking in terms of both long-term FDI as well as short-term FII

海外研报

2024年09月06日

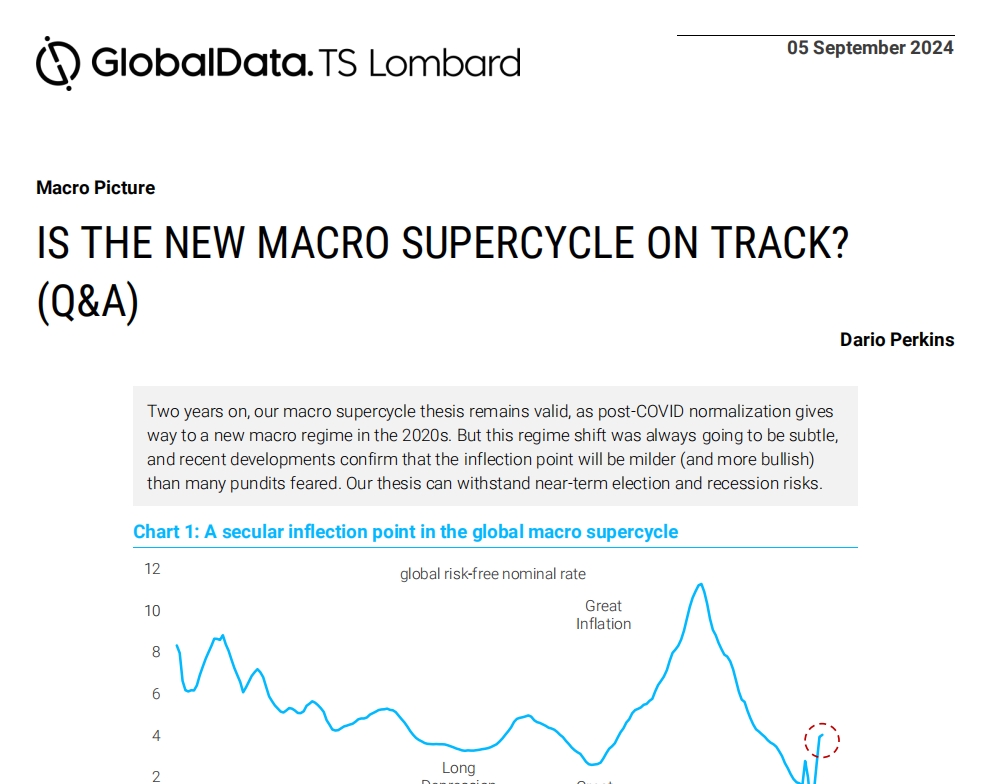

IS THE NEW MACRO SUPERCYCLE ON TRACK?

Two years on, our macro supercycle thesis remains valid, as post-COVID normalization gives way to a new macro regime in the 2020s. But this regime shift was always going to be subtle,

海外研报

2024年09月06日

A more dovish ECB on inflation?

Last time, in June, the ECB surprised markets with significant upward revisions onthe inflation path while cutting its rates. This time, we expect the second rate cut

海外研报

2024年09月06日

Asia-Pacific Growth Monitor: Steady overall, SE Asia outperforming

This publication summarizes regional and country-specific growth data across nthe Asia-Pacific economies we cover. In most cases, the latest data points arefor August 2024.

海外研报

2024年09月06日

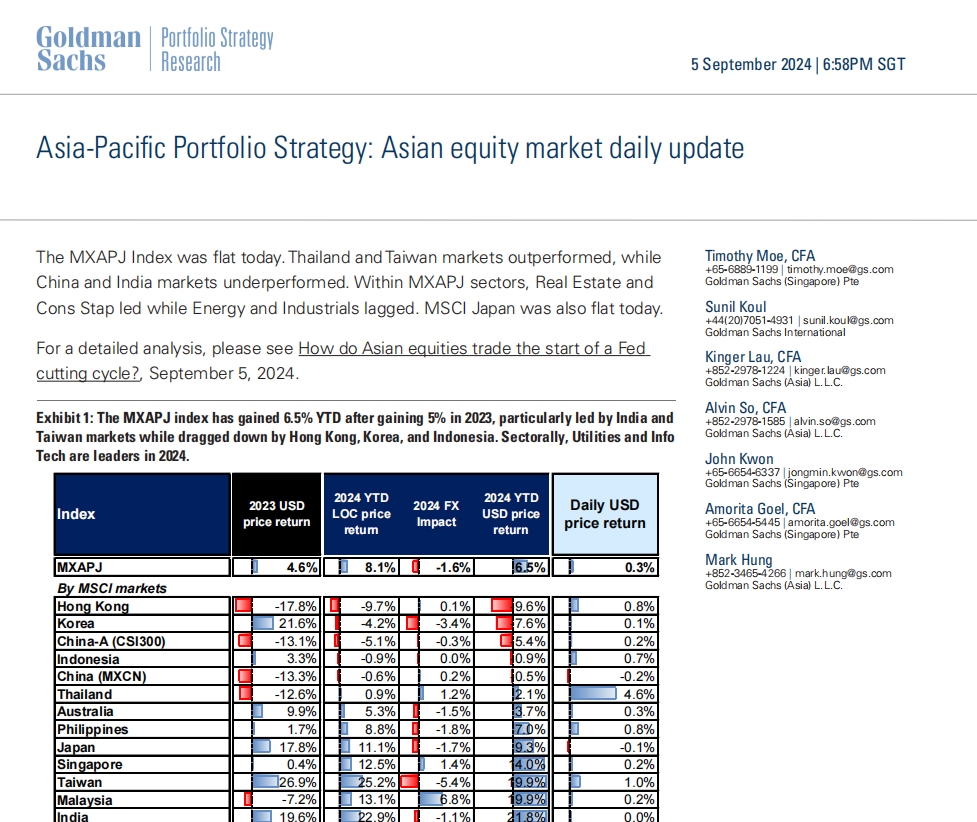

Asia-Pacific Portfolio Strategy: Asian equity market daily update

The MXAPJ Index was flat today. Thailand and Taiwan markets outperformed, while

海外研报

2024年09月06日

August employment preview: improved from July

We expect nonfarm payrolls to rise by +165k in August, bouncing back somewhat from the soft print of just +114k in July. If our forecast is on

海外研报

2024年09月06日