海外研报

筛选

BofA Securities Equity Client Flow Trends Near-record week of equity outflows

Biggest net sales since Nov. 2020• Biggest net sales since Nov. 2020: In the final week of August (ahead of a

海外研报

2024年09月05日

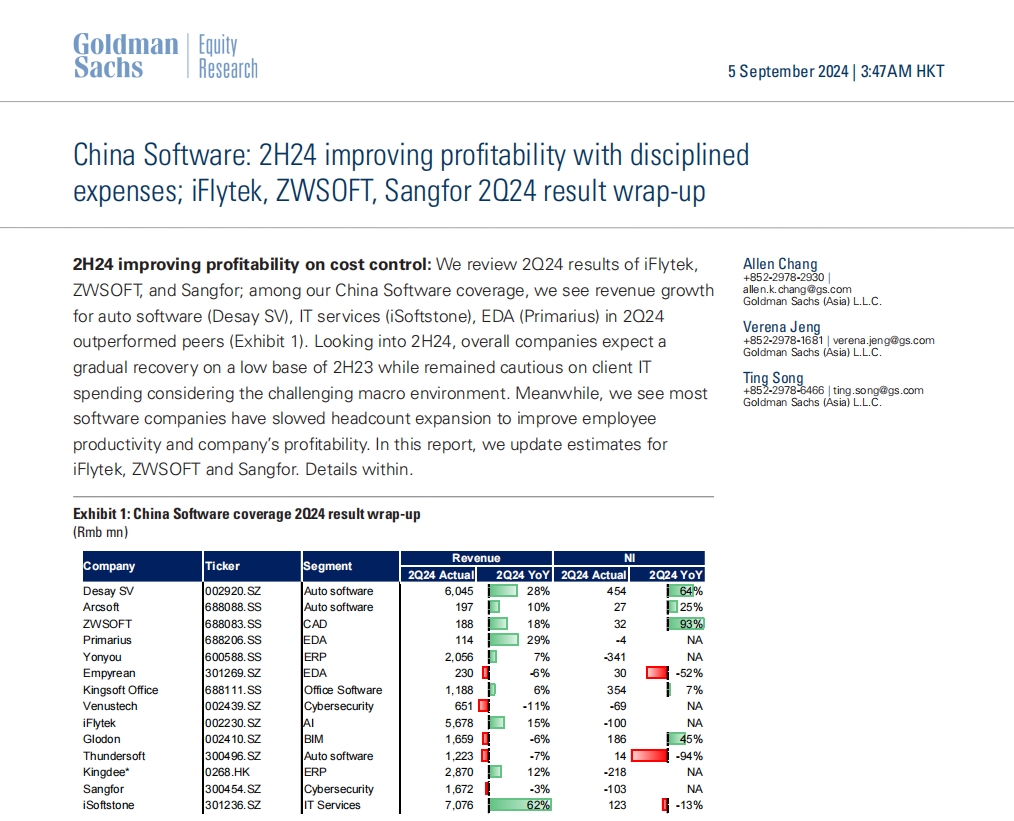

China Software: 2H24 improving profitability with disciplined expenses; iFlytek, ZWSOFT,

2H24 improving profitability on cost control: We review 2Q24 results of iFlytek,ZWSOFT, and Sangfor; among our China Software coverage, we see revenue growth

海外研报

2024年09月05日

The Global Point Wednesday, 04 September 2024

Global Multi-Asset - Industrial Technology & Mobility: How disruptive forces are driving the M&A landscape in Industrials; Focus on Germany

海外研报

2024年09月05日

Dollar Tree Stores Inc. (DLTR): First Take: 2Q miss; FY guidance lowered

DLTR reported 2Q adj EPS of $0.67, below the GS estimate of $1.07 and consensus(Refinitiv) of $1.04. Consolidated SSS of +0.7% was below GS/consensus at

海外研报

2024年09月05日

Q1 2024 ETP flows round up

At the global level, equity ETPs led the way in Q1 ($255B), alongside inflows into fixed income ($80B) and continued selling of commodities (-$6.7B). This compares with the $274B added to equities, $95.6B into

海外研报

2024年09月05日

Obesity/Diabetes thoughts into EASD and through the end of 2024

For Roche, we see negative risk/ reward into the EASD presentations with nthe stock already reflecting a largely best case scenario given the stage of

海外研报

2024年09月05日

Europe Technology: Hardware: Key investor questions for European Digital Enablers at the

Ahead of the GS Communacopia + Technology Conference in San Francisco(September 9-11), we summarise key investor questions for our coverage, spanning

海外研报

2024年09月05日

A severe case of COVIDIA: prognosis for an AI-driven US equity market

NVIDIA and its GPU customers are now a large driver of equity market returns, earnings growth, earnings revisions, industrial production and capital spending. NVIDIA’s financial results are extraordinary (it beat on

海外研报

2024年09月05日

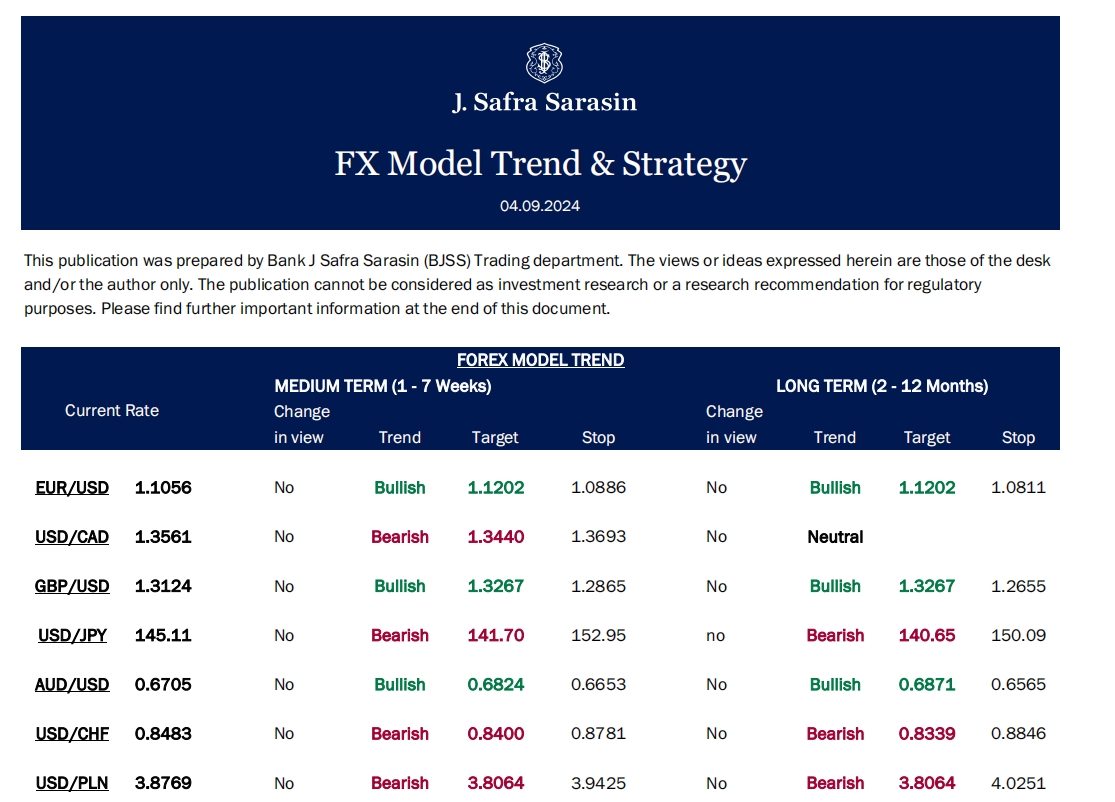

FX Model Trend & Strategy

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed herein are those of the desk

海外研报

2024年09月05日

Hidden messages of Jackson Hole 2024: how could the Fed enhance its labour market assessment?

On this second topic discussed at Jackson Hole, two major economists offered both mild critiques of the Fed’s 2021-22 labour market

海外研报

2024年09月05日