海外研报

筛选

Asia Cross Asset Focus – Monthly

Focus of the month – APAC’s monetary policy outlook and market implicationsNow that the Fed is dovish and the dollar is weaker, there are no more external hurdles stopping

海外研报

2024年09月03日

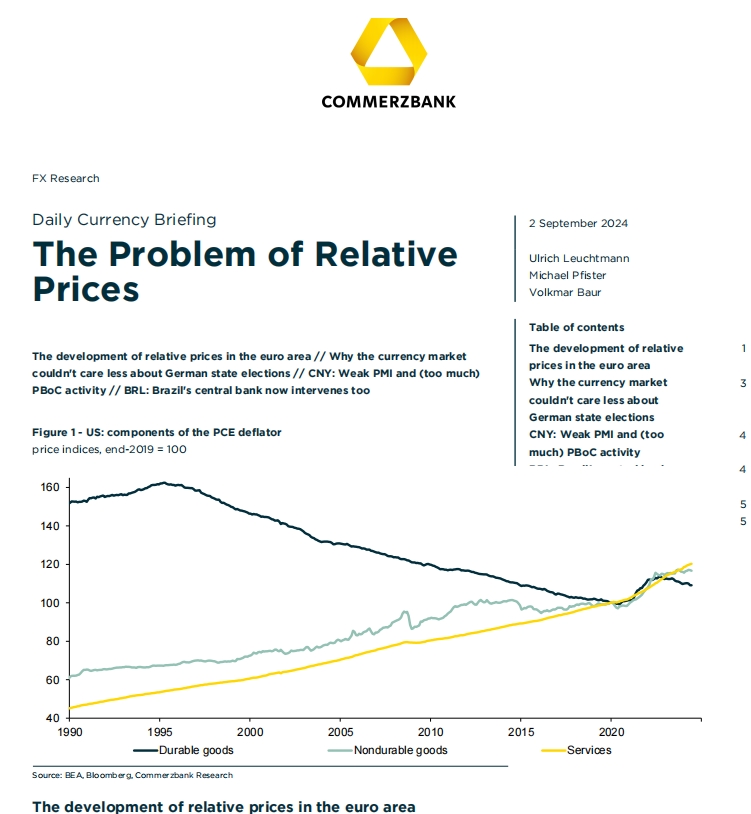

The Problem of Relative Prices

One of the points I don't understand was brought home to me again when I read what ECBExecutive Board member Isabel Schnabel said on Friday: that the ECB's monetary policy

海外研报

2024年09月03日

FAST FX Fair Value Model

The UK bank holiday last Monday meant the FAST FX model did not enter any trades last week. The model remains up 2.50% over the past year

海外研报

2024年09月03日

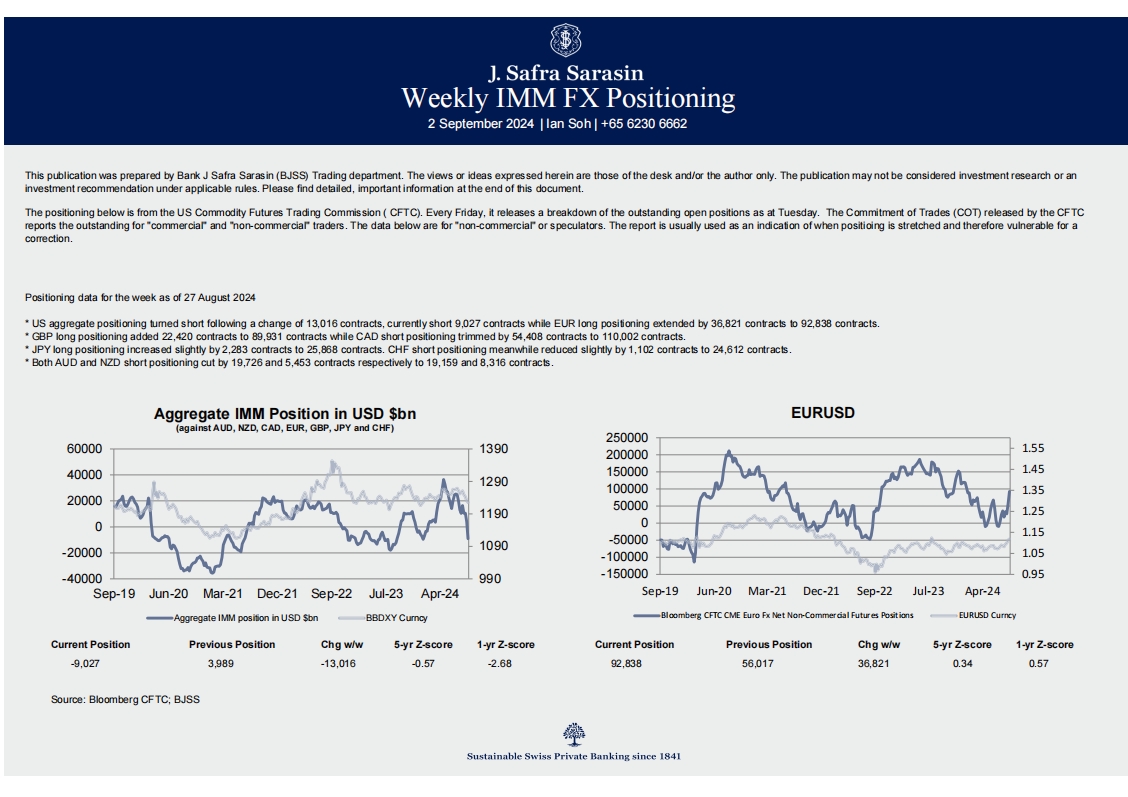

Weekly IMM FX Positioning

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed herein are

海外研报

2024年09月03日

TOP 5 CLIENT QUESTIONS

Is the US in recession or will it be in the next 12 months? Recession probably hasn’t started yet. The economy is entering a soft patch but the Fed will now begin cutting every

海外研报

2024年09月05日

Investment Banking Monitor: Some improvement in M&A and DCM, but weaker ECM

Announced August investment banking activity levelsrose 9% YoY and were only 2% below average August

海外研报

2024年09月05日

nterest Rate Cuts; Analysis Shows Transports Fare Well

Bottom Line: As the probability that a rate cut comes more into view at theSeptember Fed meeting, we wanted to refresh our analysis on share price

海外研报

2024年09月05日

How do Asian equities trade the start of a Fed cutting cycle?

Post-Fed cut performance hinges on the growth backdrop: While performancefollowing the first Fed cut has varied widely, the MXAPJ median performance has

海外研报

2024年09月05日

Capital at risk: nature through an investment lens

As natural resources come under growing strain, we see new risks and opportunities emerging for investors. An

海外研报

2024年09月05日

Global Equity Volatility Insights Return of Fed put adds to risk of fragility

The time has come… to dust off the fragility playbookAt Jackson Hole, Powell spoke of contained inflation, lower rates ahead, and a revived

海外研报

2024年09月05日