海外研报

筛选

Intel considering strategic options -potential impact

Over the weekend, press articles indicated that Intel is exploring strategic optionsto turn around its business, including scrapping some factories, selling assets aswell as potentially splitting or spinning-ofits Foundry and product/design teams.In

海外研报

2024年09月03日

Long-end better value

For markets, the summer has come to a close and activity resumes with bond issuance picking up from a number of countries including some unusual very longend supply prospects. While small bond

海外研报

2024年09月03日

Market Review & Outlook

Review – A roller-coaster rideIn August, markets experienced a roller-coaster ride. The Fed had

海外研报

2024年09月03日

KEY EVENTS IN THE MONTH AHEAD

After the turmoil at the start of August risk appetite rebounded sharply and we start September with the dollar at weaker levels – the DXY index fell by 2.3% in August as

海外研报

2024年09月03日

More headwinds than tailwinds

Rates: Bunds should face more headwinds than tailwinds over the coming dayswith month-end support out of the way, markets bracing for more supply and the

海外研报

2024年09月03日

ETFs – A New Landscape

Many 'new' ETF products allow more investors to gain exposure to alternative portfolios diversifiers as they shift away from pure 60/40 equity/bond strategies.

海外研报

2024年09月03日

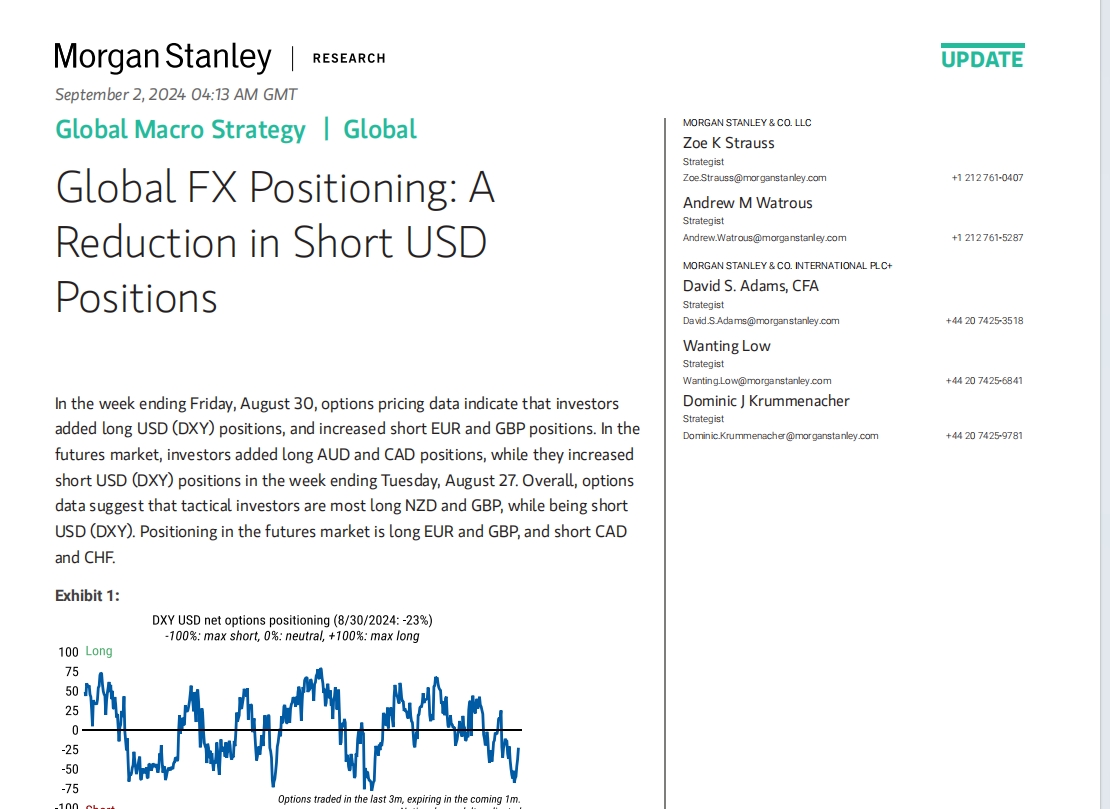

Global FX Positioning: A Reduction in Short USD Positions

In the week ending Friday, August 30, options pricing data indicate that investors added long USD (DXY) positions, and increased short EUR and GBP positions. In the

海外研报

2024年09月03日

Fixed Income Weekly Back to reality

September is about to begin with a series of key data that will enable the market to finetune its rate cut pricing. As central banks aim to ease their monetary policy stance preemptively, there is no reason to rush

海外研报

2024年09月03日

FX View Humpty Dumpty dollar?

The first of the two charts below shows the dollar’s real effective value since 1980 during which time we have already seen two major rallies (in the first half of the 1980s and the second

海外研报

2024年09月03日

Week Ahead in Economics

US non-farm payrolls will take centre stage next week. Following the soft July figure, we expect a rebound to 175k, which is a moderation from the pace seen earlier in the year. This

海外研报

2024年09月03日