海外研报

筛选

Cross-Asset Weekly

Don’t underestimate the US consumerConcerns about the US consumer's health have risen in recent months as the labour market has cooled. These fears may be

海外研报

2024年09月02日

ECB—Recent Commentary Points to Limited Change in the Projections and Communication in September

BOTTOM LINE: Recent ECB commentary has argued that the incoming data broadlyconfirms the baseline scenario and that policy rates can be lowered further if the

海外研报

2024年09月02日

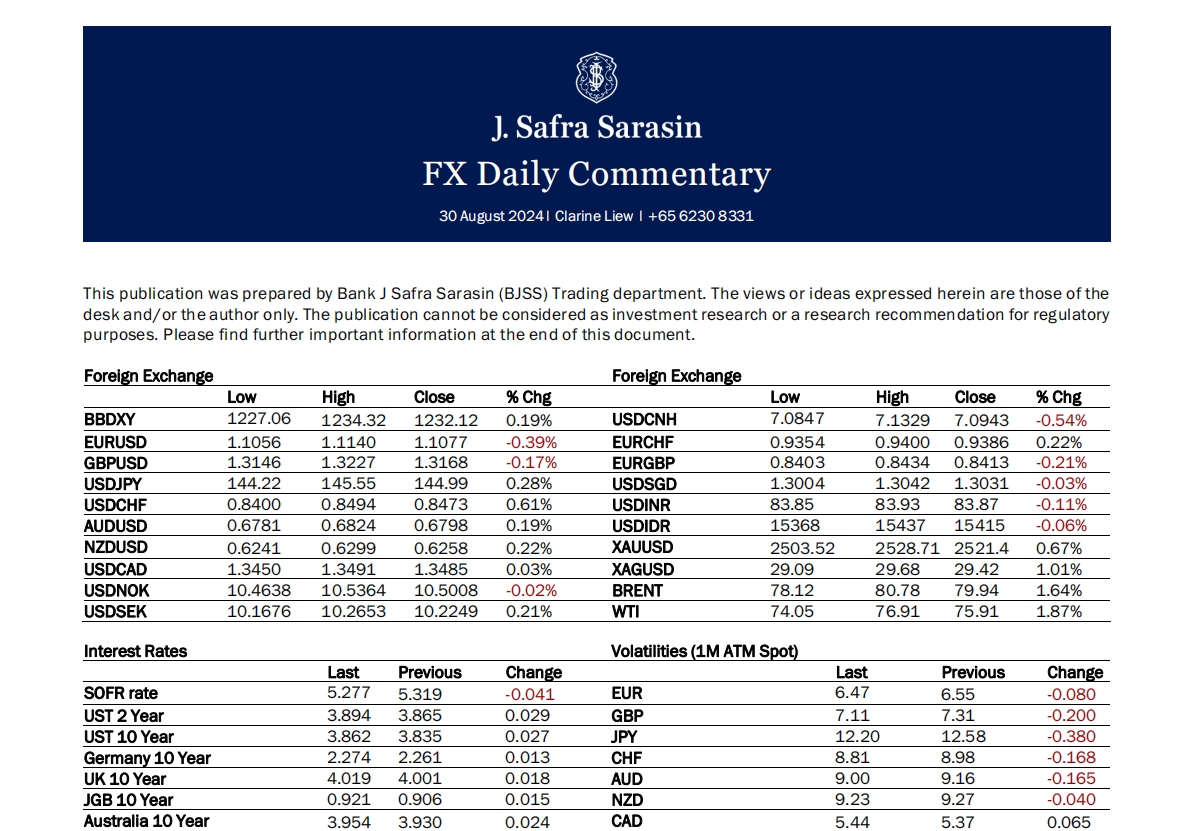

FX Daily Commentary

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed herein are those of the

海外研报

2024年09月02日

A Little Less Resilient

One of the outstanding features of Europe’s long stretch of sub-par growth has been the surprising resilience of the continent’s labor market. For six

海外研报

2024年09月02日

Global FX Trader Waiting for Labor Da(y)ta

Our thoughts on USD, CNY, EUR, CAD, & TRYUSD: Rates in the driving seat for now. Despite recent market turbulence, the nUS economy looks close to achieving a soft landing, with the Fed likely to deliver

海外研报

2024年09月02日

Global Rates Trader Policy Priorities Diverge

Ahead of key US data next week, signals out of the US have furthered the post-JulyNFP theme. Incremental inflation news has reinforced the shift in Fed focus towards

海外研报

2024年09月02日

Latest monthly NISA data still showing strong growth

Summary of the weekTOPIX: 2,712.63 (1.0%) / NK225: 38,647.75 (0.7%)

海外研报

2024年09月02日

J.PMorgan US Weekly Prospects

3Q GDP growth tracking stronger on signs of solidconsumer spendingBusiness spending has been more cautious and busi-ness sentiment is downbeat

海外研报

2024年09月02日

It’s About Labor Markets Now

The Fed is shifting focus toward the labor market. Because we expect slowing but no slump, we think the Fed resets policy

海外研报

2024年09月02日

Cycle Playbook – Preparing for a Peak

Amid the excitement around AI, we must not lose sight of the cyclical nature of semiconductors and tech hardware. As we approach a cycle peak, we share our insights on navigating the transition.

海外研报

2024年09月02日