海外研报

筛选

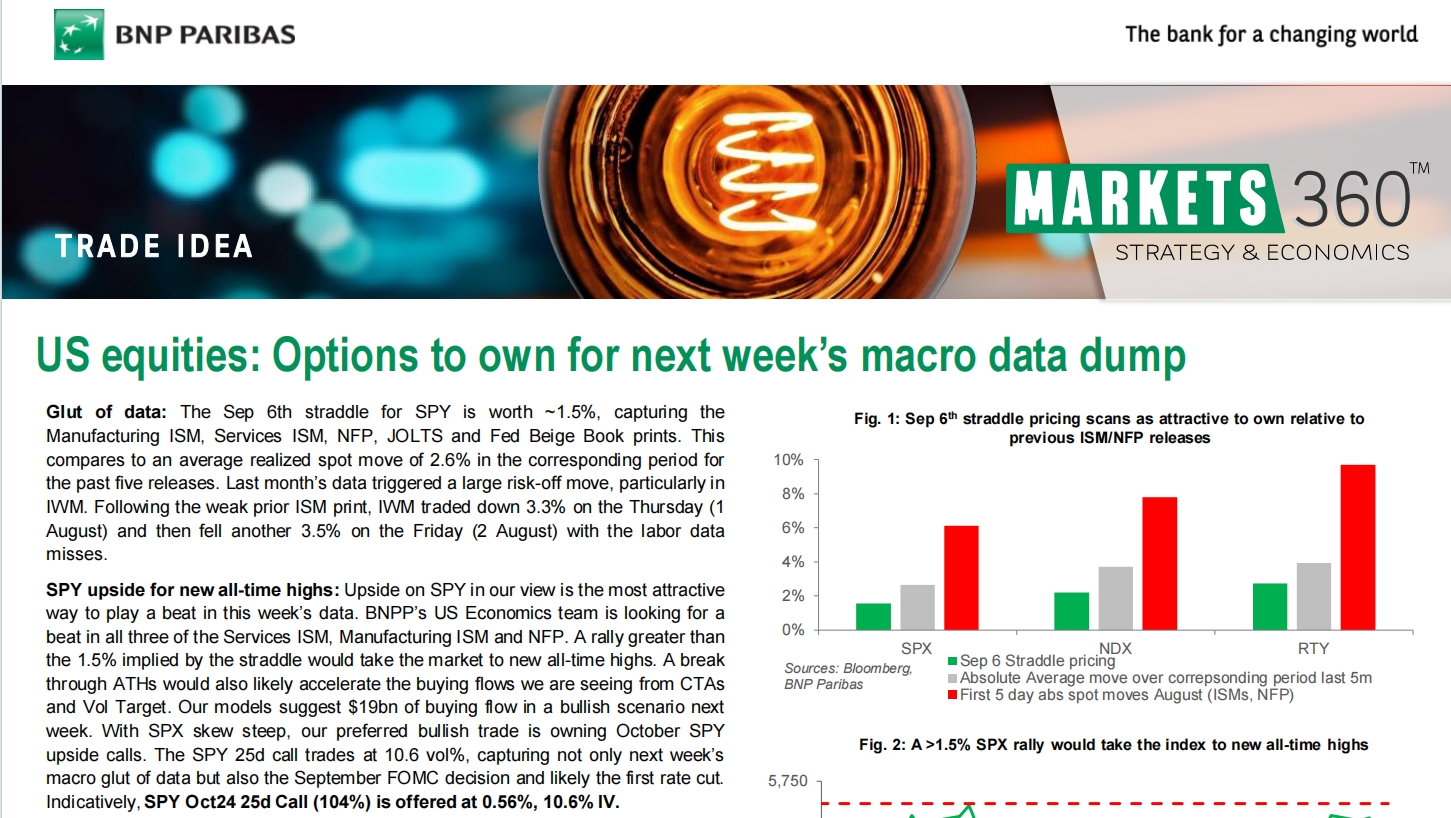

US equities: Options to own for next week’s macro data dump

Glut of data: The Sep 6th straddle for SPY is worth ~1.5%, capturing theManufacturing ISM, Services ISM, NFP, JOLTS and Fed Beige Book prints. This

海外研报

2024年09月02日

Active managers’ holdings update What are your neighbors doing?

2Q trades: LOs bought Comm. Svcs., sold cyclicalsOver the last quarter, long-only funds (LOs) increased their relative weight in

海外研报

2024年09月02日

Low-income core consumer pressures 2Q comp, see continued risks; Underperform

F2Q adj. EPS $1.70 & comps +0.5% below estsDollar General’s (DG) 2Q adj. EPS of $1.70 was below our $1.84 est. and the Street at

海外研报

2024年09月02日

Global Emerging Markets Weekly USD’s summer soft spot for EM

The View: USD’s summer soft spot for EMEM investors remain focused on whether EM assets can benefit from further USD

海外研报

2024年09月02日

Global FX weekly What’s next for the USD?

USD. Close to fair value, balanced risks near term, but we remain bearish further out.China matters despite decoupling optics, could further restrain near-term USD sell-off.

海外研报

2024年09月02日

Global Research Unlocked Normalizing consumption keeping inflation civil

Key takeaways• BofA Global Research analysts join the podcast to discuss emerging risks, opportunities and growth themes in global markets.

海外研报

2024年09月02日

August CPI: Price hikes spreading gradually in private services

August CPI: Strongest growth in a year, exceedingforecastsToday’s August Tokyo CPI was an upside surprise, with the Japan-style core CPI (ex.

海外研报

2024年09月02日

NVDA, OKTA, PNC, XLF and new highs versus new lows

Three stocks, one ETF and another solid breadth indicator

海外研报

2024年09月02日

Stretched positioning a risk to UST market’s favorite trade

Key takeaways• The most notable positioning shift in recent weeks has been the duration bid concentrated at the front end of the curve

海外研报

2024年09月02日

Cheatsheet - G10 & EM Week Ahead: One ring to rule them all

Labor Day means a long weekend in the US and Canada.US NFP, prefaced by JOLTS, ISM services employment, and weekly jobless claims, will be critical for macro sentiment. Fed

海外研报

2024年09月02日