海外研报

筛选

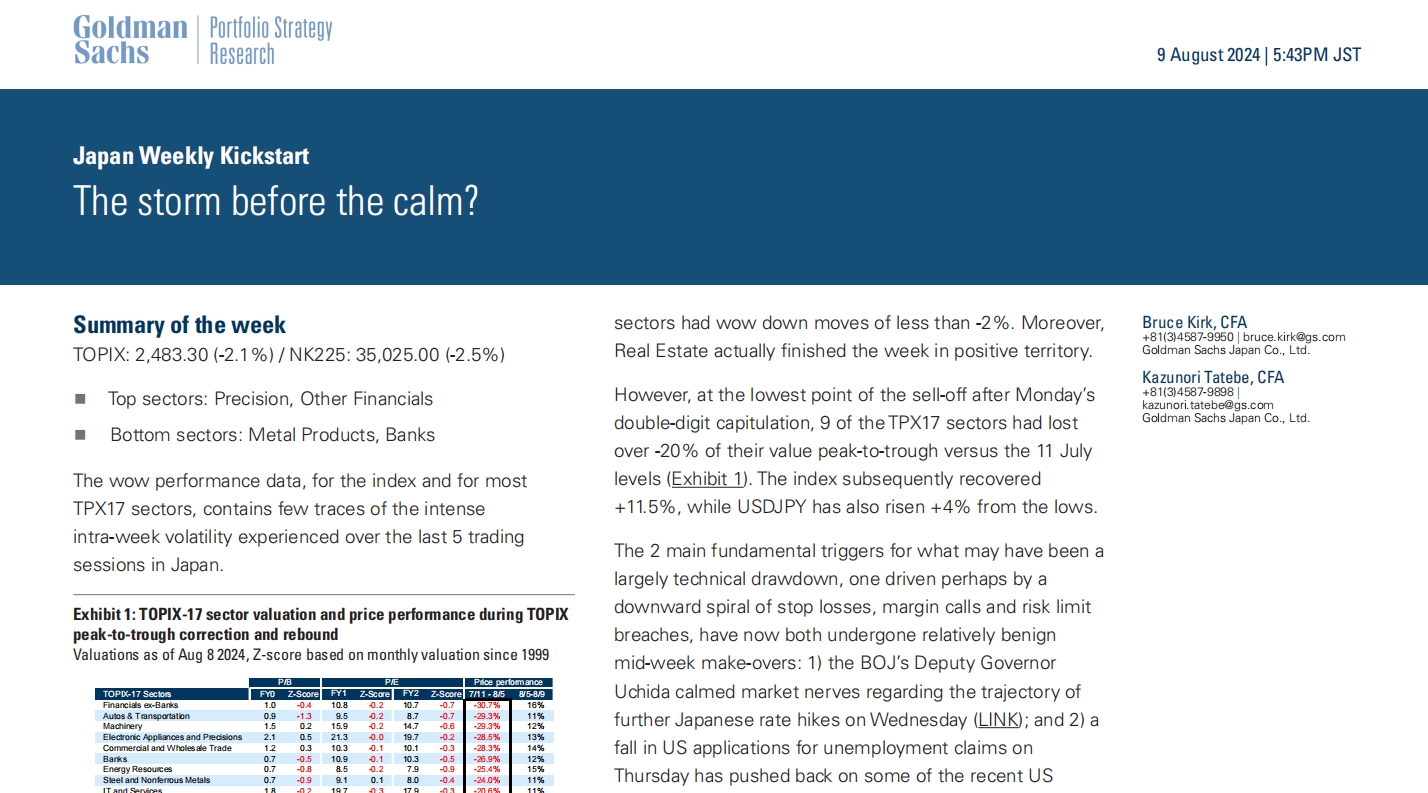

The storm before the calm?

sectors had wow down moves of less than -2%. Moreover,Real Estate actually finished the week in positive territory.

海外研报

2024年08月12日

US Weekly Prospects

Compared to last week’s event-filled calendar, the relatively quiet schedule this week gave time to pause and reflect on the

海外研报

2024年08月12日

A slowing, not a slump: what we're watching

We expect a moderate slowdown, and the Fed cutting 25bps in September. But the burden of proof is on the soft landing. Last

海外研报

2024年08月12日

The Global 360 Our views around the world

Morgan Stanley does and seeks to do business with companies covered in Morgan Stanley Research. As a result, investors should be aware that the firm may have a conflict of

海外研报

2024年08月12日

Implied Thoughts Four key takeaways from the latest sell-off

The short-term rates market is still fully pricing in a recession (and risks position unwinds if data doesn’t comply).

海外研报

2024年08月12日

On Our Minds-Consumers help lift 2024 growth estimate, but 2025 outlook has weakened

Recent industrial production and retail sales data point to strong consumptionfueled growth in 2Q24, with a carryover effect leading us to upgrade our 3Q24

海外研报

2024年08月12日

US Economics Weekly Risingunemployment is not“transitory'

CITI'S TAKEThe rise in the unemployment rate is the clearest sign yet that rather thanachieving a “soft landing" the US economy is more likely to slide intorecession.Attempts to explain away

海外研报

2024年08月14日

There’s No Place Like Home: close-out and home repatriation of Yen-funded positions triggers global

Years of negative policy rates enticed Japanese households, pension plans, state-owned banks and the Bank of Japan itself to create what Deutsche Bank estimates as a $20 trillion carry trade0F

海外研报

2024年08月14日

Central Bank Policy Tracker August 2024

Recent policy changes: DM central banks have continued to cut rates, with23.3% (on a GDP-weighted basis) lowering policy rates over the last three

海外研报

2024年08月14日

G7 and BIC outlook

Although the labor market has cooled substantially, there is not enough evidence of recession in the near-term.

海外研报

2024年08月14日