海外研报

筛选

UK—July Inflation and June Labour Market Preview

BOTTOM LINE: We expect the upcoming July inflation print (scheduled for releaseon 14th August) to see services inflation decelerate to 5.48%, down from 5.74% in

海外研报

2024年08月10日

Ukraine: Inflation Rises Above Mid-Point of Target, As Expected

Bottom Line: Headline CPI rose by 0.6pp to +5.4%yoy in July, broadly in line withour forecast and consensus expectations (both +5.3%yoy). This marks the first time

海外研报

2024年08月10日

MONETARY POLICY MATTERS, BUT GROWTH MATTERS MORE

Macro Drivers: Despite the soft payroll numbers, a US recession remains unlikely ◼ Multi Asset: Fed cuts are only good for risk assets when a recession does not follow

海外研报

2024年08月12日

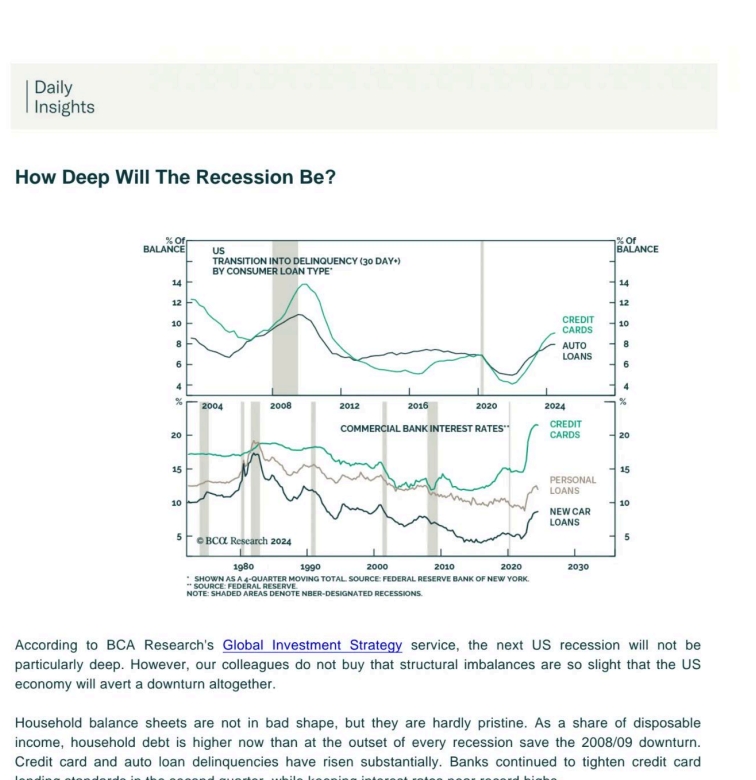

How Deep Will The Recession Be?

According to BCA Research's Global investment Strategy service, the next US recession will not beparticularly deep. However, our colleagues do not buy that structural imbalances are so slight that the USeconomy will avert a downturn

海外研报

2024年08月12日

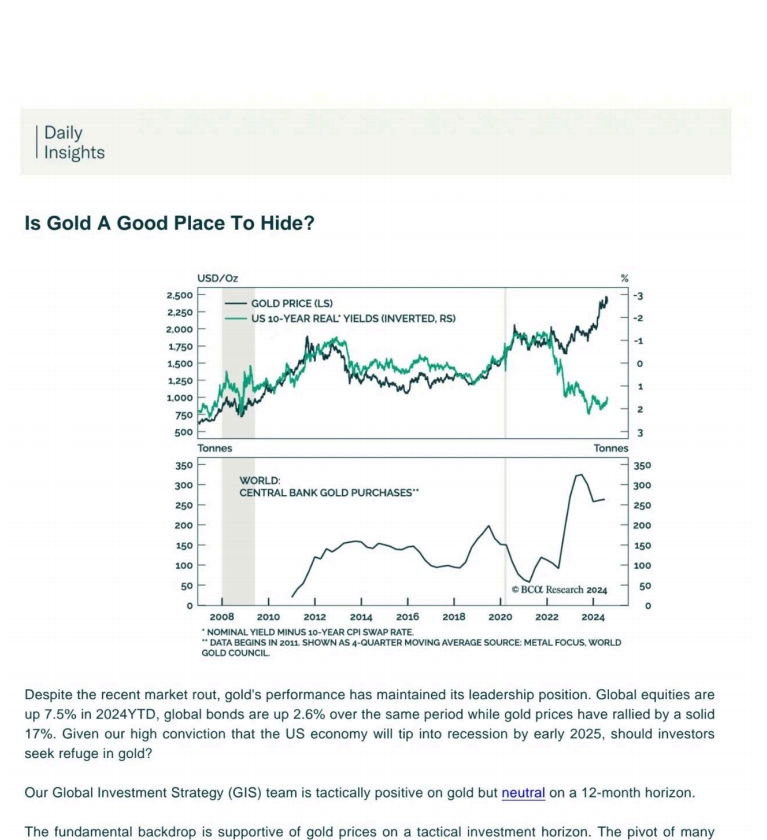

Is Gold A Good Place To Hide?

Despite the recent market rout, gold's performance has maintained its leadership position. Global equities arup 7.5% in 2024YTD, global bonds are up 2.6% over the same period while gold prices have rallied by a soli17%. Given our high conviction

海外研报

2024年08月12日

European equities: Q2 2024 earnings season recap

Cautious guidance: Current market volatility is due to a combination of factors in a poorliquidity month and cautious corporate guidance. We continue to recommend a defensivestance and buying into high-quality companies that have derated.

海外研报

2024年08月12日

Global Macro Watch Known Unknowns 11 – 16 August

July US CPI should be good enough for a September cutWe forecast headline CPI rose by 0.3% mom in July, owing mainly to a pickup in core

海外研报

2024年08月12日

Data offers a bit of comfort, but sentiment still fragile

CPI inflation has improved in recent months following the hotter-thanexpected data in Q124, and we expect that trend to continue with another

海外研报

2024年08月12日

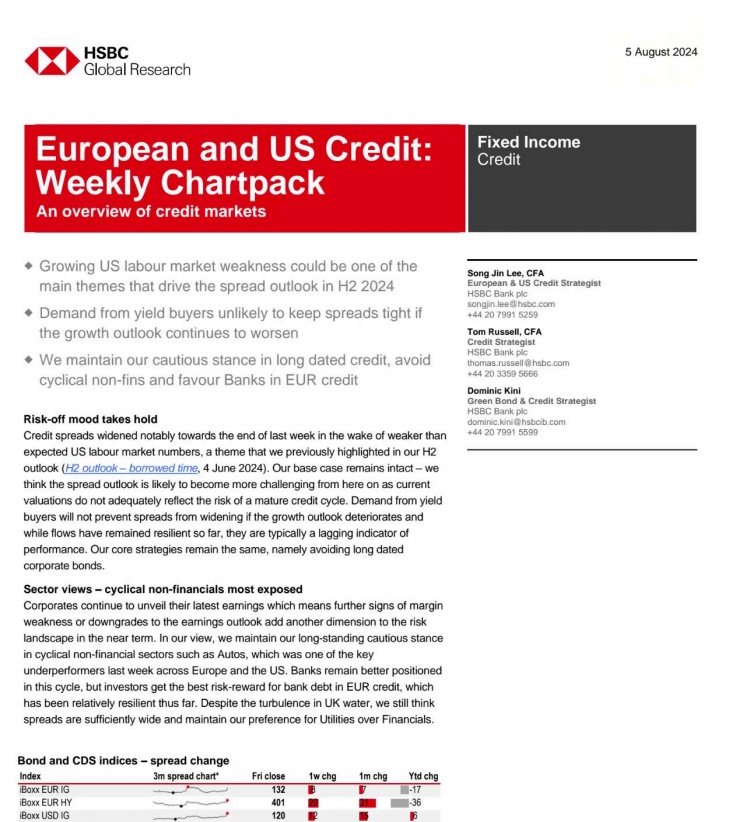

European and US Credit:Weekly ChartpackAn overview of credit markets

Credit spreads widened notably towards the end of last week in the wake of weaker thanexpected US labour market numbers, a theme that we previously highlighted in our H2outlook (H2 outlook- borowed time, 4 June 2024). Our base case

海外研报

2024年08月12日

Investor Allocations

Marginal decline in price momentum; fund inflows remain strongAmid a somewhat a dovish tone in the July FOMC meeting, which laid thegroundwork for possible rate cuts in September and beyond, globalequities (FTSE All World) ended the month

海外研报

2024年08月12日