海外研报

筛选

Ferrous Tracker: Drop in Steel Output Hits Iron Ore Consumption

The Platts 62%Fe iron ore index (CFR China) returned to $99.3/t yesterday (8thAugust), down 4% from last Friday.

海外研报

2024年08月10日

Global FX Trader Too Much Shade on the Carry Trade

n JPY: Carry not so scary. Since the sharp sell-off in USD/JPY that started onFriday and accelerated through Monday alongside broader market volatility, the

海外研报

2024年08月10日

It's positioning, stupid!

US jobless claims were down by 17,000 to 233,000 in the week that ended 3 August. The drop was

海外研报

2024年08月10日

Global Rates Trader Risk Relaxation

Last week’s labor market surprise gave way to broader market tremors as the weekbegan, but relatively benign data out of the US appears to have helped calm rates

海外研报

2024年08月10日

Assessing Market Volatility | Oil Views | European Banks

Since the US July employment report last Friday (Aug 2), there has been heightenedmarket volatility particularly in the US and Japan, with the latter mainly impacted by

海外研报

2024年08月10日

GS TWIG Notes: This Week in Global Research - August 9, 2024

Labor data, recession risk, the Fed, and the path aheadn In the US, David Mericle raised our 12-month recession odds to 25% (from 10%)

海外研报

2024年08月10日

Reflecting On 2Q24 Earnings Amid An Uncertain Macro... Investor sentiment; market color

Correlations and volatility spiked during a dizzying week of sentiment whippingaround on recession risks (still low and still-data dependent, as per the latest from

海外研报

2024年08月10日

FX Focus India: Will INR weaken further?

We have received increasing client questions on whether INR could turn sharply weaker, or continue to weaken for that matter.

海外研报

2024年08月10日

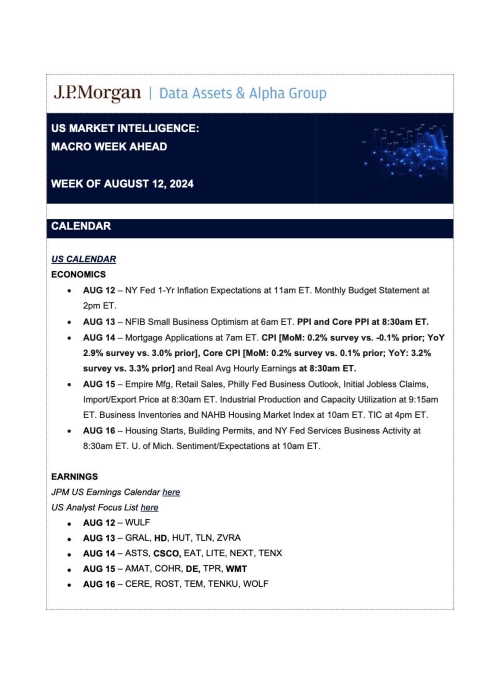

US MARKET INTELLIGENCE:MACRO WEEK AHEAD WEEK OF AUGUST 12,2024

ECONOMICSAUG 12 - NY Fed 1-Yr infiation Expectations at 11am ET. Monthly Budget Stalement at2pm ET.AUG 13 - NFlB $mall Business Optimism at 6am ET. PPl and Core PPl at 8:30am ET.AUG 14-

海外研报

2024年08月10日

Market Intelligence: US Morning Update

Stocks in Asia closed higher Friday, ending a relatively volatile week on a calm note.South Korea and Taiwan outperformed, with tech stocks advancing on the back of

海外研报

2024年08月10日