海外研报

筛选

US Pulse: Fed officials view the labour market as healthy

Financial market volatility has eased since the disappointing US nonfarm payrolls (NFP) data for July roiled markets. Better data and Fed speak last

海外研报

2024年08月14日

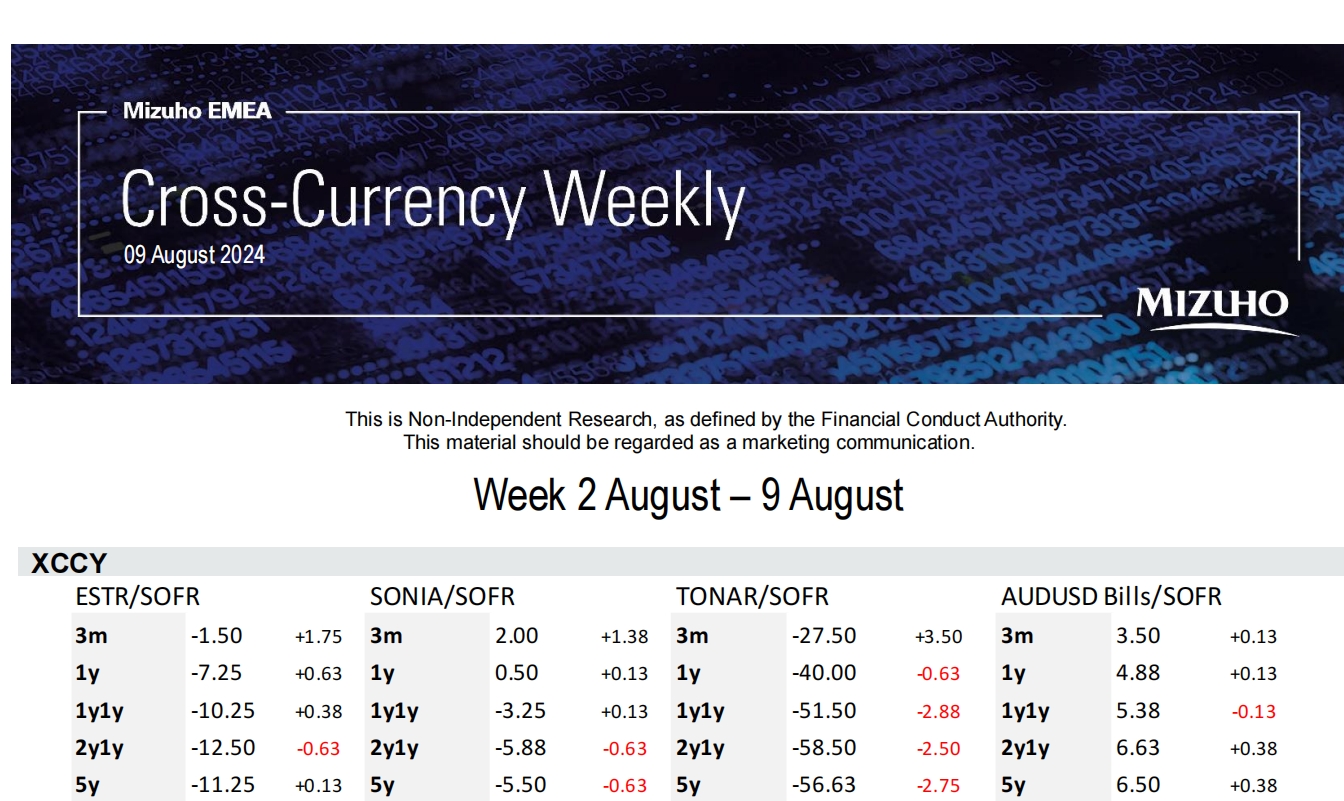

Week 2 August – 9 August

The risk-off sentiment that characterised the beginning of this week was also felt in XCCY markets. However, looking at the broader picture, XCCY spreads were relatively sheltered. This included USDJPY XCCY, despite

海外研报

2024年08月14日

Key learnings from earnings season that support The Future of Utilities Capex

With second quarter earnings season now behind us, we reflect on key learningsthat support The Future of Utilities Capex, our constructive view on Utilities, and our

海外研报

2024年08月14日

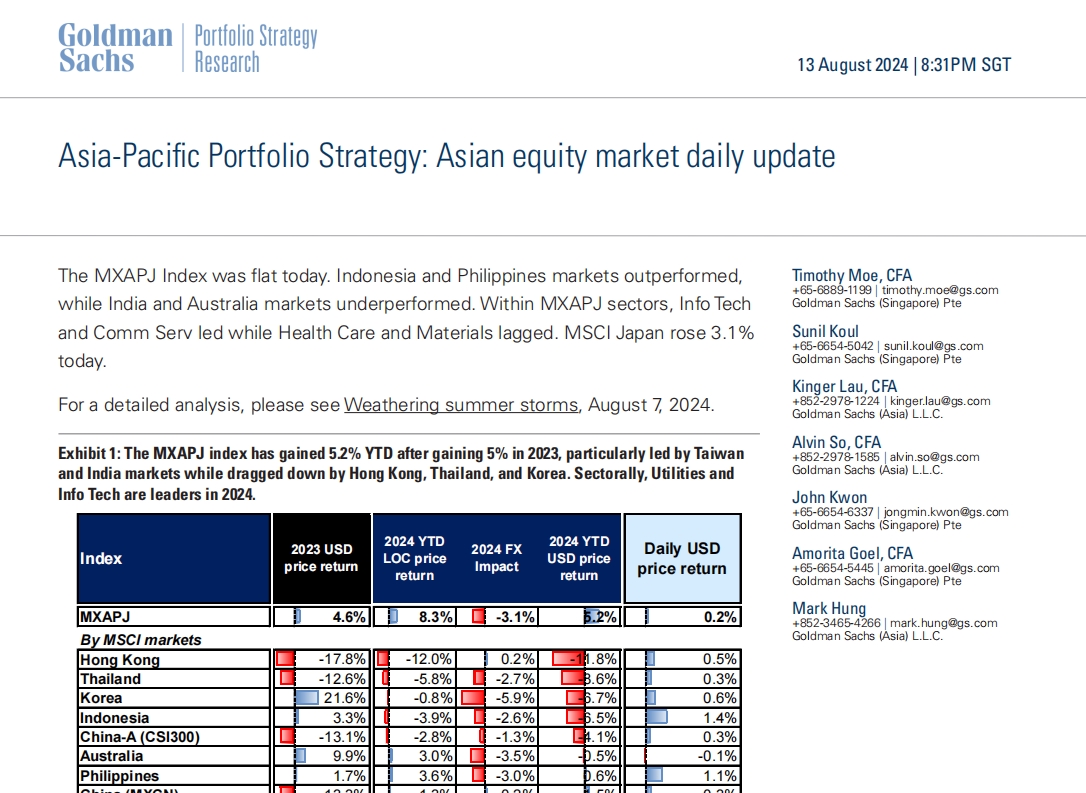

Asia-Pacific Portfolio Strategy: Asian equity market daily update

The MXAPJ Index was flat today. Indonesia and Philippines markets outperformed,while India and Australia markets underperformed. Within MXAPJ sectors, Info Tech

海外研报

2024年08月14日

Core CPI expected to have firmed in July

We look for firming in July core CPI inflation to 0.21% m/m SA,from an unusually soft 0.06% reading in June. We expect a

海外研报

2024年08月14日

US July CPI preview: Further easing

KEY MESSAGES• We expect US core CPI to extend its recent run of favorable prints with a 0.19% m/m gain in July (report released on 14 August).

海外研报

2024年08月14日

Boeing Co. (BA): July aircraft order & delivery report

Boeing reported 72 gross new aircraft orders, 1 outright cancellation, and 1 positiveASC 606 adjustment for the month of July. BA delivered 43 aircraft in the month,

海外研报

2024年08月14日

AI Revolution: A Polymath in Every Pocket

AI bubble? We’re just getting startedThe third major tech cycle of the past 50 years has begun. We wrote in our inaugural AI

海外研报

2024年08月14日

uly US CPI Inflation preview: Modestly firmer, but good enough for Fed cuts

CPI inflation to firm to 0.3% m/m in JulyCPI in June surprised to the downside. We expect some of that surprise to reverse in July.

海外研报

2024年08月14日

How much does credit card delinquency matter for spending?

Beware clickbaitRecent releases of the New York Fed’s Quarterly Report on Household Debt and Credit

海外研报

2024年08月14日