海外研报

筛选

OLYMPIC MEDALS AS A LEADING INDICATOR?

With the Paris Olympics having finished with a medal table reminiscent of Cold War superpower dominance, we decided to take a look at the historical medal performance at the Summer Games

海外研报

2024年08月22日

The VIEW Asia's Bond Markets

This month's Overview is a primer on Panda bonds, RMB-denominated bonds issued byoffshore entities in China's domestic market. Gross issuance rose 82% in 2023 to a recordRMB154bn, and 2024 is on course to be another big year, We explore

海外研报

2024年08月22日

Demand upcycle creates valuation upside; Raise TPs for GDS/VNET; Buy GDS

More specifically, we see China wholesale IDCs are entering an upward demandcycle driven by Gen-AI and GPU-related capex among cloud hyperscalers (e.g. we

海外研报

2024年09月06日

GS--Asian equities fell by 2%, dragged down by North Asian markets

MXAPJ -2%, dragged by Korea (-6%), Taiwan & China (-3%),while Thailand posted a 6% gain. Financials and software

海外研报

2024年09月09日

Global Economics Weekly A change in narrative

As central bankers gather in Jackson Hole next week, thenarrative for policy easing is building. Inflation is in retreat,

海外研报

2024年08月19日

On Our Minds - Taiwan Still thriving in the AI boom

Taiwan’s economy has remained resilient thanks to the AI boom. 2Q GDP growth was stagnant – but this followed strong expansion in recent quarters. The AI boom has

海外研报

2024年08月02日

FX Viewpoint USD: Cool data, hot politics

Key takeaways• Cooling US data and Fed-speak has brought forward cut pricing and weighed on the USD. We expect more depreciation in H2.

海外研报

2024年07月31日

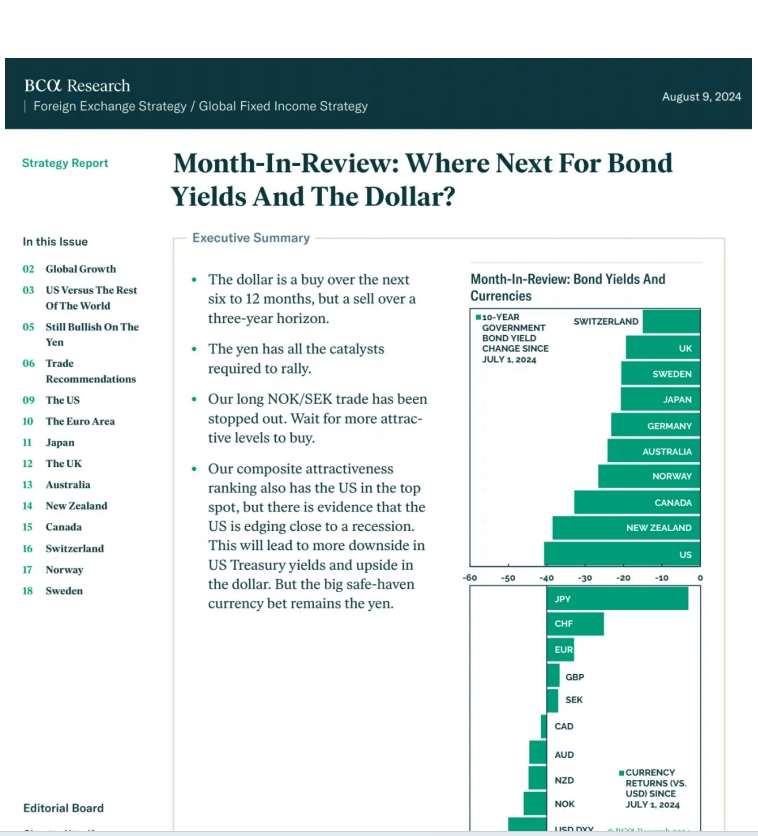

Month-In-Review: Where Next For BondYields And The Dollar?

The dollar is a buy over the nextsix to 12 months, but a sell over athree-year horizon.The yen has all the catalystsrequired to rally.

海外研报

2024年08月12日

GEMs Equity Wrap-up July 2024

In July 2024, EM equities underperformed all other major regional indices, though allwere in positive territory, india contributed most positively, distantly followed by SouthAfrica, but it was majory offset by the negative performance of Taiwan

海外研报

2024年08月12日

Investor Sentiment: Risk-Love A binary call

Global Risk-Love resets to neutralGlobal Risk-Love, our contrarian sentiment indicator for equities, has plummeted from

海外研报

2024年08月14日