海外研报

筛选

The Maestros in Jackson Hole

Jackson Hole: “Effectiveness & Transmission of Monetary Policy.” Sep cut signal, size TBD. Rates: buy dip even if marginally hawkish. FX: limited impact.EUR.

海外研报

2024年08月18日

US Economics Weekly in the datavei

CITI'S TAKEStronger-than-expected retail sales and the drop in initial jobless claimsraised market optimism that a "soft landing" might still be achieved, but thecontinued contraction in manufacturing, falling

海外研报

2024年08月19日

TOPIX rises 7.9% wow, continuing its recovery from the recent steep fall

Summary of the weekTOPIX: 2,678.60 (7.9%) / NK225: 38,062.67 (8.7%)

海外研报

2024年08月19日

Global Macro Commentary | North America August 16 Morgan Stanley & Co.

Strong US data caps UST rally; solid UK retail sales sends gilts higher; RBNZ's Silk says contraction may be needed to lower

海外研报

2024年08月19日

The Consumer in Context

Our view has been that consumer spending would slow but not slump; so far that path has played out. Employment, wealth, and

海外研报

2024年08月19日

US Daily: Renewed Progress on Recession Risk (Hatzius)

After the July jobs report released on August 2 triggered the “Sahm rule,” weraised our 12-month US recession probability from 15% to 25%. Now, we have

海外研报

2024年08月19日

The yen carry trade-what if Japaninstitutions decide to unwind?

Public pension funds. lhe GPlF is the big one here, with other smallerfunds believed to generally follow its lead. There's a growing view that theGPIFcould cutforeign bond exposure when it announces its next policy mixin 2025.

海外研报

2024年08月20日

What Companies Are Saying: StillWaiting And Seeing

Companies broadly report steady growth butnota lotofupward momentum as theyand their customers are still in a pervasive wait and see loop given lingeringuncertainties around inflation, interest rates, domestic politics, elections,

海外研报

2024年08月20日

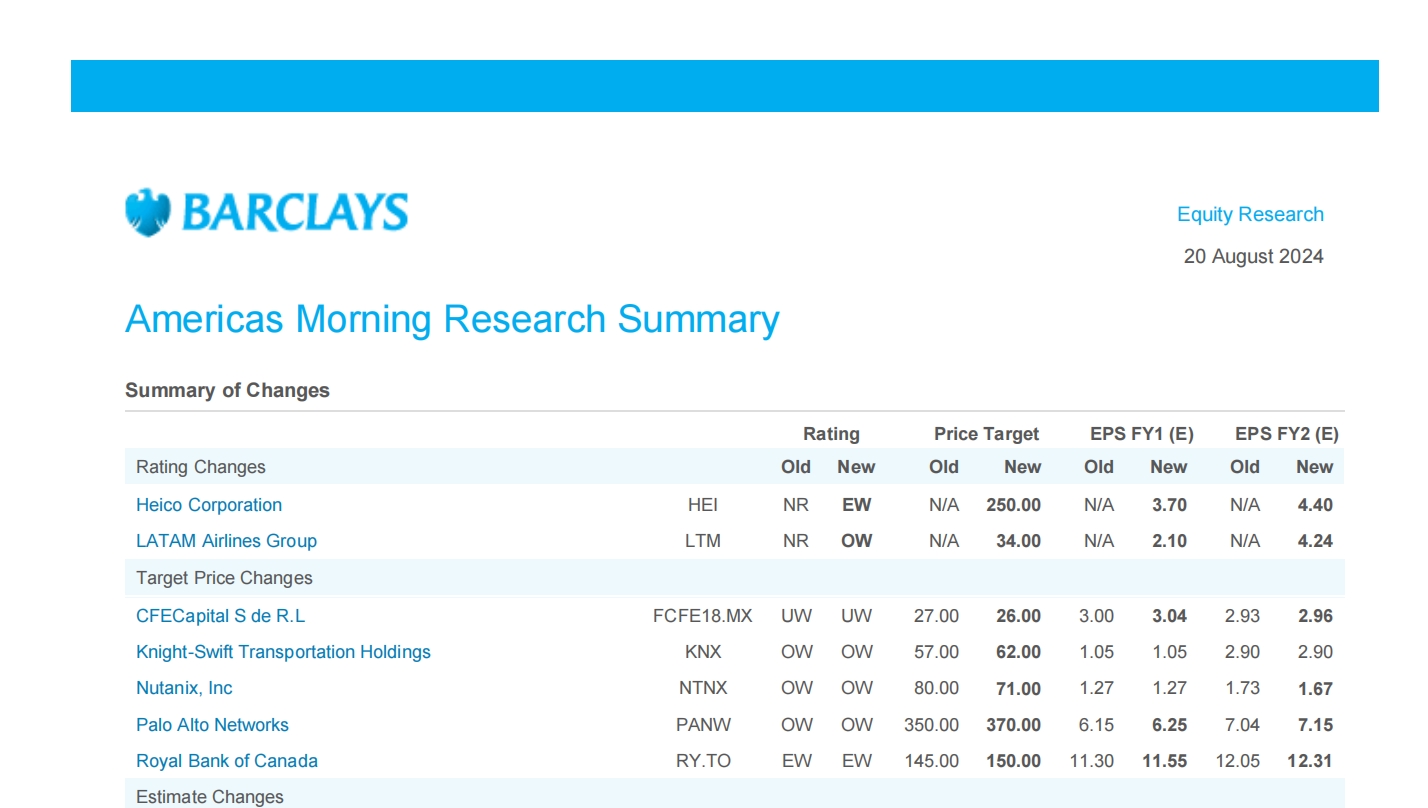

Americas Morning Research Summary

This summary is compiled from research reports previously published by Barclays Equity Research. A full list of all publications is available on

海外研报

2024年08月21日

Energy Sigma Another reset

Oil prices have recovered somewhat from the early-Augustselloff that coincided with another reset in speculative

海外研报

2024年08月21日