海外研报

筛选

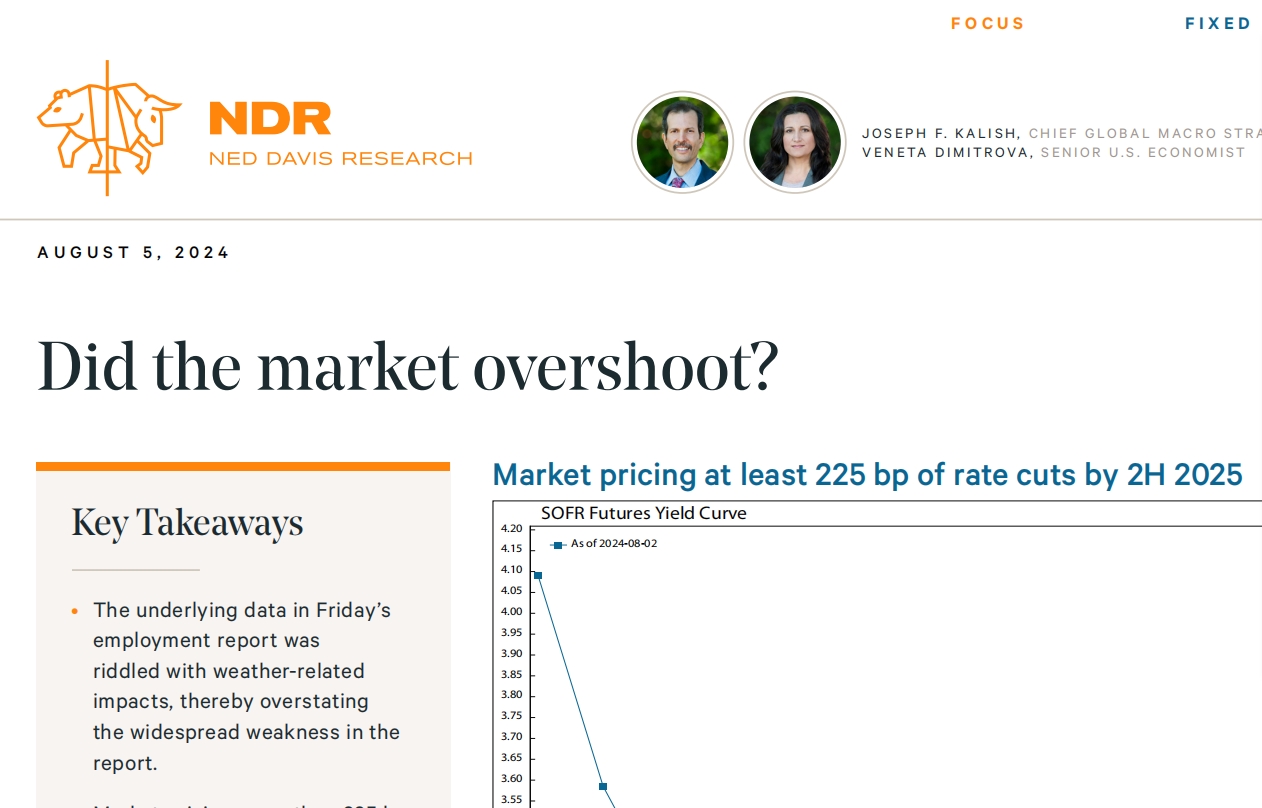

Weak jobs report could put 50bp cut on the table

The July employment report was a weak one across the board, with downside surprises in just about every key metric. If there were any

海外研报

2024年08月05日

U.S. Desk Strategy Macro2Markets Outlook

As the dust settles post one of the most active macro weeks of the summer, the broader market is at the mercy of lower summer liquidity amid ongoing

海外研报

2024年08月06日

Hong Kong: PMI rose in July

The S&P Global Hong Kong PMI (which covers the manufacturing, construction,wholesale, retail and services sectors) rose to 49.5 in July from 48.2 in June. Among

海外研报

2024年08月06日

Healthcare Pulse: Oh August... Investor sentiment

Considerations for the XLV @ 10k Feet. Macronarratives got turned on their head yet again with the

海外研报

2024年08月06日

GS Utilities Daily: ENWL sale has positive read across to SSE

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result,investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this

海外研报

2024年08月06日

European Week Ahead: August 5 - August 11

08:15 Spanish PMI - Composite, Jul F (consensus 54.7, last 55.8)08:15 Spanish PMI - Services, Jul F (consensus 55.5, last 56.8)

海外研报

2024年08月06日

Trading Catalysts It’s the Fed now

Equities: Is the Fed put alive? The July jobs report came in below our goldilocks range for equities (+150K, +/- and financial markets indicate that the risk is no longer balanced between growth and

海外研报

2024年08月06日

Big GBP unwind in broad risk-off

At present, the G10 FX PIX 2.0 signals that the AUD, NZD and NOK areoversold while the CHF and JPY are overbought. We have temporarily

海外研报

2024年08月06日

The Bear Traps Report With Larry McDonald

“The beast inside the market now has the Fed in its grip. The serpent will demand FAR more

海外研报

2024年08月06日