海外研报

筛选

Global Economic Weekly Unwarranted panic

Weaker than expected US payrolls last week unleashed a market headwind that peaked this Monday. At peak, the rates market priced 140bp of Fed cuts by year-end, effectively

海外研报

2024年08月10日

CAD: still labouring away

Asia overnightThe NZD has been the marginal outperformer of otherwise largely steady G10 FX

海外研报

2024年08月10日

All EM Asian markets saw foreign selling this week

Foreign (FII) flows / positioningn EM Asian region saw selling (-US$6.5bn) across marketsthis week, led by A-shares (-US$2.1bn) and Taiwan

海外研报

2024年08月10日

How to Navigate Summer Volatility?

The past two weeks have been highly volatile in the markets and across our NaturalResources coverage. As such, we ask our senior analyst team to reflect on where

海外研报

2024年08月10日

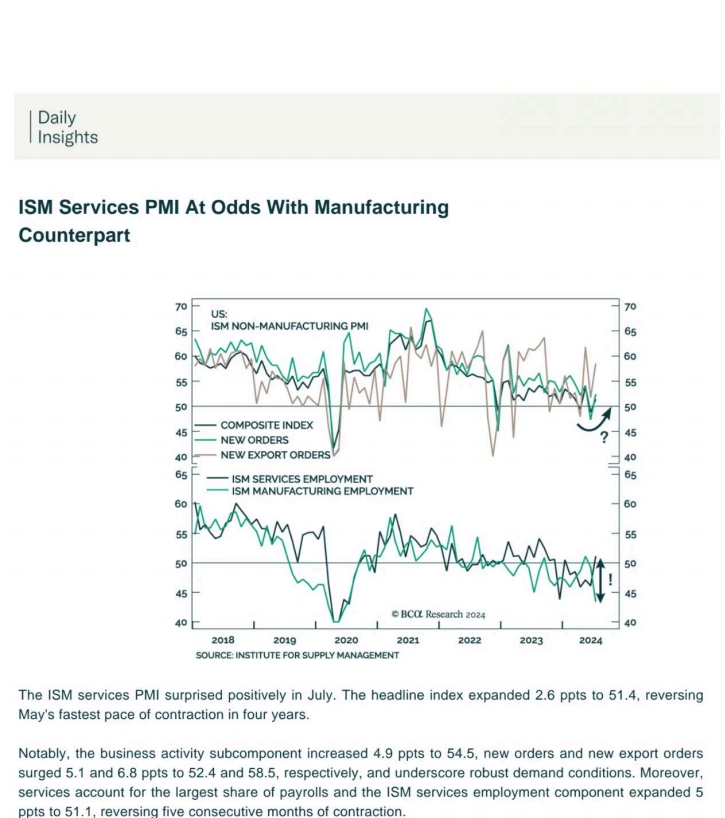

ISM Services PMl At Odds With ManufacturingCounterpart

The lSM services PMl surprised positively in july. The headline index expanded 2.6 ppts to 51.4, reversingMay's fastest pace of contraction in four years.

海外研报

2024年08月12日

Any more systematic pressure in USDJPY and US equities?

Benchmark CTA down big this past MondayWhile declining steadily in each of the last four weeks, this past Monday the SG CTA benchmark index posted its largest daily drop since Mar-23. This on the same day

海外研报

2024年08月12日

All EM Asian markets saw foreign selling this week, led by A-shares and

EM Asian region saw selling (-US$6.5bn) across marketsthis week, led by A-shares (-US$2.1bn) and Taiwan

海外研报

2024年08月12日

Global Rates ldeas EM & DM

We highlight opportunities for tactical flattening carry tradesin the US and Türkiye

海外研报

2024年08月12日

Precious Metals Trading Desk View

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed herein are those of the desk and/or the author only. The publication cannot be considered as investment research or a

海外研报

2024年08月12日

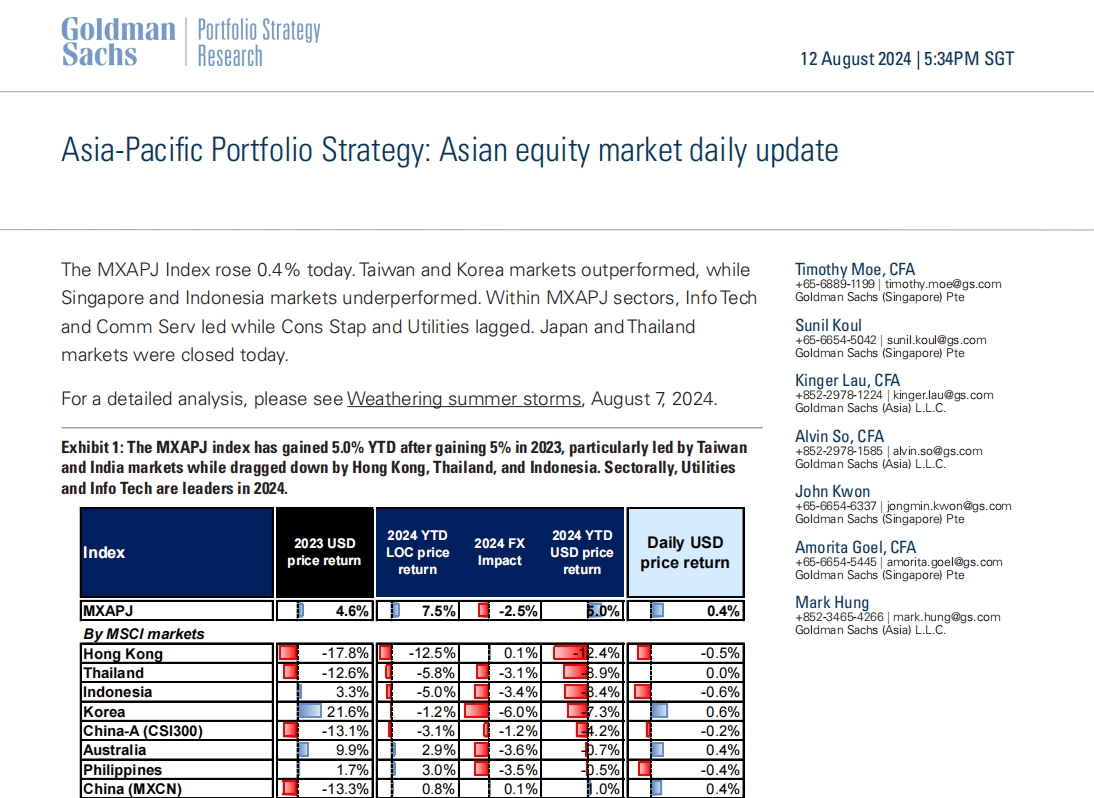

Asia-Pacific Portfolio Strategy: Asian equity market daily update

The MXAPJ Index rose 0.4% today. Taiwan and Korea markets outperformed, whileSingapore and Indonesia markets underperformed. Within MXAPJ sectors, Info Tech

海外研报

2024年08月14日