海外研报

筛选

European Morning Research Summary

This summary is compiled from research reports previously published by Barclays Equity Research. A full list of all publications is available on

海外研报

2024年08月18日

US Economic Weekly Slow and steady, not fast and furious

Weekly viewpointThis week’s jam-packed data calendar delivered mostly good news. Inflation was

海外研报

2024年08月18日

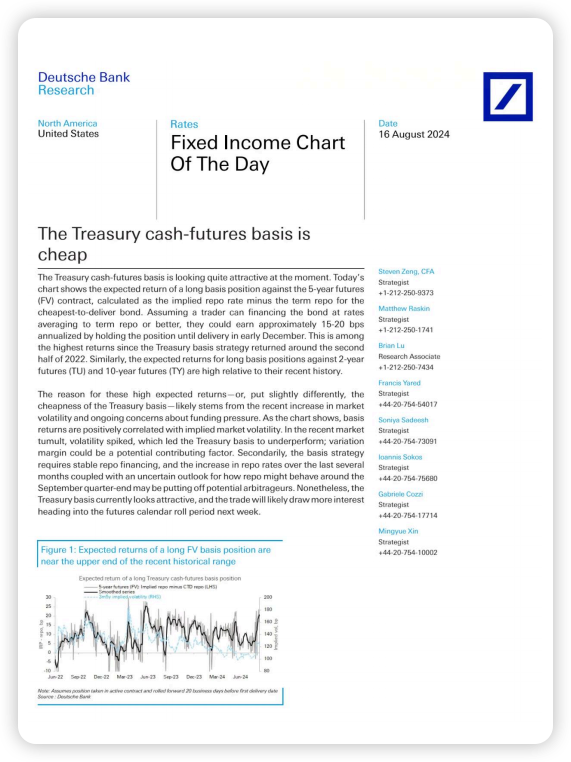

The Treasury cash-futures basis ischeap

The reason for these high expected returns-or, put slightly differently, thecheapness of the Treasury basis -likely stems from the recent increase in marketvolatility and ongoing concerns about funding pressure. As the chart shows,

海外研报

2024年08月20日

LONG CARRY, SHORT TREND

Powell's Jackson Hole speech gave a strong indication that inflation is no longer the tail risk for the Fed and that it is the health of the labour market that is now paramount. While the dual

海外研报

2024年08月29日

TECHNICAL ANALYSIS

2y UST down move stalled after defending the May 2023 trough near 3.65% but signals of significant upside are not yet visible. 2y

海外研报

2024年08月29日

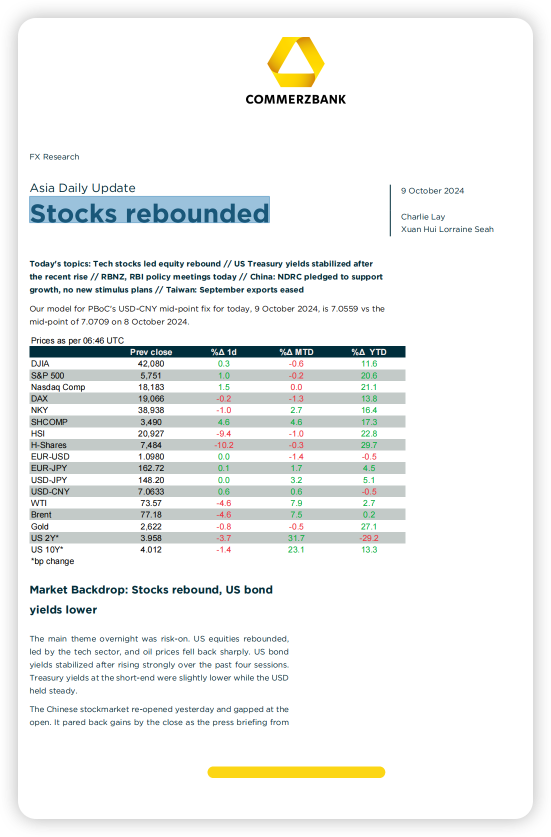

CommerzBank--Stocks rebounded

Our model for PBoC's USD-CNY mid-point fix for today, 9 October 2024, is 7.0559 vs themid-point of 7.0709 on 8 October 2024.

海外研报

2024年10月11日

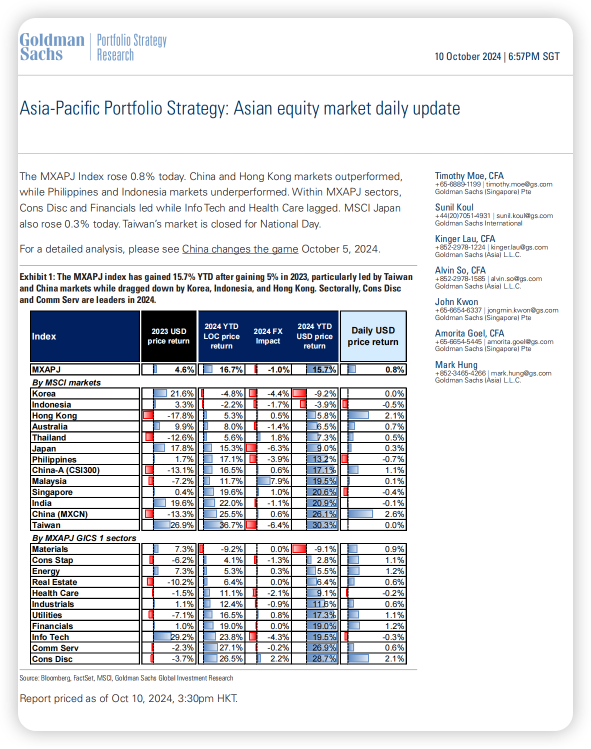

GS--Asia-Pacific Portfolio Strategy_ Asian equity market daily update(53)

The MXAPJ Index rose 0.8% today. China and Hong Kong markets outperformed,while Philippines and Indonesia markets underperformed. Within MXAPJ sectors,

海外研报

2024年10月11日