海外研报

筛选

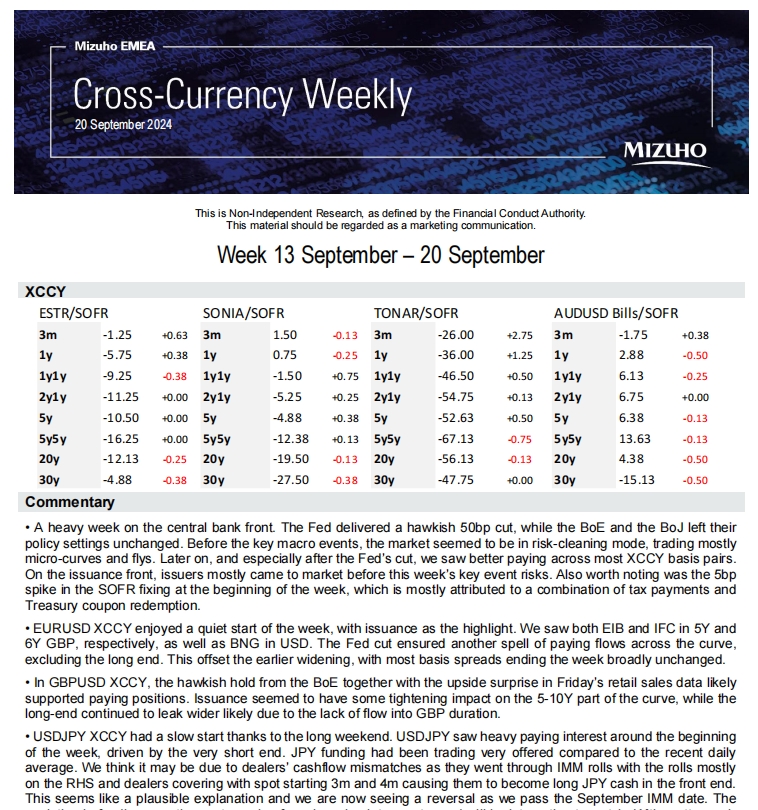

XCCY Weekly 2024-09-20

• A heavy week on the central bank front. The Fed delivered a hawkish 50bp cut, while the BoE and the BoJ left their

海外研报

2024年09月24日

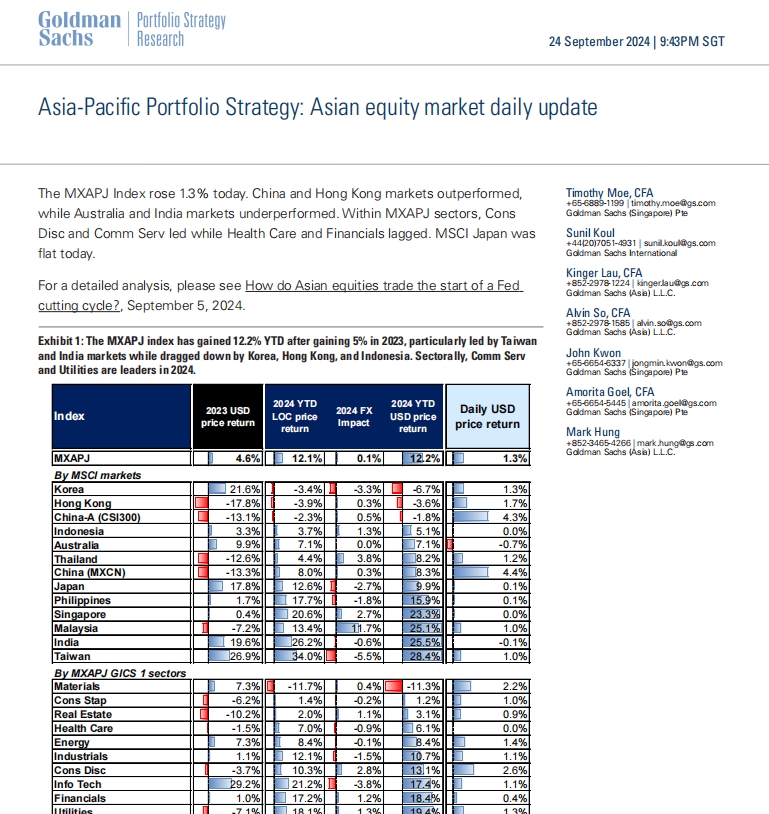

GS--Asia-Pacific Portfolio Strategy: Asian equity market daily update01

The MXAPJ Index rose 1.3% today. China and Hong Kong markets outperformed,while Australia and India markets underperformed. Within MXAPJ sectors, Cons

海外研报

2024年09月25日

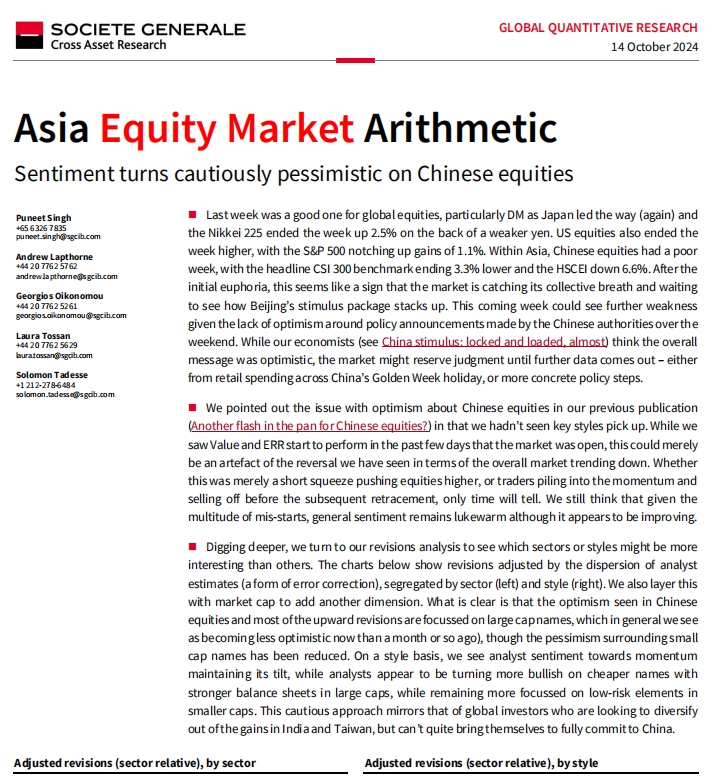

SocGen_Asia Equity Market Arithmetic Sentiment turns cautiously pessimistic o

◼ Last week was a good one for global equities, particularly DM as Japan led the way (again) and

海外研报

2024年10月17日

China+ Chartbook September 2024

China’s August activity data confirmed the insipid domestic demand picture, as retail sales and fixed asset investment growth slowed, despite a

海外研报

2024年09月22日

CEE in focus: Limited spillovers from French elections so far

Weekly report highlighting our latest EM views, recent performance, currentvaluation, the latest model updates, and our forecasts across EM.Focus for the Week:

海外研报

2024年07月01日

Healthcare Pulse: Shifts Now Afoot... Investor sentiment

The title of our last weekly, “Strap-In” was a grossunderstatement for the epic momentum reversal thatensued this week

海外研报

2024年07月22日

Strong Quarter Highlights Future Growth Trajectory

Summary: While 2Q op EPS of $1.69 missed the Street's $1.71 estimate and our $1.76, PPNRbeat on accelerating growth, with all of the miss from higher provision due to outsized loan

海外研报

2024年07月22日

Navigating 2025 AI cloud investment

The Morgan Stanley tech team's median expectation is for NVIDIA-related stocks to grow 37% Y/Y and non-NVIDIA to grow 14%.

海外研报

2024年08月12日

PBOC shifting to short-term rates

Markets seemed calmer and took the French Election results in their stride, even asit’s unclear which coalition in France if any can be mustered to form a government.

海外研报

2024年07月10日

Germany CAI Continues to Underperform Rest of Europe in June

Please find an update of our proprietary global economic indicators below. The databehind these exhibits can be downloaded here. Interactive charts can be found onour living page here.

海外研报

2024年07月12日