海外研报

筛选

GS--Refreshing our Commodity Terms of Trade Indices (Fishman/Kanter)

through next year, as oil prices face two-sided US policy risks and likely OPEC

海外研报

2024年10月17日

GS--GS EUROPEAN EXPRESS: Encore: Buy ASML (on CL), Wise

Global Metals & Mining Conference Takeaways: Commodity outlooks, growth

海外研报

2024年10月17日

HF Highlights - 2024.10.11

There was some divergence in HF returns this past week as performance of equities across regions was relatively mixed (US

海外研报

2024年10月17日

UBS--China confirms big fiscal stimulus—how big yet to be confirmed

• China’s Ministry of Finance has outlined the broad

海外研报

2024年10月17日

GS-- partly to reflect our new forex assumptions

We update our earnings estimates and 12-month target prices for our

海外研报

2024年10月17日

JPM_Flows & Liquidity Why equity and credit investors got it right while rate investors

While traditionally rate markets were perceived to have been moresuccessfulthan equityor credit markets in anticipating the =

海外研报

2024年10月17日

JPM_US Market Intell Morning Briefing_20241016

SPX +0.0%, NDX +0.1%,RTY +0.4%.WTl -28bps at $70.38, NatGas -52bps to $2.49, UKNatGas +58bps to 0.9937,Gold %,D

海外研报

2024年10月17日

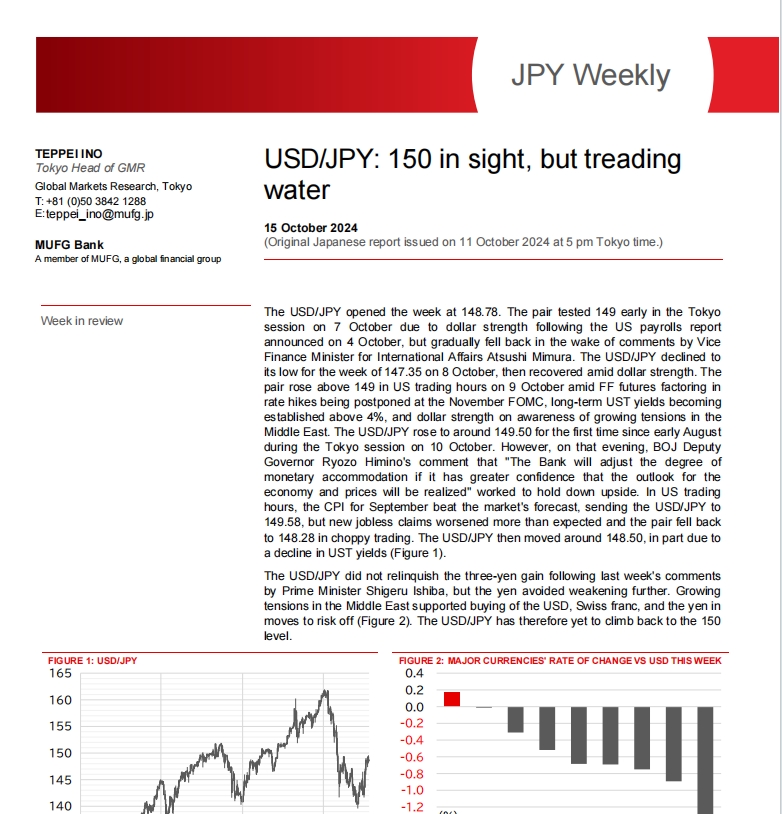

JPY Weekly - 15 October 2024

The USD/JPY opened the week at 148.78. The pair tested 149 early in the Tokyo

海外研报

2024年10月17日

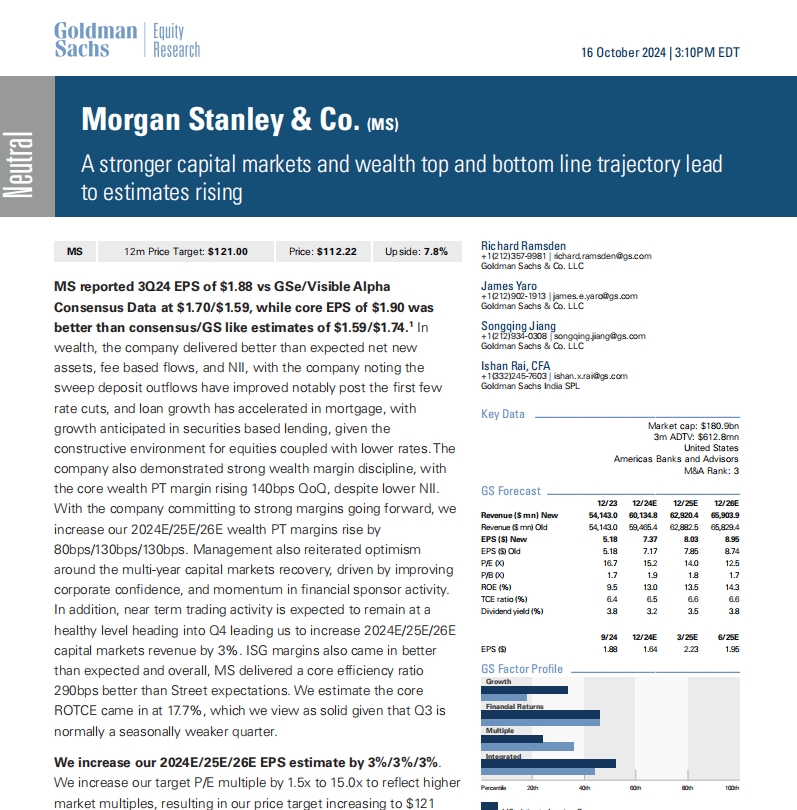

GS--A stronger capital markets and wealth top and bottom line

MS reported 3Q24 EPS of $1.88 vs GSe/Visible Alpha

海外研报

2024年10月17日

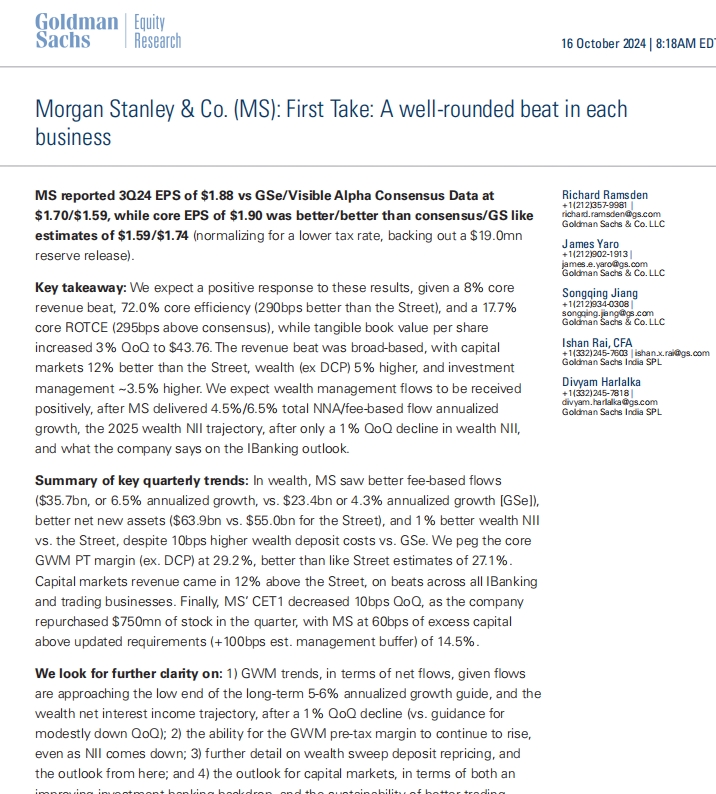

GS--First Take: A well-rounded beat in each business

MS reported 3Q24 EPS of $1.88 vs GSe/Visible Alpha Consensus Data at

海外研报

2024年10月17日