海外研报

筛选

SocGen - European Economic Outlook - Growth close to potential and diverging fortunes

GDP growth was weak between 4Q22 and 4Q23, while employment has held up. It recovered to 0.3% qoq in 1Q24 and 0.2% qoq in 2Q24 and we expect it to hover around

海外研报

2024年09月27日

SocGen - FX View - A surprisingly resilient euro

The RBA left rates on hold this morning and at first, the currency liked it. Some concerns about growth (stagflation was bandied around in the press) have taken the gloss off, though in general,

海外研报

2024年09月27日

SocGen - Market Wrap-up - Rating changes remain at record highs

Credit quality continues to improve in both Europe and the US. And while it is

海外研报

2024年09月27日

SocGen_Market Wrap-up Uniform performance is unlikely to last_20240924

Since the early August sell-off, we’ve seen financials outperform non-financials. However, since the weakness recorded two weeks ago, the market has seen all

海外研报

2024年09月27日

GS--USA: New Home Sales Decline by Somewhat Less Than Expected

BOTTOM LINE: New home sales declined by somewhat less than expected in

海外研报

2024年09月27日

GS--Events that will Drive a Seasonal Increase in Volatility

Single stock notional options volumes have declined notably over the past threemonths led by a significant decline in NVDA volumes. We see this as an indicator of

海外研报

2024年09月27日

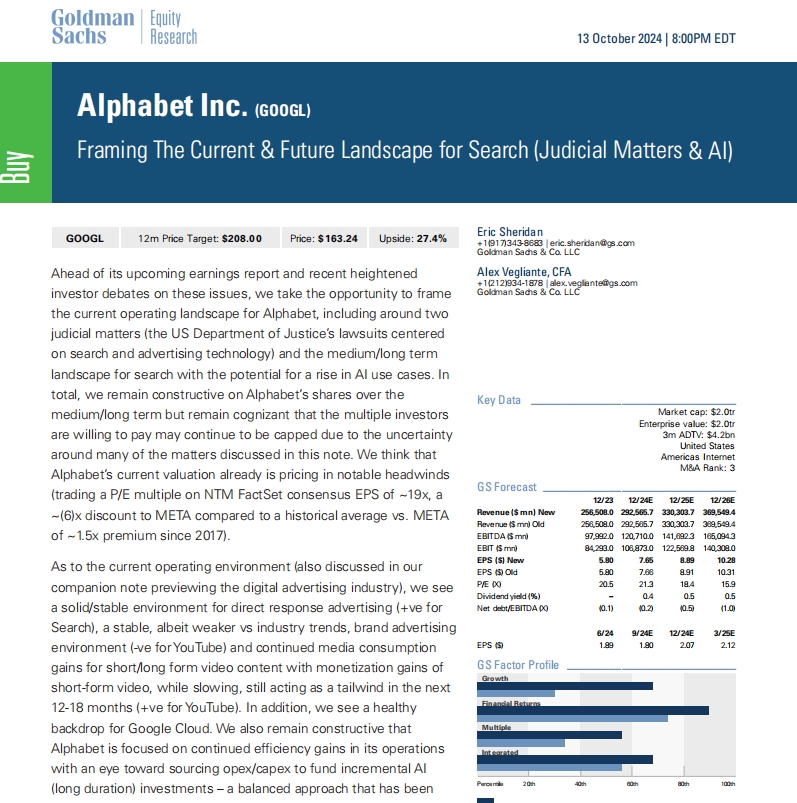

GS--Framing The Current & Future Landscape for Search (Judicial Matters & AI)

Ahead of its upcoming earnings report and recent heightenedinvestor debates on these issues, we take the opportunity to frame

海外研报

2024年10月14日

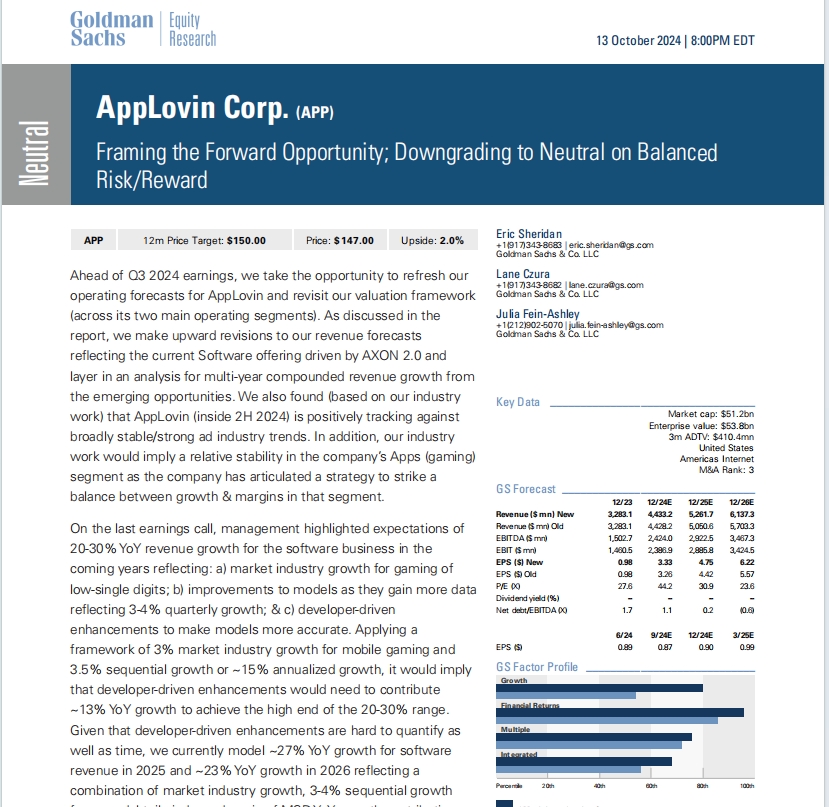

GS--Framing the Forward Opportunity; Downgrading to Neutral on Balanced Risk/Reward

Ahead of Q3 2024 earnings, we take the opportunity to refresh our

海外研报

2024年10月14日

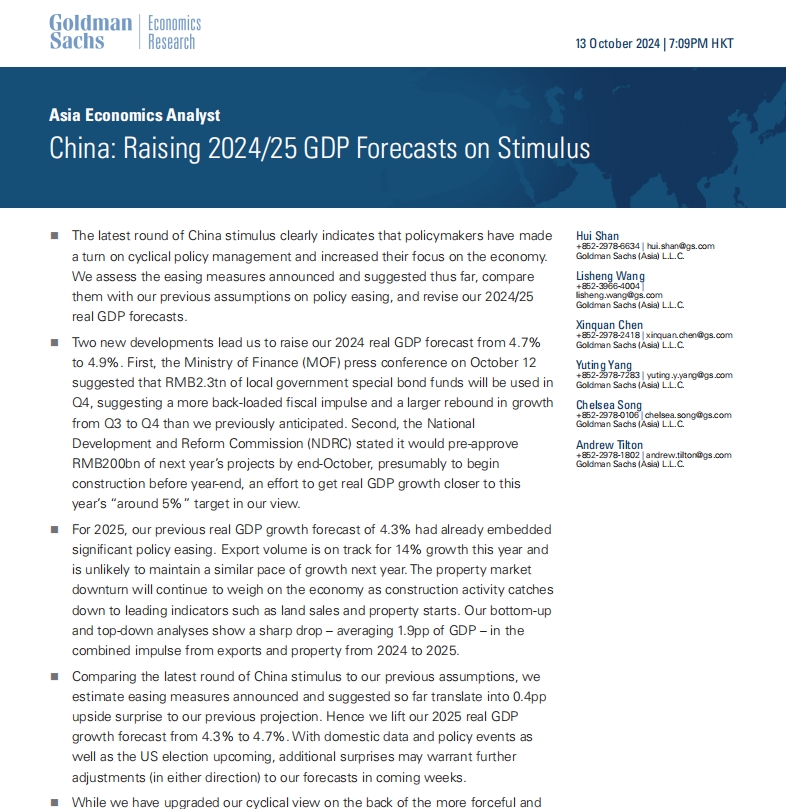

GS--China: Raising 2024/25 GDP Forecasts on Stimulus

na turn on cyclical policy management and increased their focus on the economy.

海外研报

2024年10月14日

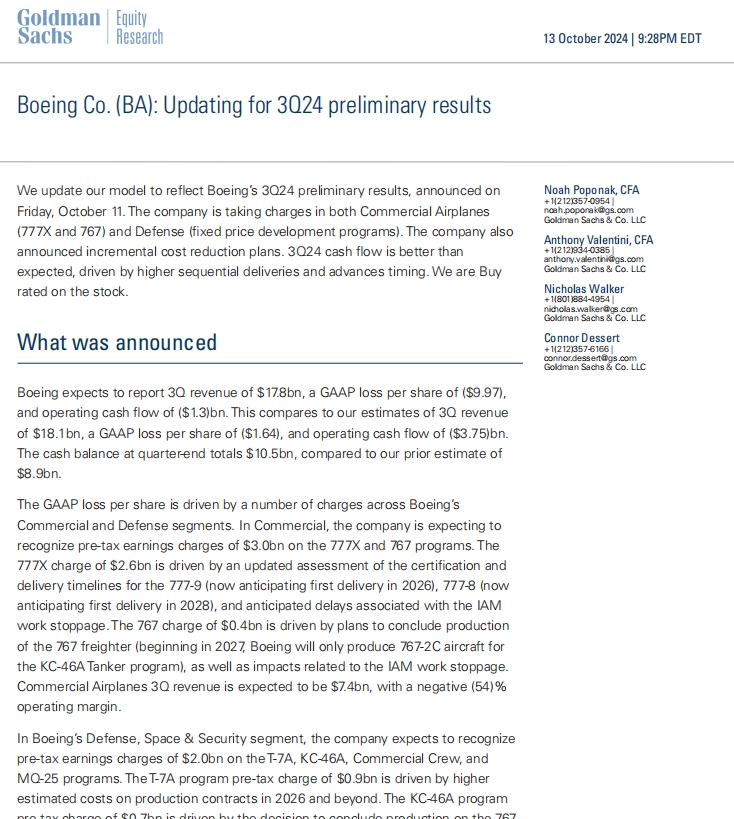

GS--Boeing Co. (BA): Updating for 3Q24 preliminary results

Boeing expects to report 3Q revenue of $17.8bn, a GAAP loss per share of ($9.97),

海外研报

2024年10月14日