海外研报

筛选

GS--Global FX Trader Is The First Cut the Deepest?

USD: Fed brings better balance; adjusting our forecasts. With a 50bp rate ncut, the FOMC most likely chose the option that leads to lower economic and1

海外研报

2024年09月23日

GS--Healthcare Pulse: Macro/Micro Mash-Up ... Investor sentiment

The T+1 reaction function across HC in the immediateaftermath of this week’s Fed cut was consistent with “right

海外研报

2024年09月23日

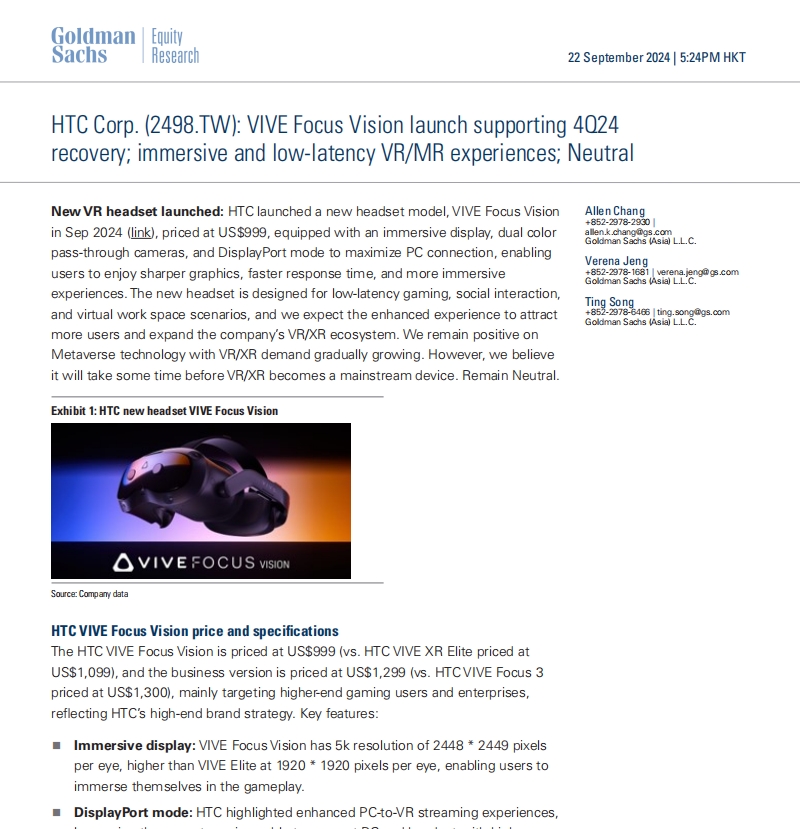

GS--VIVE Focus Vision launch supporting 4Q24 recovery; immersive and low-latency VR/MR experiences

New VR headset launched: HTC launched a new headset model, VIVE Focus Visionin Sep 2024 (link), priced at US$999, equipped with an immersive display, dual color

海外研报

2024年09月23日

JPM_Positioning Intell Weekly Wrap_20240920

In the US, HFs remained net sellers (-1.3z in past 5d) as selling/de-grossing prior to the Fed was not reversed on Wed/Thurs. Gross and net leverage were basically unchanged WoW. Retail investors did not seem particularly

海外研报

2024年09月23日

US--Long awaited easing cycle commences with a bang

With the FOMC meeting in the rear view, it will be a quieter week ahead,with highlights including PCE inflation, personal income & spending,

海外研报

2024年09月23日

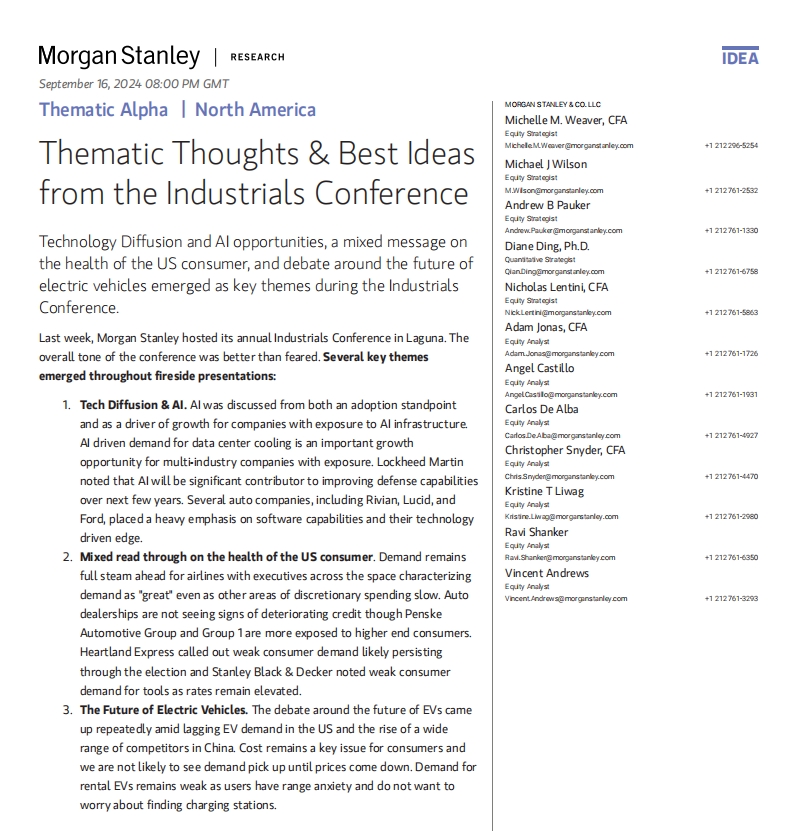

MS - Thematic Alpha - Thematic Thoughts & Best Ideas from the Industrials Conference_20240916

Tech Diffusion & AI. AI was discussed from both an adoption standpoint and as a driver of growth for companies with exposure to AI infrastructure.

海外研报

2024年09月23日

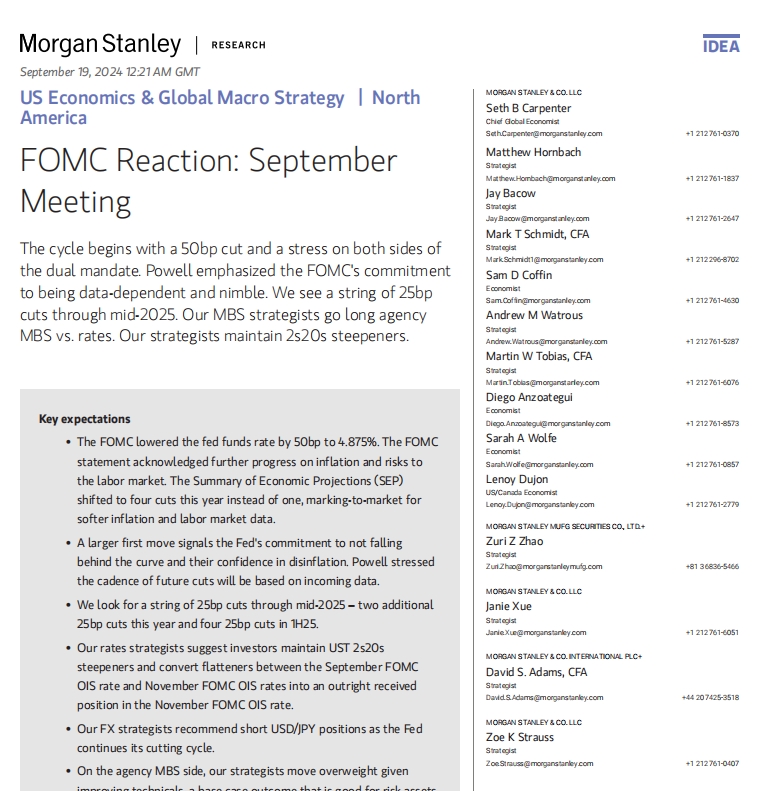

MS-- FOMC Reaction - September Meeting

• The FOMC lowered the fed funds rate by 50bp to 4.875%. The FOMC statement acknowledged further progress on inflation and risks to

海外研报

2024年09月23日

MS_India has displaced China as the largest MSCI EM market_20240917

India has displaced China as the largest MSCI EM market

海外研报

2024年09月23日

MS_September 20

While the BoJ keeps rates on hold as expected, the press conference leans dovish as BoJ Governor Ueda says there is “room to spend

海外研报

2024年09月23日

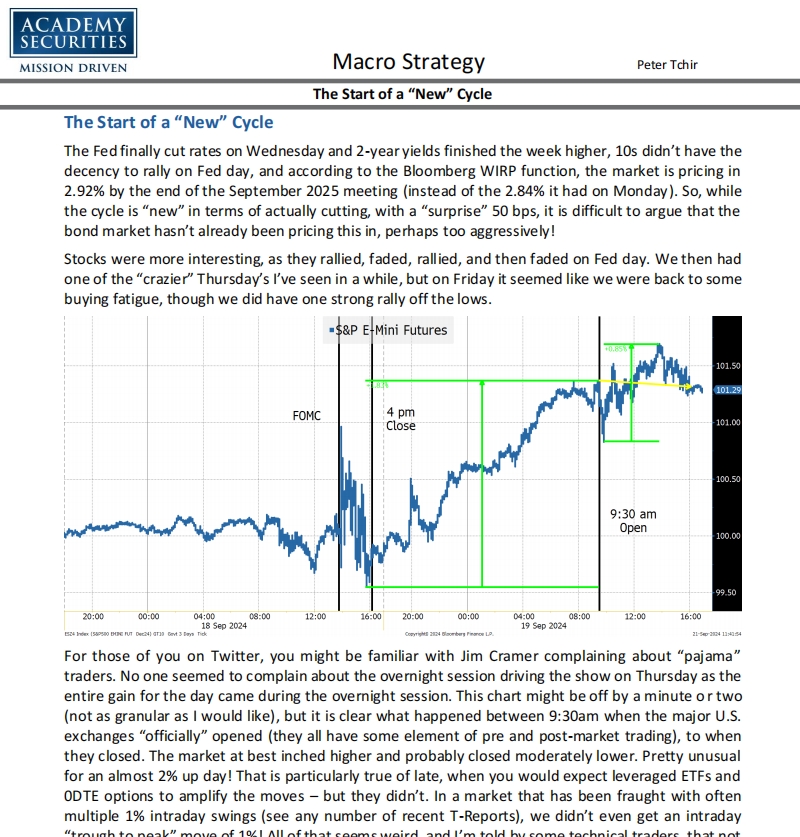

The Start of a New Cycle

The Fed finally cut rates on Wednesday and 2-year yields finished the week higher, 10s didn’t have the decency to rally on Fed day, and according to the Bloomberg WIRP function, the market is pricing in

海外研报

2024年09月23日