海外研报

筛选

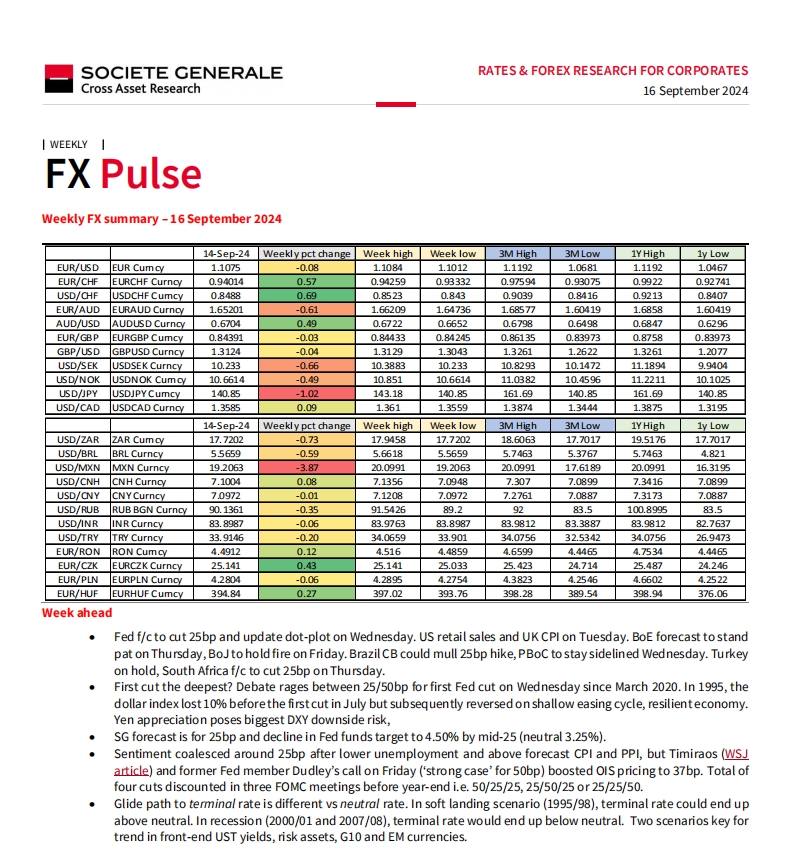

SocGen -FX Pulse - Weekly FX summary – 16 September 2024

Fed f/c to cut 25bp and update dot-plot on Wednesday. US retail sales and UK CPI on Tuesday. BoE forecast to stand pat on Thursday, BoJ to hold fire on Friday. Brazil CB could mull 25bp hike, PBoC to stay sidelined Wednesday. Turkey

海外研报

2024年09月19日

SocGen_Asia Equity Strategy 4Q24 Outlook – Don t chase returns in the late cycle_20240917

Societe Generale (“SG”) does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that SG may

海外研报

2024年09月19日

GS--September FOMC Preview: Shifting the Focus to Labor Market Risks (Mericle)

We interpret comments from Fed officials just ahead of the blackout period to nmean that the FOMC is more likely to cut by 25bp than 50bp at its September

海外研报

2024年09月19日

USA_ August Housing Starts Rebound Above Expectations

BOTTOM LINE: Housing starts rose by 9.6% in August, above expectations for asmaller increase. The rebound was led by the South, where Hurricane Beryl likely

海外研报

2024年09月19日

USA_ Core Retail Sales in Line With Expectations in August

BOTTOM LINE: Core retail sales rose 0.3% in August, in line with consensusexpectations, and headline retail sales rose 0.1%, against expectations for a decline.

海外研报

2024年09月19日

Weekly - Regional View Emerging Markets_en_1623966

Panama's strategic role as a transportation and financial hub, coupled withrobust growth in sectors such as construction, commerce, and transport,

海外研报

2024年09月19日

Weekly - Regional View US_en_1624131

It’s been over 900 days since the Federal Reserve first hiked interest rates inresponse to surging inflation, embarking on one of most aggressive policytightening journeys in history. Now, 2.5 years and

海外研报

2024年09月19日

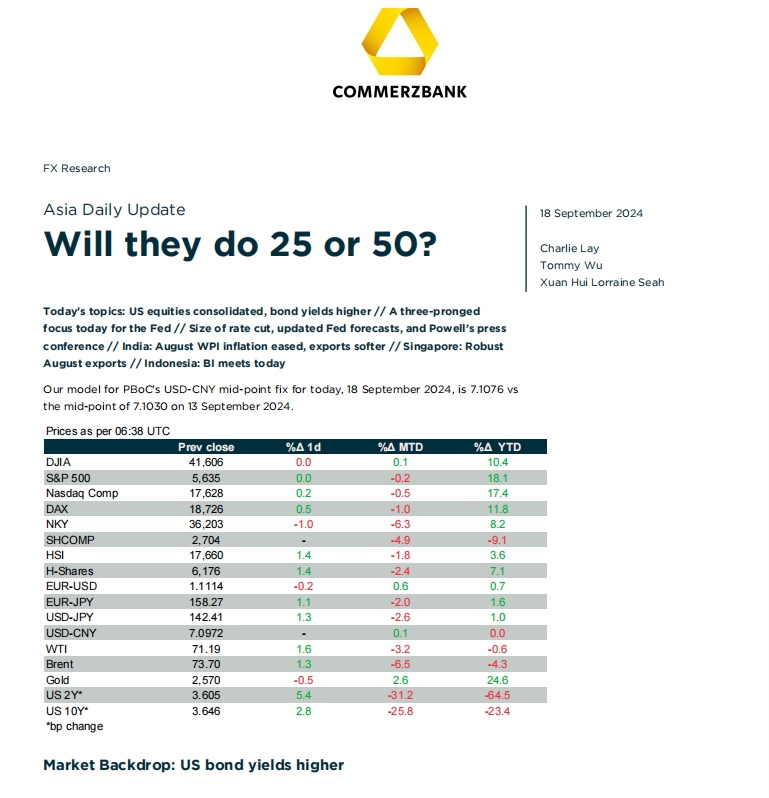

Will they do 25 or 50

Today's topics: US equities consolidated, bond yields higher // A three-prongedfocus today for the Fed // Size of rate cut, updated Fed forecasts, and Powell’s press

海外研报

2024年09月19日

GD--FED DID THE RIGHT THING, AND NOW THE FUN BEGINS

By finally easing and revealing its plan for a faster pace of cuts, the FOMC finally set loose a new set of marketdynamics to impact the economy – unless the path to recession is already fated. I do not believe recession is fated

海外研报

2024年09月20日

GD--LONG RISK – REVIEWING OUR KEY TRADES

We maintain our risk on positioning (equal weight S&P 500 & high-yield creditfocused trades) as the combination of Fed rate cuts and resilient growth will send

海外研报

2024年09月20日