海外研报

筛选

GS--Snowflake Inc. (SNOW): Communacopia + Technology Conference 2024 — Key Takeaways

New CEO, Dr. Sridhar Ramaswamy, continues executing against his visionfor the company: Snowflake discussed how the recently appointed CEO,

海外研报

2024年09月15日

GS--Vertiv Holdings (VRT): 2024 Communacopia + Technology Conference — Key Takeaways

Presenters: We hosted Giordano Albertazzi, the CEO of Vertiv, and David Fallon,CFO of Vertiv at the Communacopia + Technology Conference.

海外研报

2024年09月15日

GS--ZoomInfo Technologies Inc. (ZI): Communacopia + Technology Conference 2024 — Key Takeaways

. Committed to returning to growth and returns to shareholders: ZoomInfo’snear term priorities are to get the business back to growth, buying back stock,

海外研报

2024年09月15日

GD--RATE CUTS MEET SOFT PATCH

An economic soft patch is taking shape, paving the way for an accelerated BoE easing cycle against the backdrop of a tighter fiscal stance.

海外研报

2024年09月15日

GS--WHIFF OF NEW US-RUSSIA MISSILE CRISIS SHOULD UNDERPIN THE GOLD PRICE

Although this topic remains firmly in the arena of tail-risk monitoring rather than an active market driver, PresidentPutin’s clear ‘red line’ signal yesterday is notable for two reasons: as a tail-risk ‘fattener’ in its own right, and as a

海外研报

2024年09月15日

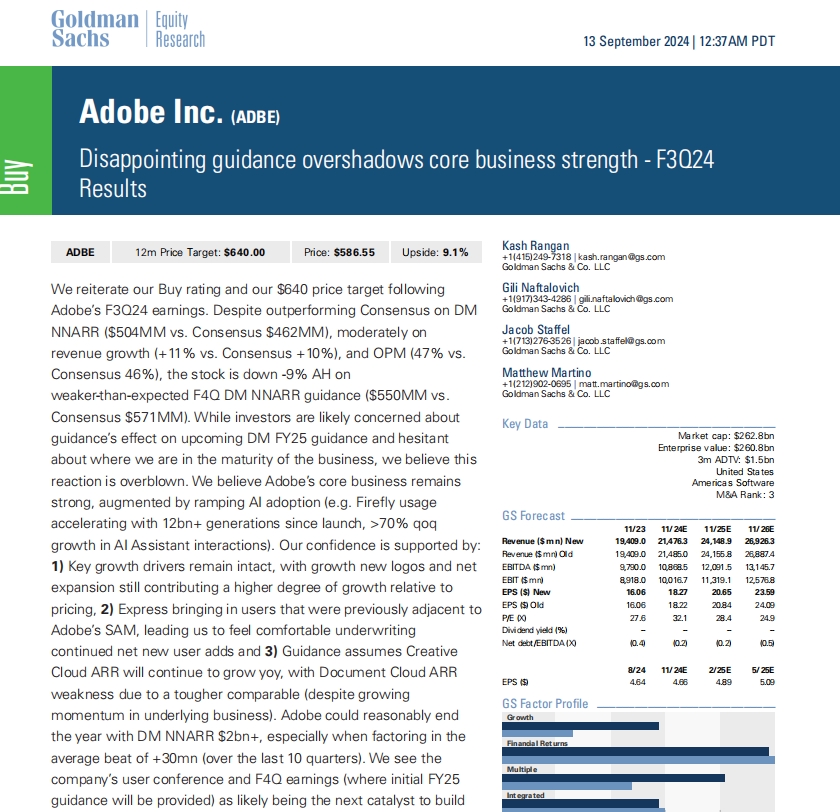

GS--Disappointing guidance overshadows core business strength - F3Q24 Results

We reiterate our Buy rating and our $640 price target followingAdobe’s F3Q24 earnings. Despite outperforming Consensus on DM

海外研报

2024年09月15日

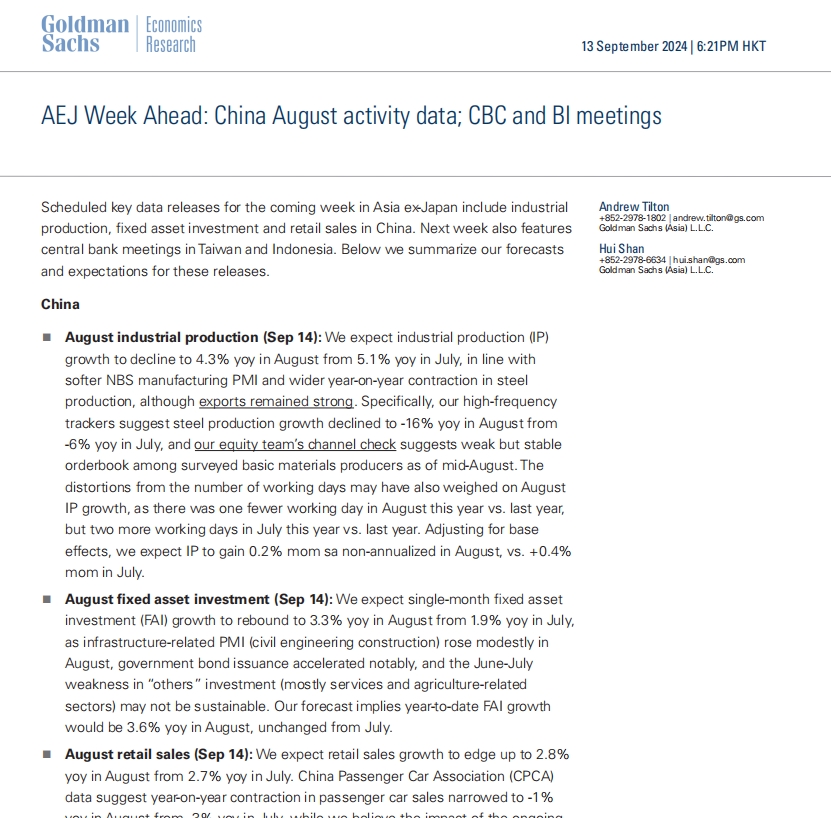

GS--AEJ Week Ahead: China August activity data; CBC and BI meetings

growth to decline to 4.3% yoy in August from 5.1% yoy in July, in line withsofter NBS manufacturing PMI and wider year-on-year contraction in steel

海外研报

2024年09月15日

GS--What’s Powering Your Services Recap - 9/13/24

This week in Business & Information Services, we had a number of companiespresent at our 2024 Communacopia + Technology Conference in San Francisco,

海外研报

2024年09月15日

BofA - Hartnett - The Flow Show 3B Bulls_20240912

Scores on the Doors: gold 21.6%, stocks 13.6%, crypto 9.1%, HY bonds 6.9%, IG bonds 4.8%, cash 3.7%, govt bonds 2.2%, US dollar 0.3%, commodities -2.0%, oil -6.1% YTD.

海外研报

2024年09月15日

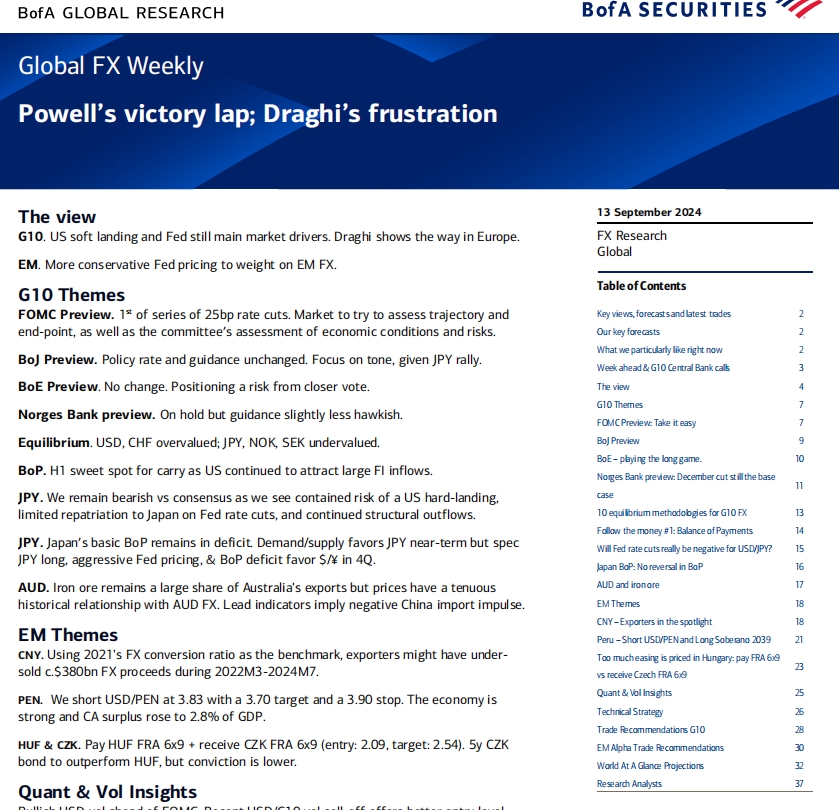

BofA--Global FX Weekly Powell s victory lap- Draghi s frustration_20240913

G10. US soft landing and Fed still main market drivers. Draghi shows the way in Europe. EM. More conservative Fed pricing to weight on EM FX.

海外研报

2024年09月15日