海外研报

筛选

Seeking Certainty Amid Change

We expect a range-bound market in near term, as recent rallyhas largely priced in the positive developments since February.Despite positive policy pivots, we caution against persistentdeflation pressure and rising complexity from trade protection

海外研报

2024年07月01日

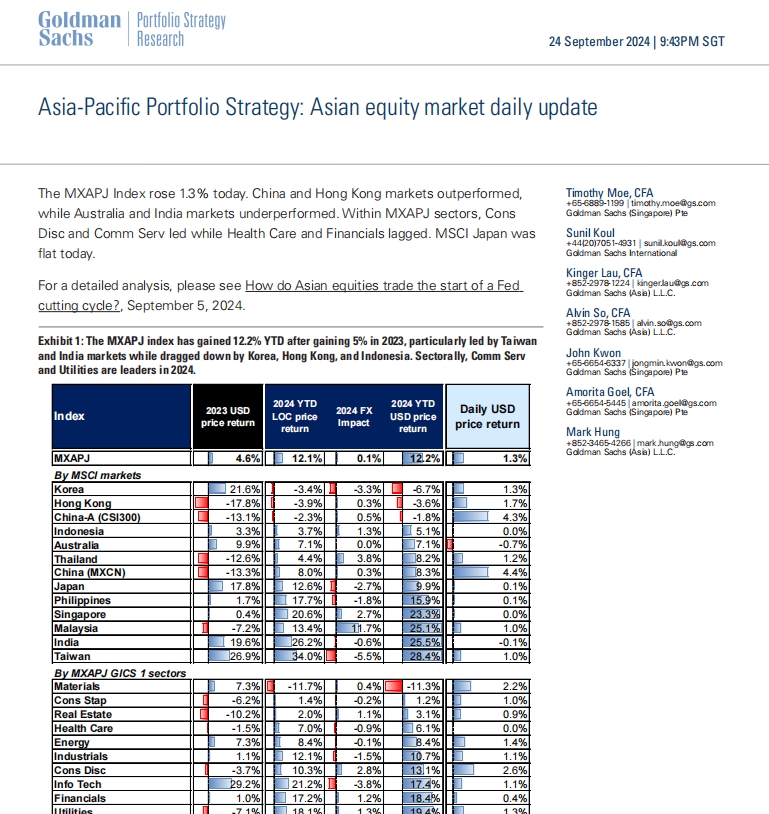

GS--Asia-Pacific Portfolio Strategy: Asian equity market daily update01

The MXAPJ Index rose 1.3% today. China and Hong Kong markets outperformed,while Australia and India markets underperformed. Within MXAPJ sectors, Cons

海外研报

2024年09月25日

SocGen_Asia Equity Market Arithmetic Sentiment turns cautiously pessimistic o

◼ Last week was a good one for global equities, particularly DM as Japan led the way (again) and

海外研报

2024年10月17日

USB--Get ready 4Q outlook: Rates, votes, and volatility

As we look ahead into the fourth quarter of the year, rates, votes, and volatility will be in focus—all of which could affect investment outcomes.

海外研报

2024年09月24日

FX Weekly--Muted USD reaction as Fed easing begins

FX View: This week the US dollar (DXY) is lower by only 0.4% following the FOMC decision to cut rates by 50bps. It’s clear market participants were well positioned for

海外研报

2024年09月24日

SocGen - Credit Strategy Weekly - Rate cuts to the rescue

A 50bp cut gave a boost to risky assets and credit took full advantage The Fed’s decision

海外研报

2024年09月24日

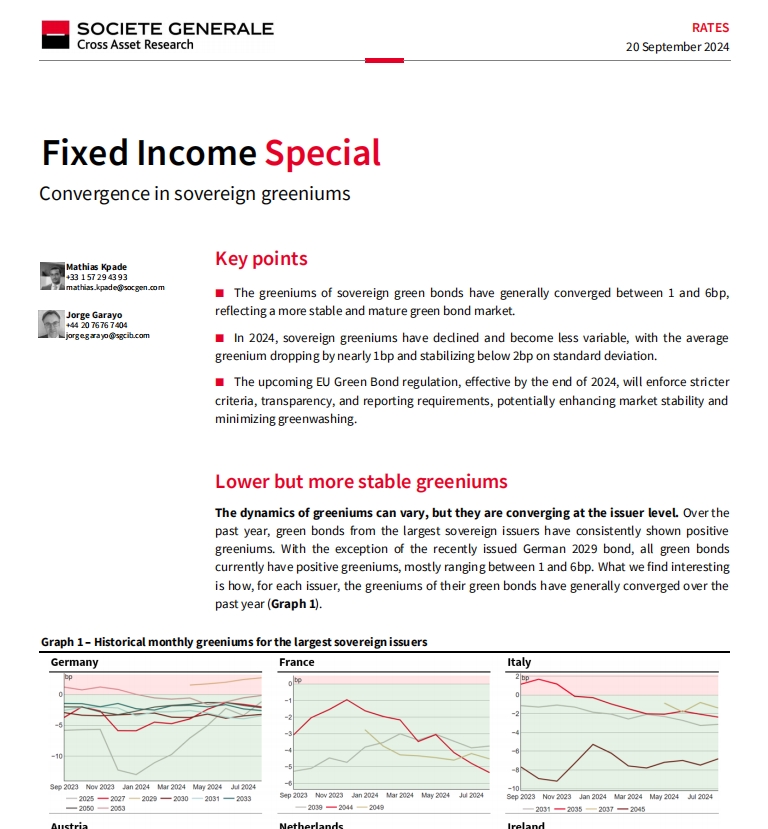

SocGen - Fixed Income Special - Convergence in sovereign greeniums

The greeniums of sovereign green bonds have generally converged between 1 and 6bp, reflecting a more stable and mature green bond market.

海外研报

2024年09月24日

GS--This Week in Asia-Pacific Macro: 23 - 29 September (Audio)

A quick summary of our macro insights on the past week’s developments andupcoming events in Asia-Pacific — including economic data, central bank policies,

海外研报

2024年09月24日

UBS--Preparing portfolios for the fourth quarter Weekly Global

Deeper DiveEquity markets are approaching the end of the third quarter in high spirits.

海外研报

2024年09月24日

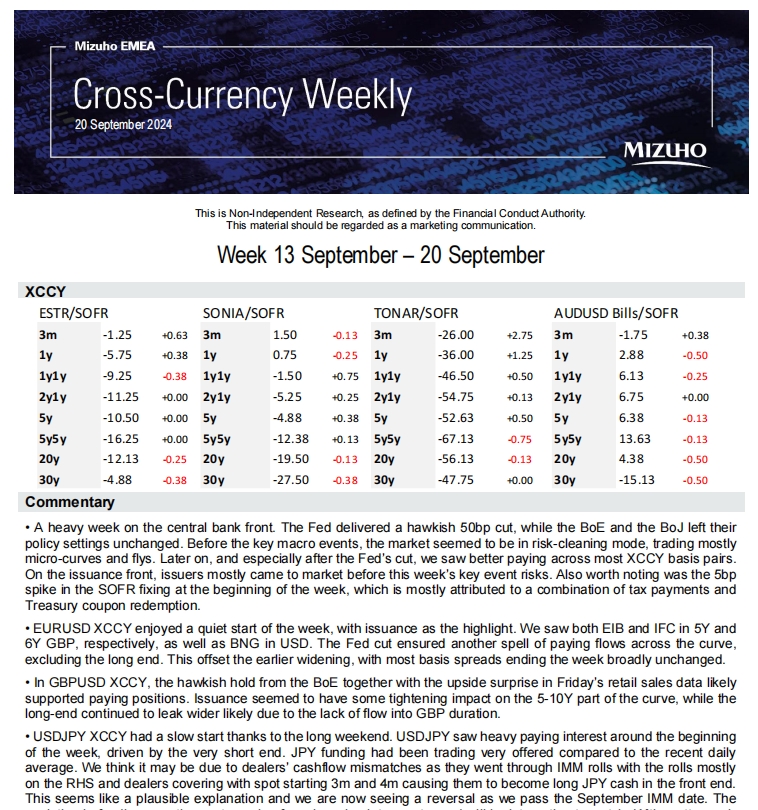

XCCY Weekly 2024-09-20

• A heavy week on the central bank front. The Fed delivered a hawkish 50bp cut, while the BoE and the BoJ left their

海外研报

2024年09月24日