海外研报

筛选

Weekly - Regional View US_en_1624131

It’s been over 900 days since the Federal Reserve first hiked interest rates inresponse to surging inflation, embarking on one of most aggressive policytightening journeys in history. Now, 2.5 years and

海外研报

2024年09月19日

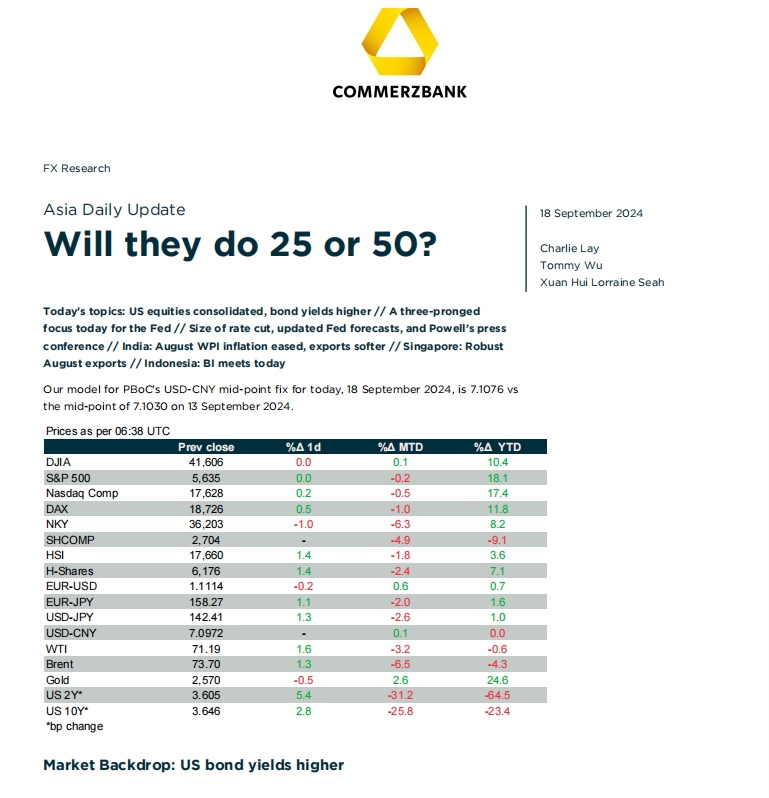

Will they do 25 or 50

Today's topics: US equities consolidated, bond yields higher // A three-prongedfocus today for the Fed // Size of rate cut, updated Fed forecasts, and Powell’s press

海外研报

2024年09月19日

GD--FED DID THE RIGHT THING, AND NOW THE FUN BEGINS

By finally easing and revealing its plan for a faster pace of cuts, the FOMC finally set loose a new set of marketdynamics to impact the economy – unless the path to recession is already fated. I do not believe recession is fated

海外研报

2024年09月20日

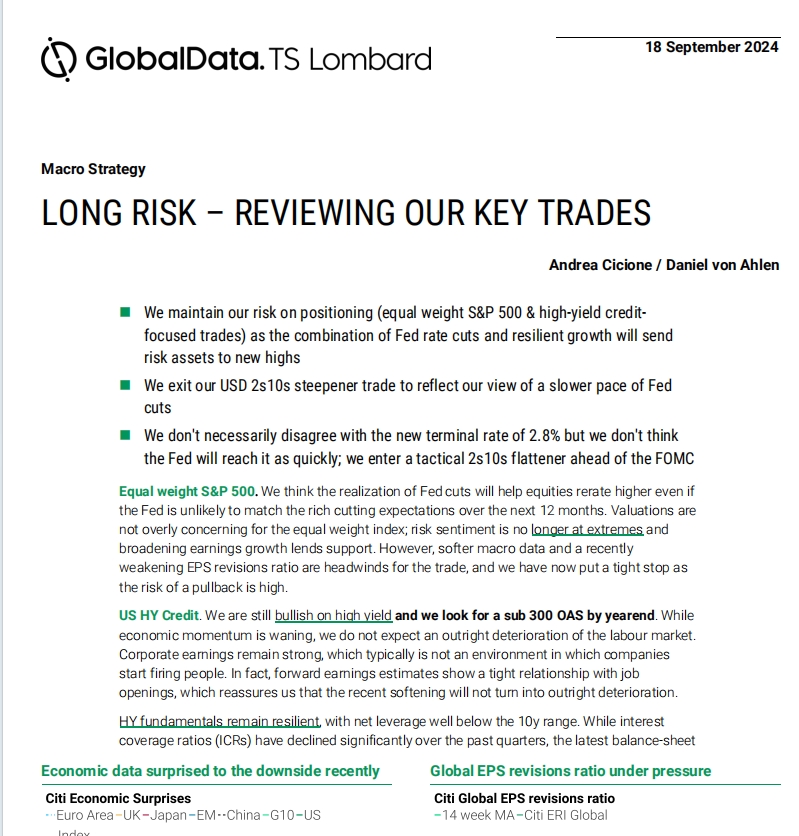

GD--LONG RISK – REVIEWING OUR KEY TRADES

We maintain our risk on positioning (equal weight S&P 500 & high-yield creditfocused trades) as the combination of Fed rate cuts and resilient growth will send

海外研报

2024年09月20日

A jumbo cut to start the easing cycle

The FOMC delivered what markets had asked for by cutting the target range 50bp to 4.75-5.00%, highlighting its strong commitment “to

海外研报

2024年09月20日

GS--3Q Uniform Rental Sentiment Survey reveals stable growth outlook

Our 3Q Uniform Rental Sentiment Survey, which provides a rolling six-monthforward-looking view on multiple dimensions of the industry, points to a stable

海外研报

2024年09月20日

GS--Non-Residential Construction: August Data Mixed Despite Outlook for Lower Rates

Key Data Points Diverge: The Dodge Momentum Index rose 3% sequentially inAugust and was 24% higher YOY, while the Architecture Billings Index declined to45

海外研报

2024年09月20日

GS--Americas Real Estate: REITs: Large rate cuts and a stable economy could be a winning comb

Following the Fed’s announcement of a 50bps reduction to its policy rate, we revisitour analysis of residential REIT performance around Fed rate cuts. We find that

海外研报

2024年09月20日

GS--Overview of Contracting Activity Heading into Year-End; Buy CCJ on Exposure to Asym

In this note, we discuss spot and term market dynamics within uranium and nuclearfuel. In recent conversations with investors, we note an increasing focus on

海外研报

2024年09月20日

Barclays_September FOMC- A 50bp re- calibration_20240919

The FOMC initiated its rate-cutting cycle today with a largerthan-expected 50bp cut and an SEP showing 100bp of cuts thisyear, followed by 100bp in 2025, 50bp in 2026 and a longer-run

海外研报

2024年09月20日