海外研报

筛选

De-grossing, Positioning Declines, and Rotations...Meaningful in July, But Could be Nearly Over

HF performance / alpha drawdown and de-grossing…are we done yet? July was the first month for negative Eq L/S alpha this year and de-grossing reached fairly extended levels for Eq L/S and Multi-Strats in

海外研报

2024年08月06日

RECESSION APPEARS INEVITABLE BY YEAR- END, UNLESS THE FED CUTS (THEY WILL)

The search is on for indications that the economy is heading towards recession if the Fed fails to act sooner than later – not for indicators of recession itself. The softening data that are rolling

海外研报

2024年08月07日

INTERNATIONAL MARKET INTELLIGENCE:MORNING BRIEFING AUGUST 8.2024

OVERNIGHT BRIEFUS/EU trade: European Equities were higher (SXXP +1.5%, $X5E +2%). Almost all D1 baskatsrallied over +iz today as mean revarsion picked up momantum from the open after

海外研报

2024年08月09日

MXAPJ closed the week flat, led by rebounds in the Greater China markets

MXAPJ closed flat, with Hong Kong & China Offshore (+2%)leading Korea (-4%), Singapore (-3%), and Australia (-2%).

海外研报

2024年08月12日

SALES COMMENTARY ONLY (NOT A PRODUCT OF RESEARCH)

What a week – not only in markets but also in sports. With the Summer Olympics set to conclude on Sunday, it’s been nothing short of

海外研报

2024年08月14日

BofA on USA Payback, not a slowdown

We expect a consensus-like retail sales report for JulyTotal card spending per household (HH), as measured by BAC aggregated credit and

海外研报

2024年08月15日

European Morning Research Summary

This summary is compiled from research reports previously published by Barclays Equity Research. A full list of all publications is available on

海外研报

2024年08月18日

US Economic Weekly Slow and steady, not fast and furious

Weekly viewpointThis week’s jam-packed data calendar delivered mostly good news. Inflation was

海外研报

2024年08月18日

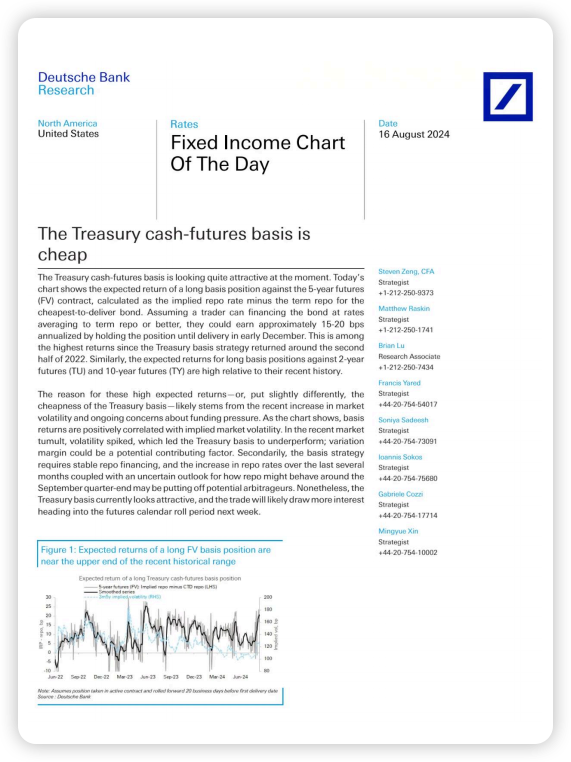

The Treasury cash-futures basis ischeap

The reason for these high expected returns-or, put slightly differently, thecheapness of the Treasury basis -likely stems from the recent increase in marketvolatility and ongoing concerns about funding pressure. As the chart shows,

海外研报

2024年08月20日

LONG CARRY, SHORT TREND

Powell's Jackson Hole speech gave a strong indication that inflation is no longer the tail risk for the Fed and that it is the health of the labour market that is now paramount. While the dual

海外研报

2024年08月29日