海外研报

筛选

Market moves continue to follow the drift towards Trump in the betting odds

US: Stocks closed lower; NDX lagged. Bond yields resumed the upward momentum: 2y and 10yare 5bp and 4bp higher,

海外研报

2024年10月24日

GS--Prime_Insights_and_Analytics_Chart_Pack_October_2024_-_Marquee

Fundamental L/S returns are up +0.6% in Oct MTD (now up +12% on the year), driven by positive alpha and to a lesser extent

海外研报

2024年10月24日

GS--South Africa: Inflation Moderates in September, In Line with Expectations

Bottom line: Headline inflation declined from 4.4%yoy to 3.8%yoy and core inflation

海外研报

2024年10月24日

The Real Risk Is Japan

Japan’s real policy interest rate differential versus the US stands at an unprecedented

海外研报

2024年10月24日

The USD and the US election: the 4% rule

Polls remain very close ahead of the US presidential election, making it

海外研报

2024年10月24日

GS--Phone net additions above the Street, with a slight uptick to guidance

Key stock takeaways: We expect the stock to move modestly higher following

海外研报

2024年10月24日

GS--USA: Existing Home Sales Slightly Below Expectations

BOTTOM LINE: Existing home sales declined 1.0% to 3.84 million units in

海外研报

2024年10月24日

GS--Attractive Options on Big Earnings Movers

Big earnings-day moves are happening more frequently than any time in the

海外研报

2024年10月24日

GS--Post-election economic policies, more monetary easing, lower long-term US equity returns

Post-election economic policies

海外研报

2024年10月24日

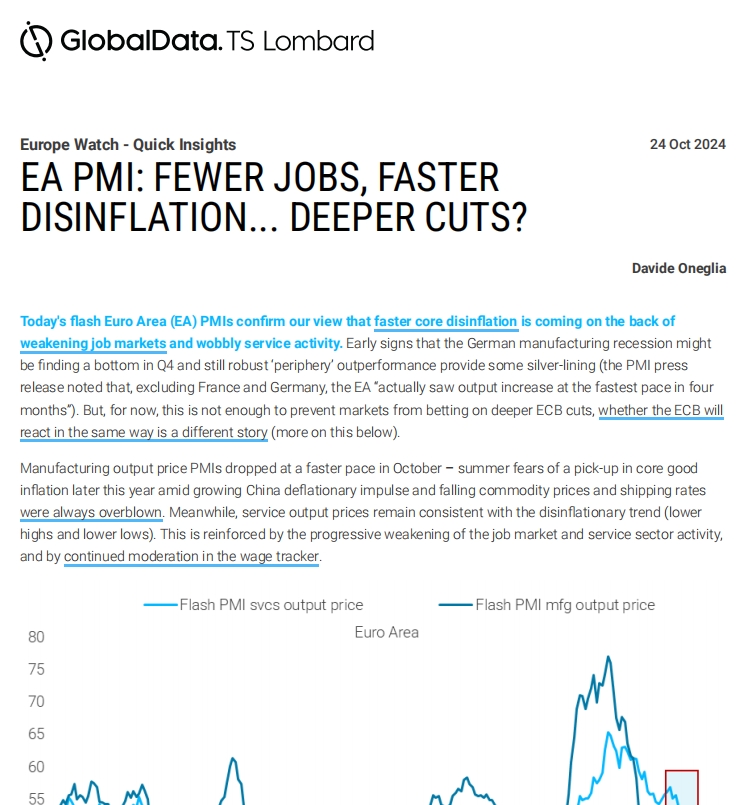

GD--EA PMI: FEWER JOBS, FASTER DISINFLATION... DEEPER CUTS?

Today's flash Euro Area (EA) PMIs confirm our view that faster core disinflation is coming on the back of

海外研报

2024年10月25日