海外研报

筛选

Japan Equities and the Yen

Incoming economic data may drive a further unwinding of JPY carry trades/FXhedged activity from overseas equity investors. We retain a bullish JPY skew.

海外研报

2024年08月12日

The Weekly Worldview: The cycles advance

Last week was marked by three key central bank decisions. The BoJ hiked for the first time after ending negative interest rate policy (and specified a plan to reduce

海外研报

2024年08月12日

Answering your questions on Japan macro developments

The US growth scare coupled with a hawkish BoJ have contributed to high volatility in Japan's asset markets. We assess

海外研报

2024年08月12日

Gen AI: Who is spending what? Where will revenues come from? The ultimate industry model.

The world will spend $105bn on XPUs in 2024, i.e.$210bn in AI capex, up 10x vs. 2020.

海外研报

2024年08月12日

On Our Minds RBI: Growth optimism behind hawkish stance

The RBI kept the policy rate (at 6.5%) and the policy stance (withdrawal of accommodation) unchanged during its monetary policy meeting in August

海外研报

2024年08月12日

Some relief, however the risks still remain

The market began the week with a broad-based risk-off sentiment on Monday, and the continued carry trade unwinding pushed the USD/JPY and USD/CNY

海外研报

2024年08月12日

European Contextual Diary The Week Ahead

In this note we preview the coming week's corporate events Below we highlight three key events for next week. Please see this excel for a full list of

海外研报

2024年08月12日

UK Weekly Kickstart Summer data-only update

General disclosuresThis research is for our clients only. Other than disclosures relating to Goldman Sachs, this research is based on current public

海外研报

2024年08月12日

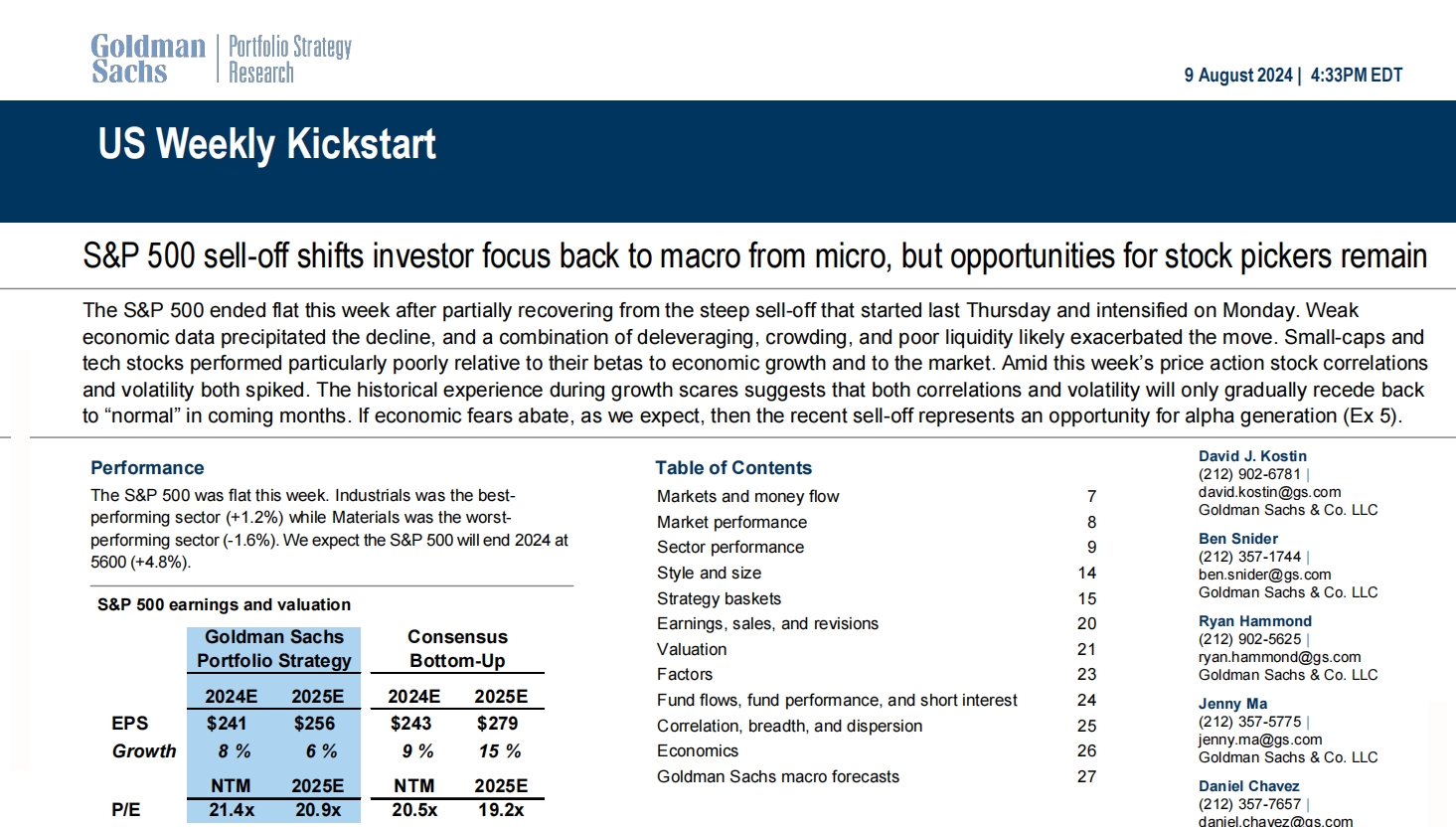

US Weekly Kickstart

The S&P 500 ended flat this week after partially recovering from the steep sell-off that started last Thursday and intensified on Monday. Weak

海外研报

2024年08月12日

Mizuho China Weekly Outlook

China’s CPI rose by 0.5% YoY in July, surpassing market expectations. However, this uptick in the inflation rate was helped by stabilizing food prices rather than improved consumer demand. Food prices in July

海外研报

2024年08月14日