海外研报

筛选

Frasers Centrepoint Trust

MMaaiinnttaaiinn BBUUYY wwiitthh TTPP ooff SS$$22..7700.. FCT continues pull the right levers with the recent acquisition of NEX mall, placing it as “King of suburban retail malls”. With

海外研报

2024年07月27日

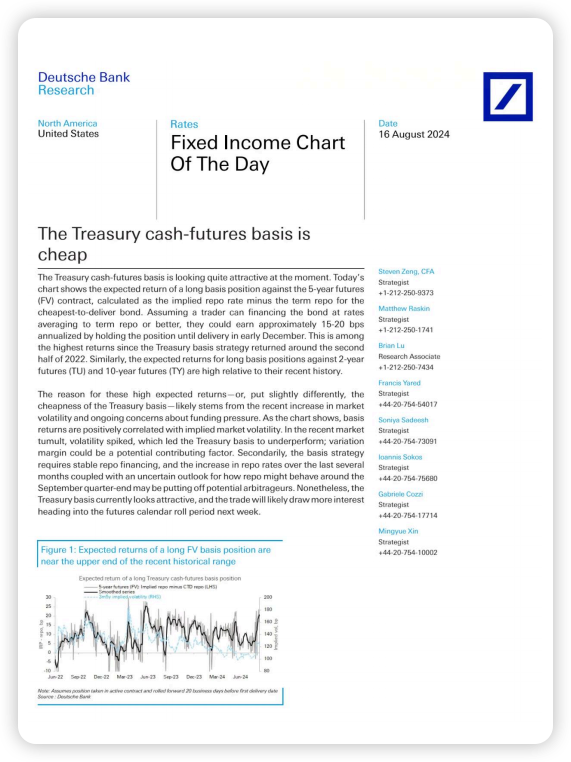

The Treasury cash-futures basis ischeap

The reason for these high expected returns-or, put slightly differently, thecheapness of the Treasury basis -likely stems from the recent increase in marketvolatility and ongoing concerns about funding pressure. As the chart shows,

海外研报

2024年08月20日

The Flow Show Peak Oligarchy

Scores on the Doors: crypto 33.5%, gold 14.1%, stocks 11.0%, oil 9.3%, commodities 5.4%, HY bonds 4.4%, cash 3.0%, US dollar 2.9%, IG bonds 0.8%, govt bonds -3.1% YTD.

海外研报

2024年07月27日

DeskTalk - Macro whispers of Trump 2.0 trades

US Treasuries are opening lower after a holiday in Tokyo. 2s10s curve is bull steepening though the move is likelyto be contained ahead of Fed Chair Powell's interview today. That said, our rates strategists think momentum, weak

海外研报

2024年07月16日

growth slowdown, US elections, market concentration

The GOAL Risk Keeper is a new regular publication which focuses onrisk-management of multi-asset portfolios. It presents liquid alternatives, dynamic

海外研报

2024年07月27日

Transforming World – Q3 2024 Thematic Primer Picks & Stocklist (GWIM)

Transforming World: Quarterly Update of Stocks We highlight in this report our quarterly update of Thematic primer picks that are on BofA Global Research’s regional Q3 2024 best ideas lists, new thematic company

海外研报

2024年07月22日

European Morning Research Summary

This summary is compiled from research reports previously published by Barclays Equity Research. A full list of all publications is available on

海外研报

2024年07月24日

BofA Securities Equity Client Flow Trends Big week of equity selling

Biggest net sales since Nov. 2020: Last week, during which the S&P 500 was -2.0%, BofA Securities clients were largest net sellers of US equities (-$7.0B) since 2015. Sales were driven by single stocks, while ETFs saw muted inflows.

海外研报

2024年07月24日

Global Fixed Income Markets Weekly

• Summary performance statistics for trades closed in 2022-2024• Covering Europe, UK, Scandinavia, Japan and Australia/New Zealand trades

海外研报

2024年07月19日

Global Fixed Income Technical Update

The 5s/30s curve extends the breakout steepening to the 29.5bp Jan 78.6% retrace and 30bp Apr-Jun range measured move objective. Multi-year base

海外研报

2024年07月19日