海外研报

筛选

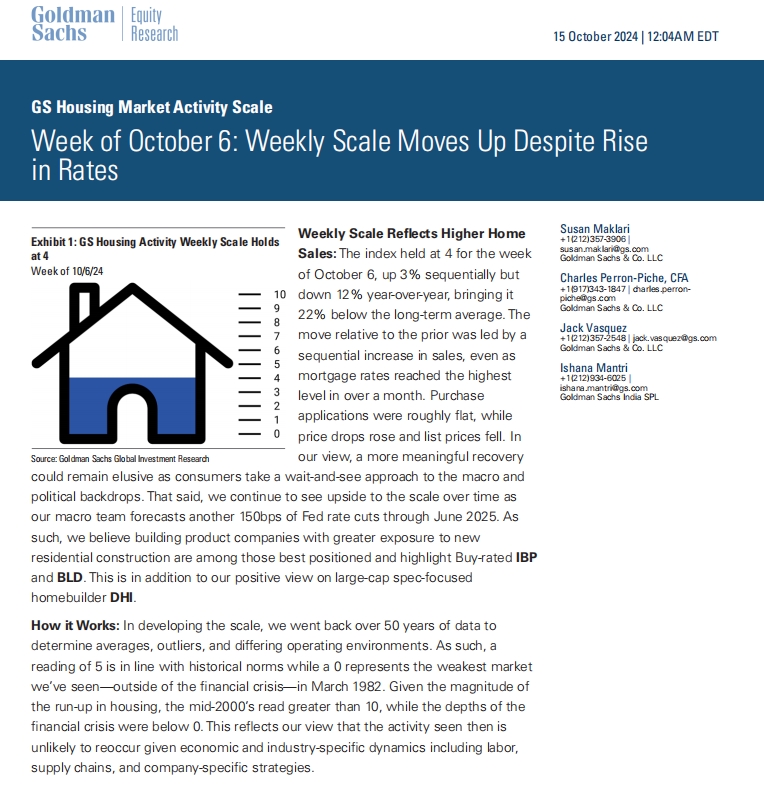

GS--Week of October 6: Weekly Scale Moves Up Despite Rise in Rates

Weekly Scale Reflects Higher Home

海外研报

2024年10月16日

BofA_Industrials-Multi-Industry DEM 599- A closer look at industry inventories and pricing_20241018

Manufacturing inventories rise in August

海外研报

2024年10月19日

GS--Buy developers with strong saleable pipeline

As we see China property prices stabilizing in late-25E (link), we expect coverage

海外研报

2024年10月23日