海外研报

筛选

The message of a bond market

It is almost comical. Just as Wall Street and mainstream media became convinced that Donald Trump is the next US president, Joe Biden’s withdrawal and the sudden rush to gather around Vice President Kamala Harris

海外研报

2024年07月31日

a complete exit from deflation after the next global economic cyclical recovery

Despite stagnant domestic demand, the BoJ's premature lifting of its negative interest rate policy and additional rate hike put downward pressure on the credit

海外研报

2024年08月08日

Investor Allocations

Marginal decline in price momentum; fund inflows remain strongAmid a somewhat a dovish tone in the July FOMC meeting, which laid thegroundwork for possible rate cuts in September and beyond, globalequities (FTSE All World) ended the month

海外研报

2024年08月12日

This is Non-Independent Research, as defined by the Financial Conduct Authority

Today’s session kicks off with markets having to digest the new set of UK inflation data. UK headline CPI was expected to rebound from June’s 2.0% handle, but the rebound was slightly smaller than expected, with

海外研报

2024年08月15日

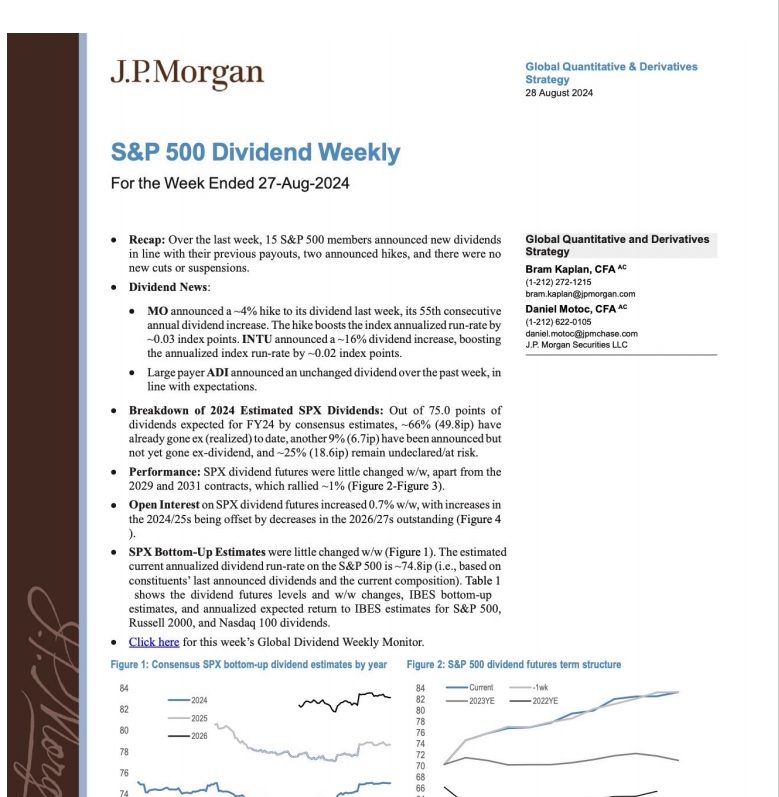

S&P 500 Dividend WeeklyFor the Week Ended 27-Aug-2024

Breakdown of 2024 Estimated $PX Dividends: Out of 75.0 points ofdividends expected for FY24 by consensus estimates, ~66% (49.8ip) havealready gone ex (realized) to date, another 9% (6,7ip) have been announced butnot yet gone ex-dividend, and

海外研报

2024年08月30日

Fixed Income Weekly Back to reality

September is about to begin with a series of key data that will enable the market to finetune its rate cut pricing. As central banks aim to ease their monetary policy stance preemptively, there is no reason to rush

海外研报

2024年09月03日

Viewpoint The Time Has Come

This month we highlight our viewpoints on forthcoming trends. It includes our expectations for a measured rate cutting cycle to begin imminently while the

海外研报

2024年09月11日

BofA_Macro Risk Digest So it begins_20240913

We estimate corporates in Europe and Asia collectively held around $1trn of FX deposits in 1Q 2024. An unwind could amplify USD depreciation, although more likely over the

海外研报

2024年09月15日