海外研报

筛选

Americas Transportation: Railroads: Weekly Rail Carload Snapshot — Week 30

Total traffic results for US Class I rails under coverage imply carload growthat +6.2% YoY in week 30, an acceleration versus -0.7% YoY in week 29.

海外研报

2024年07月31日

FADE THE RECESSION NARRATIVE

The market has been hypersensitive to negative economic surprises because of the extent to which GDP growth and earnings expectations have been ratcheted up over the course of this

海外研报

2024年08月08日

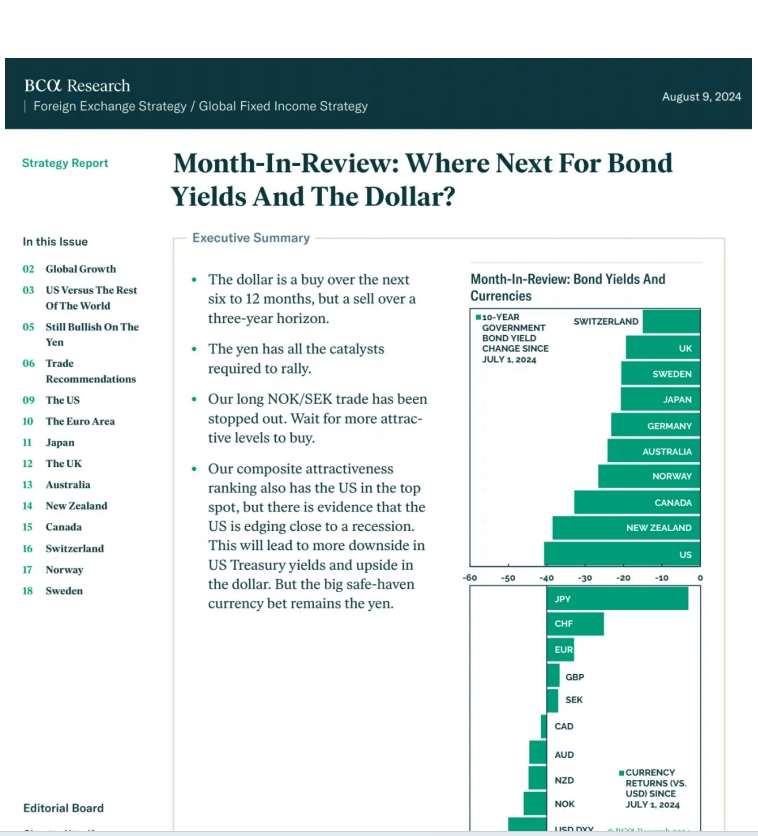

Month-In-Review: Where Next For BondYields And The Dollar?

The dollar is a buy over the nextsix to 12 months, but a sell over athree-year horizon.The yen has all the catalystsrequired to rally.

海外研报

2024年08月12日

BofA on USA Payback, not a slowdown

We expect a consensus-like retail sales report for JulyTotal card spending per household (HH), as measured by BAC aggregated credit and

海外研报

2024年08月15日

Credit Calls Thursday, August 22,2024

FeatureHG&HYRetail Earnings HalfTimeReport: Mixed consumer keeps retailerscautious (Carla Casella, CEA)It is time for the halftime report, but we feel we have a lot more color from the firsthalfthan the second, This is a good time to refresh

海外研报

2024年08月23日

Patience and persistence pay off for Pampa Energia

Move to OW on scale, trajectory, fundamentals & strategyPampa Energiía has been able to maintain low leverage, high liquidity while still

海外研报

2024年08月27日

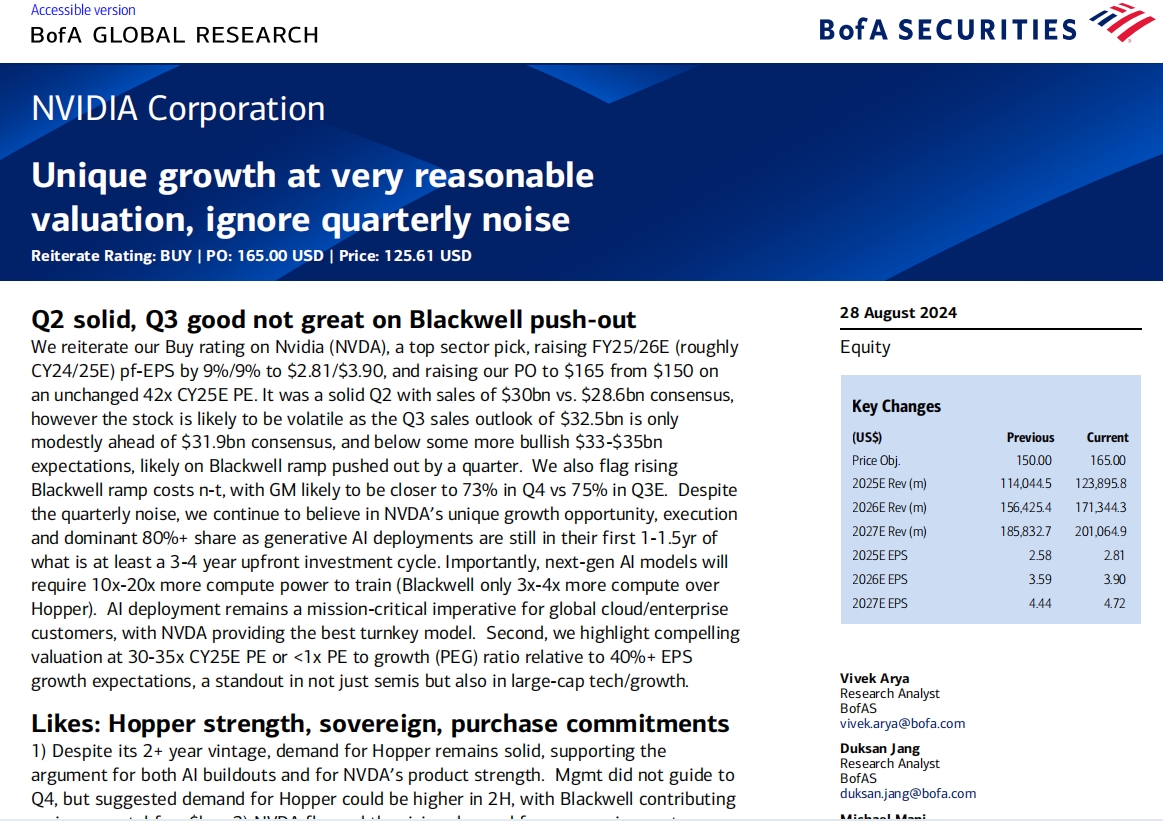

Unique growth at very reasonable valuation, ignore quarterly noise

Q2 solid, Q3 good not great on Blackwell push-outWe reiterate our Buy rating on Nvidia (NVDA), a top sector pick, raising FY25/26E (roughly .

海外研报

2024年08月30日

Banks & foreign investors buy while CTA demand peaking

Buying aboundsRecent weeks have seen buying flow from CTAs, investment funds, asset managers, banks, and even foreign investors. The bid for duration appears to be quite strong. While

海外研报

2024年09月03日

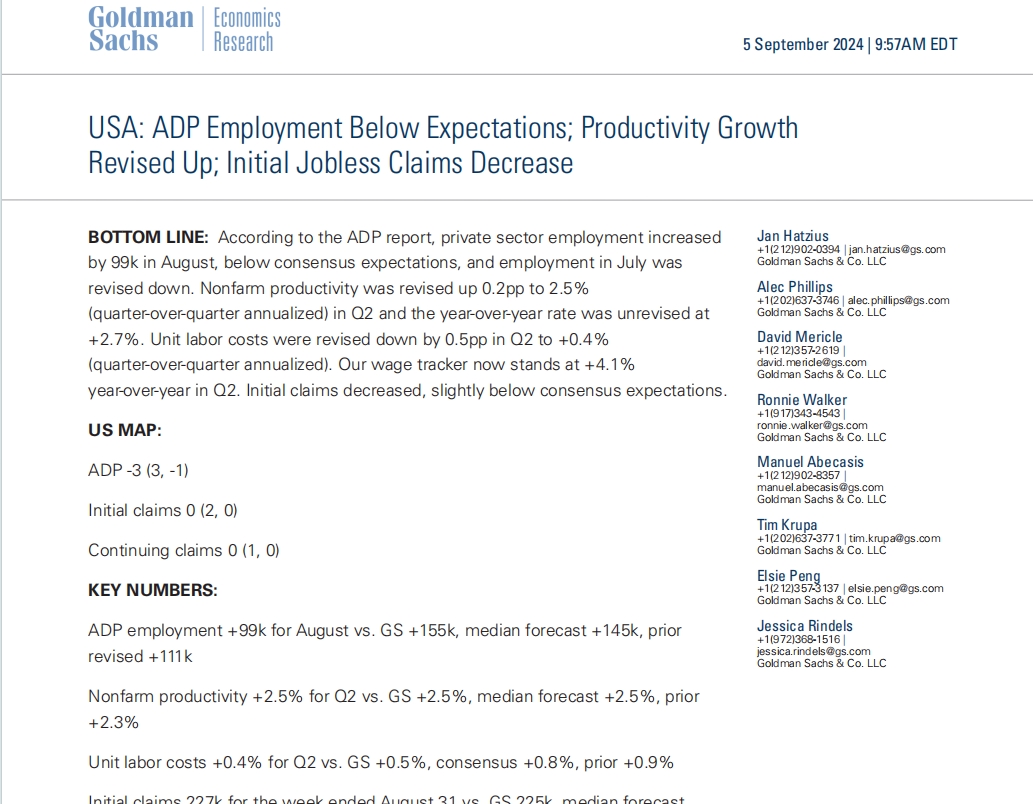

ADP Employment Below Expectations

BOTTOM LINE: According to the ADP report, private sector employment increasedby 99k in August, below consensus expectations, and employment in July was

海外研报

2024年09月06日