海外研报

筛选

Global Rates Trader Risk Relaxation

Last week’s labor market surprise gave way to broader market tremors as the weekbegan, but relatively benign data out of the US appears to have helped calm rates

海外研报

2024年08月14日

USA: July Housing Starts Fall Sharply in the South

BOTTOM LINE: Housing starts dropped by 6.8% in July from a downwardly revisedJune level, well below expectations for a smaller decrease. The decline was led by

海外研报

2024年08月18日

Learnings from Q2 earnings

Decent Q2 earnings. The Q2 reporting season saw EPS growth improving sequentially in bothEurope and US to 3% and 10%, respectively, well above consensus estimates. Both of these

海外研报

2024年08月22日

Taking stock, looking ahead

We expect a muted recovery in European and US steel prices into YE, underpinned by a seasonal pick-up in activity and, in

海外研报

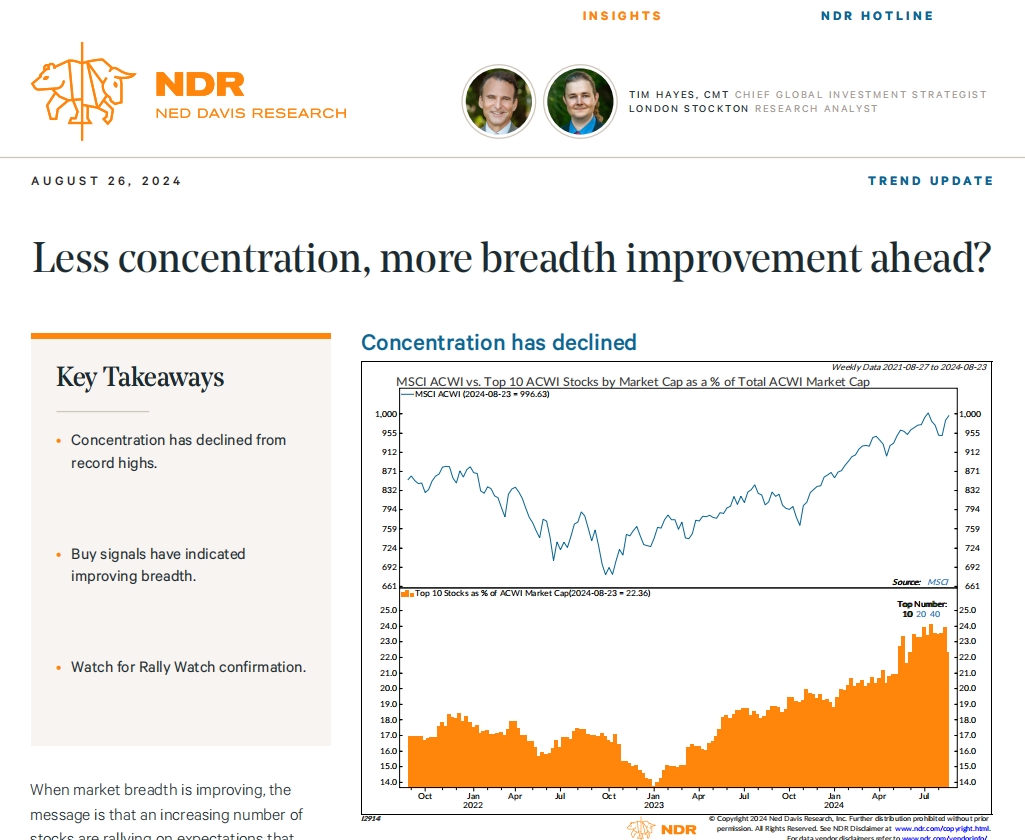

2024年08月26日

Less concentration, more breadth improvement ahead?

When market breadth is improving, the message is that an increasing number of

海外研报

2024年09月05日

GS--Earnings matters: 10 key takeaways from 6000+ companies’ 2Q/1H24 results

Offshore led A-shares. 1H24 profit growth came in at 12%/0% forMXCN/CSI300. 41% of market cap beat expectations while 35% missed.

海外研报

2024年09月10日

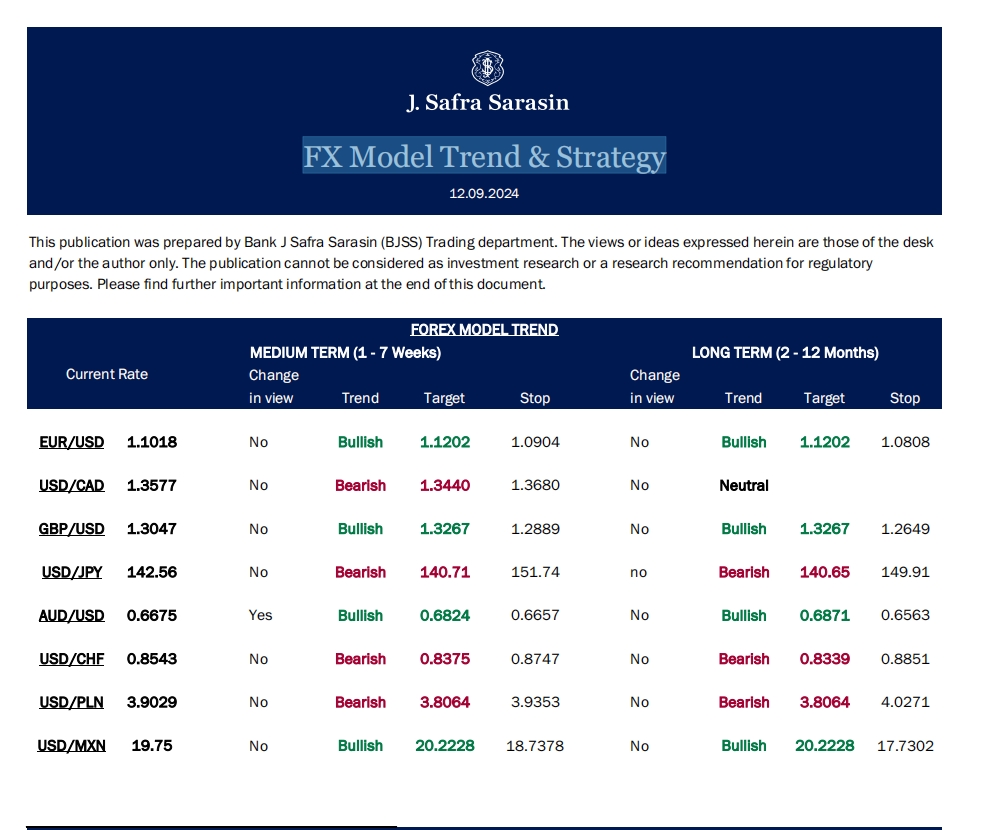

FX Model Trend & Strategy

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed herein are those of the desk

海外研报

2024年09月13日

JPM_Credit Calls Wednesday, September 18, 2024

It is easy to be wise after the event, We attended the World Chemicals Forum inHouston hosted byChemical Market Analytics (OPiS) last week, The general tonewas relatively bearish in our view with recent (and planned) capacity expansionefforts and

海外研报

2024年09月19日

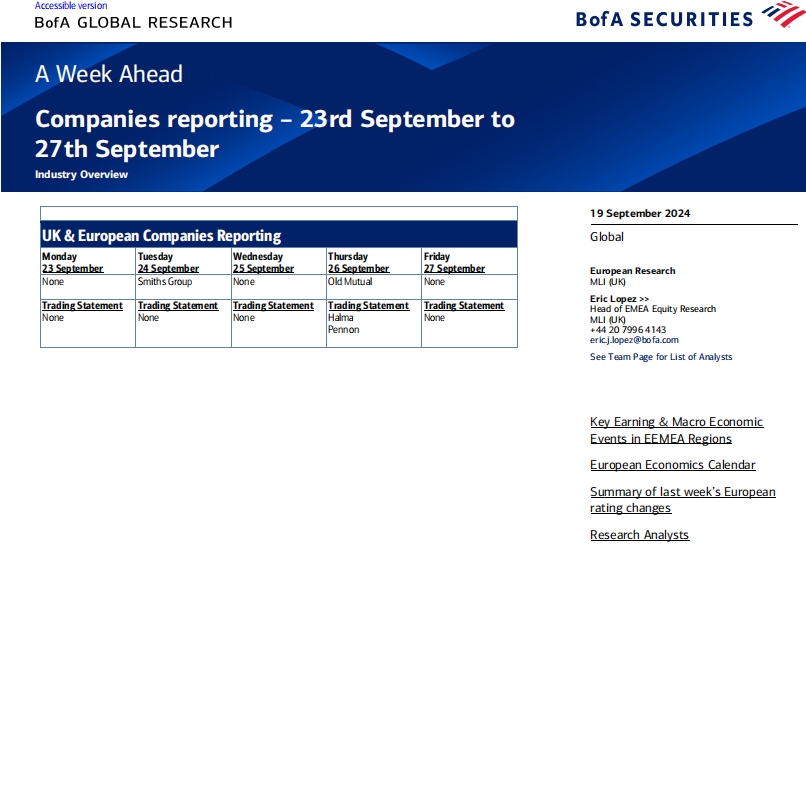

BofA_A Week Ahead Companies reporting – 23rd September to 27th September_20240919

under the FINRA rules.Refer to "Other Important Disclosures" for information on certain BofA Securities entities that take

海外研报

2024年09月23日

Global Strategy Weekly

I must apologise for falling asleep on the job. I hadn’t spotted that the US personalsaving ratio (SR) had slid all the way back to what I would describe as crisis levels.

海外研报

2024年09月27日