海外研报

筛选

Fed Chatterbox: July Edition (Rindels)

Since the FOMC’s June meeting, FOMC participants have highlighted the betterinflation readings in recent months following the firmer prints in the first quarter.

海外研报

2024年07月27日

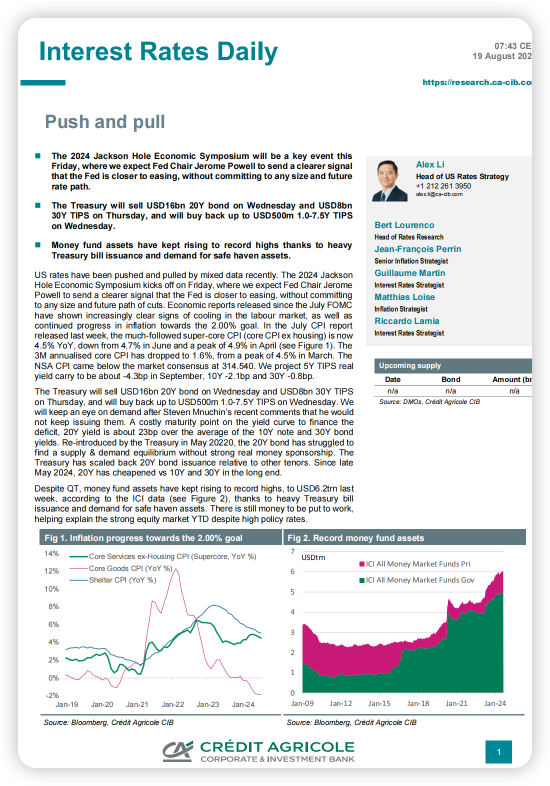

Interest Rates Daily-Push and pull

US rates have been pushed and pulled by mixed data recently. The 2024 Jackson Hole Economic Symposium kicks off on Friday, where we expect Fed Chair Jerome

海外研报

2024年08月20日

GS--NIFTY hit ATH this week, up 2%; Valuations hit peak levels

Performance: NIFTY hit all time high this week, up 2%w/w (MXAPJ: +1% w/w). Across sectors, FMCG led

海外研报

2024年09月16日