海外研报

筛选

SOFR trimming

The Fed has announced plans to make some technical tweaksto the SOFR calculation. The resulting rate is little different,

海外研报

2024年07月25日

10y JGB auction preview: A highly volatile climate

POTENTIAL POSITIVES・ BOJ's 31 July announcement has reduced uncertainty about JGB purchase taperingThe BOJ's "detailed plan" for tapering back its JGB absorption was basically in line with the

海外研报

2024年08月06日

June Q largely in-line with expectations; Taobao Tmall set for CMR reacceleration

Taobao Tmall online GMV grew high-single-digit % YoYFY1Q25 results came in mixed with revs slightly below Street expectations, including

海外研报

2024年08月18日

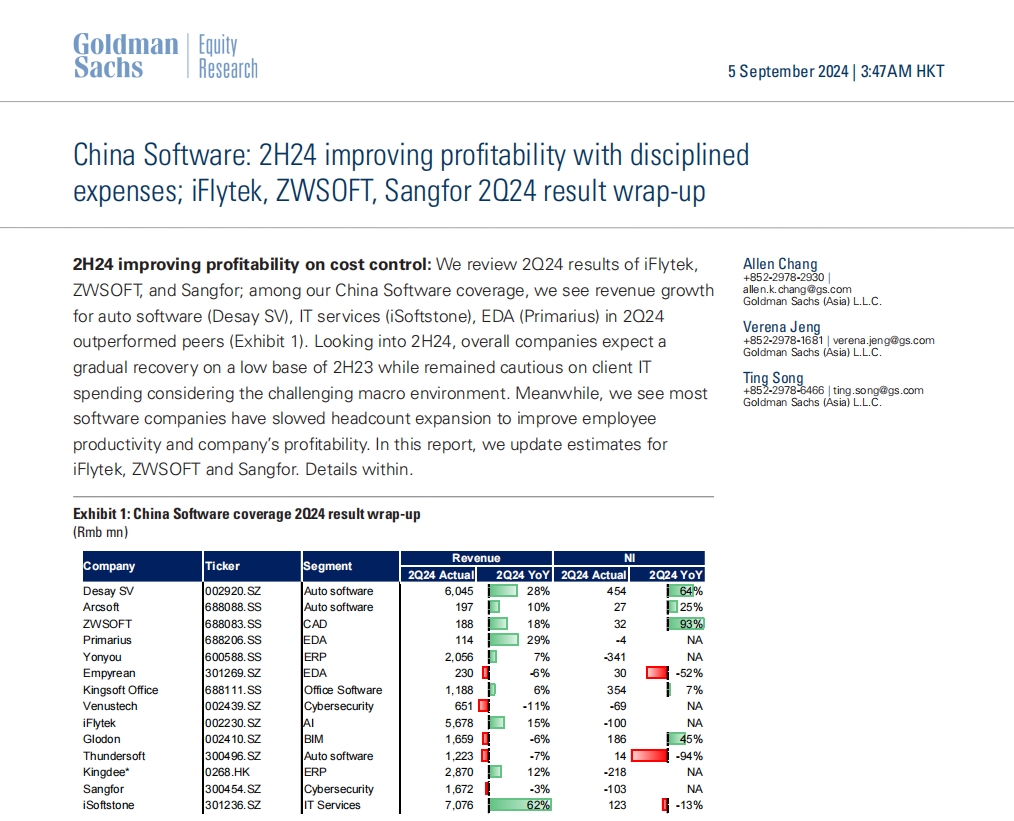

China Software: 2H24 improving profitability with disciplined expenses; iFlytek, ZWSOFT,

2H24 improving profitability on cost control: We review 2Q24 results of iFlytek,ZWSOFT, and Sangfor; among our China Software coverage, we see revenue growth

海外研报

2024年09月05日

GS--Global Economics Wrap-Up: October 4, 2024

Global Economicsn Investment in AI remained strong in Q3 as adoption inched up:

海外研报

2024年10月08日