海外研报

筛选

MS - Michael J Wilson - Weekly Warm-up_ The Market Discounts an Outsized Cut and Waits

The Market Discounts An Outsized Cut...As we laid out last week, we thought that the best short-term case for equities was that the Fed could

海外研报

2024年09月24日

UBS--Opportunities in currencies and commodities

• Why? Our general guidance is that investors shouldalign the currencies in which they hold liabilities with

海外研报

2024年09月24日

PreciousMetalsTradingDeskView_20240923_en

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed

海外研报

2024年09月24日

Quarterly Vantage Points September 18, 2024

Much of the data and conclusions on investor themes come from the Morgan Stanley Prime Brokerage Global Investor Surveys. The

海外研报

2024年09月24日

SocGen - Credit Strategy Weekly - Rate cuts to the rescue

A 50bp cut gave a boost to risky assets and credit took full advantage The Fed’s decision

海外研报

2024年09月24日

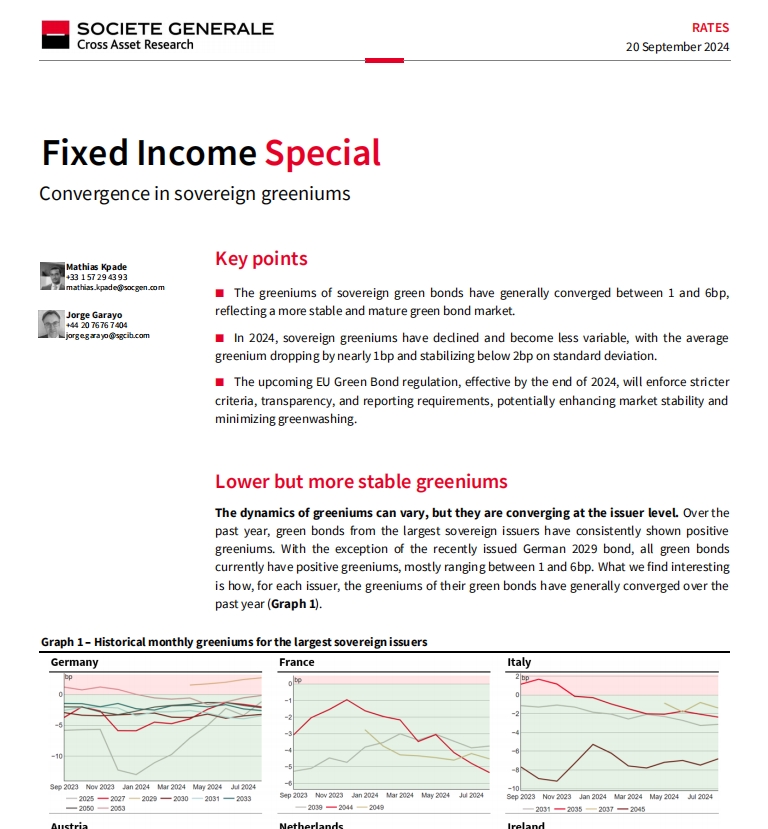

SocGen - Fixed Income Special - Convergence in sovereign greeniums

The greeniums of sovereign green bonds have generally converged between 1 and 6bp, reflecting a more stable and mature green bond market.

海外研报

2024年09月24日

SocGen - Fixed Income Weekly - Soft landing vibes

The Fed kickstarted its easing cycle with a 50bp cutwhile signalling a gradual pace ahead. The market sees rates back to neutral by mid-2025, both by the Fed and the ECB. It all

海外研报

2024年09月24日

SocGen - On Our Minds - BoJ’s next rate hike depends on fate of US economy

The BoJ kept its policy rate at 0.25% today. At the press conference, in relation to the

海外研报

2024年09月24日

SocGen - On Our Minds - Taiwan - Monetary policy divergence with the Fed to persist

Following a similar move in June, the CBC announced a 25bp increase in the required

海外研报

2024年09月24日

SocGen - Week Ahead in Economics - Big data week for the ECB after the Fed surprise

The surprise move by the Fed implies a high level of confidence that inflation is on track to

海外研报

2024年09月24日