海外研报

筛选

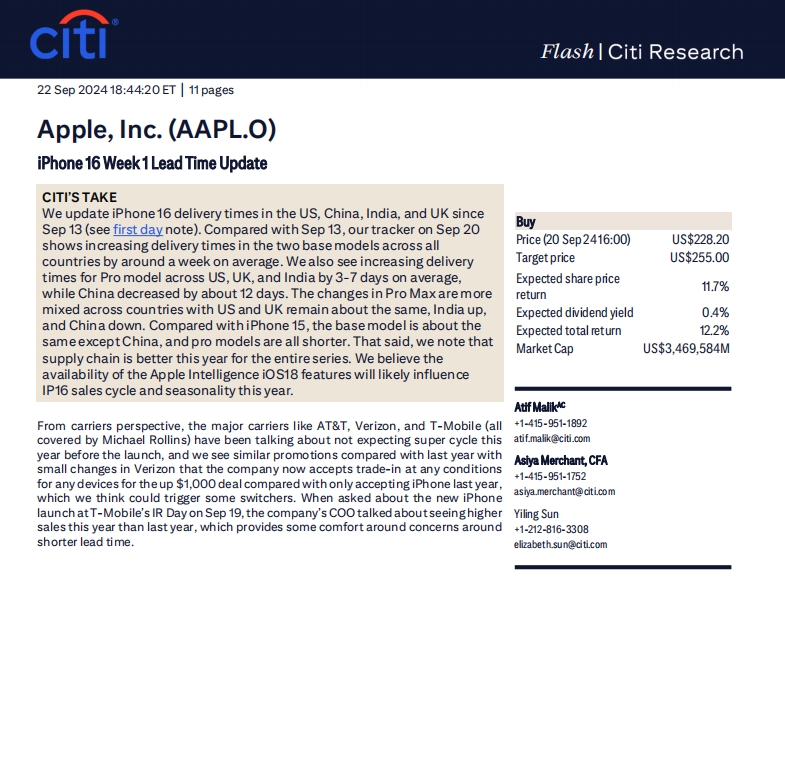

Citi_Apple, Inc. - iPhone 16 Week 1 Lead Time Update_20240922

CITI’S TAKE We update iPhone 16 delivery times in the US, China, India, and UK since

海外研报

2024年09月24日

Citi_Nike Inc - Expect Lowered F25 and Accelerated Brand Reset, with All Eyes on Mgmt Chg_20240923

CITI'S TAKE We expect 1Q25 EPS (10/1 AMC) of $0.56 vs cons $0.52 driven by lower

海外研报

2024年09月24日

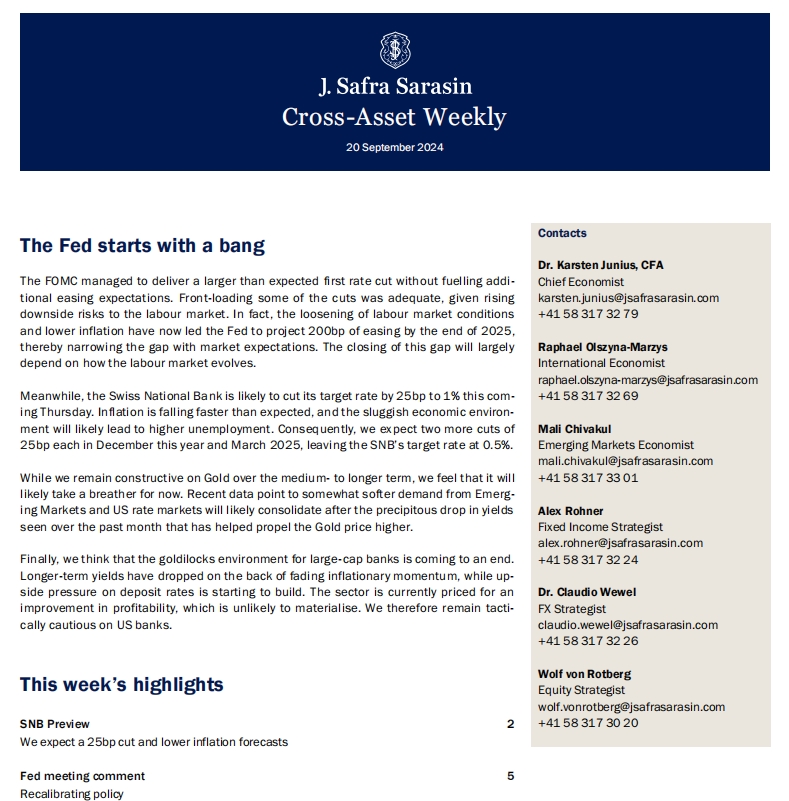

CrossAssetWeekly_20240920_en (1)

The FOMC managed to deliver a larger than expected first rate cut without fuelling additional easing expectations. Front-loading some of the cuts was adequate, given rising

海外研报

2024年09月24日

GS--Quick take: Trends show moderate upgrade in September

We refresh of our Multi-Industry Toolkit Capex Tracker to spot trends post ourlast update in July [link]. Here are our key observations:

海外研报

2024年09月24日

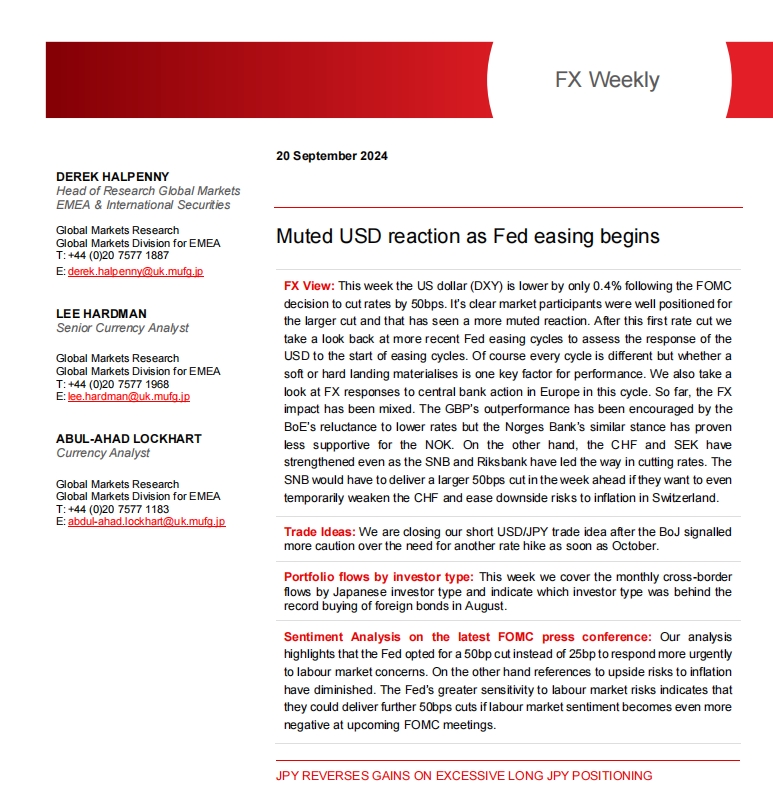

FX Weekly--Muted USD reaction as Fed easing begins

FX View: This week the US dollar (DXY) is lower by only 0.4% following the FOMC decision to cut rates by 50bps. It’s clear market participants were well positioned for

海外研报

2024年09月24日

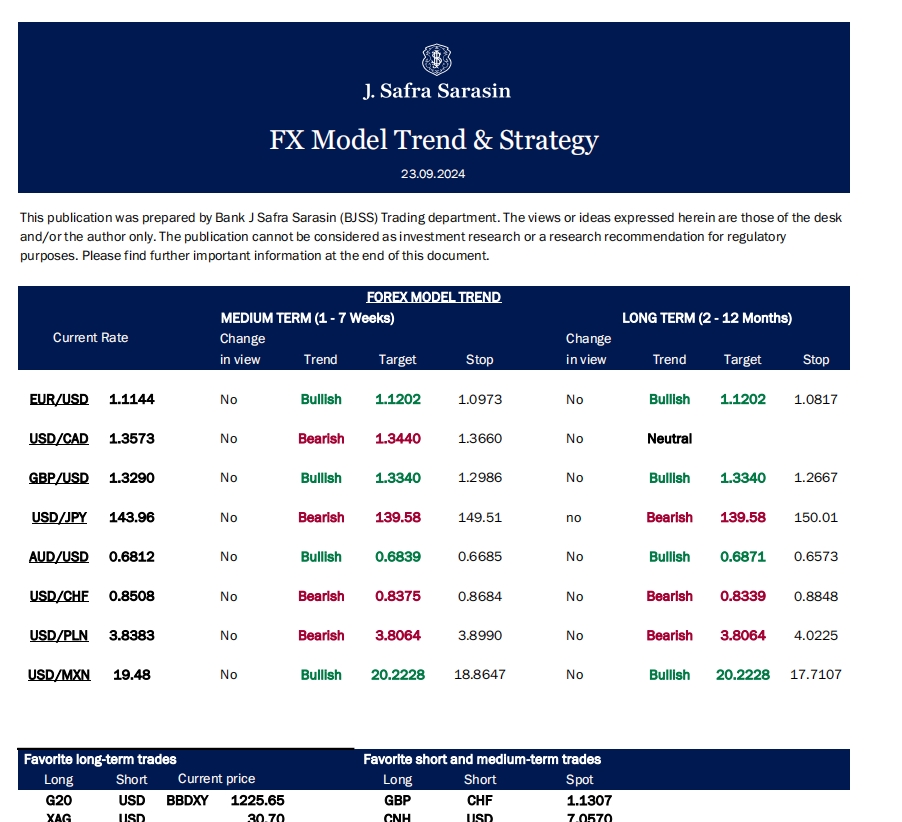

FXModelTrendStrategy_20240923_en

This publication was prepared by Bank J Safra Sarasin (BJSS) Trading department. The views or ideas expressed herein are those of the desk

海外研报

2024年09月24日

GS--Gaming What the latest state data tells us about US gaming

We update our US online sports betting (OSB) and iGaming GGR trackers,drawing on operator-level data disclosed by state gaming commissions across 29 US

海外研报

2024年09月24日

Here we are--Interest Rates Daily

Finally! Eurozone headline inflation is expected to fall below the 2.0% target, after

海外研报

2024年09月24日

USB--Hong Kong utility stocks key beneficiaries of falling US Treasury yields

Hong Kong utility stocks are historically highlycorrelated to US Treasury yields. They are key

海外研报

2024年09月24日

JPM_Equity Strategy Eurozone to keep lagging- UK stays a preferred exposure within Europe_20240923

• SX5E has failed to make ground ever since March - top chart. Even as Eurozone valuations are undemanding, trading at 12.8x forward P/E, we keep

海外研报

2024年09月24日