海外研报

筛选

GS--What’s Next in Gas: Potential Ukraine transit deal poses downside risk to our TTF forecast

News today (September 19th) of a potential deal between Ukraine andAzerbaijan that would effectively prevent the halt of the remaining 42 mcm/d of

海外研报

2024年09月22日

Why High Yield Now?

We’ve often heard that European High Yield spreads are tight (currently ~370bps), and that prices need to fall (and yields rise) before the credit cycle can ultimately

海外研报

2024年09月22日

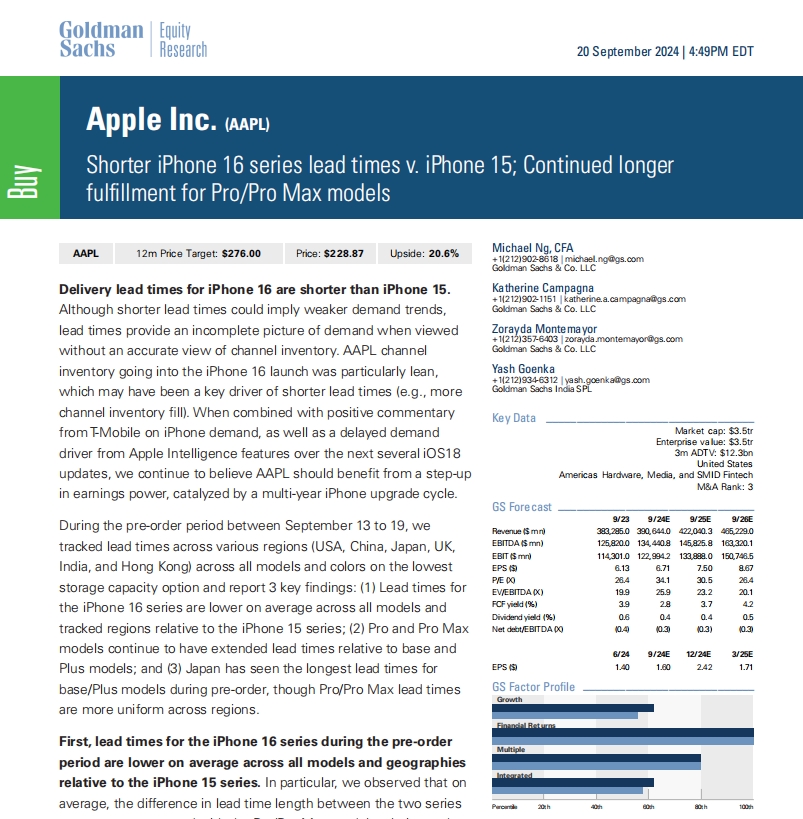

GS--Shorter iPhone 16 series lead times v. iPhone 15; Continued longer fulfillment for

Delivery lead times for iPhone 16 are shorter than iPhone 15.Although shorter lead times could imply weaker demand trends,

海外研报

2024年09月23日

GS--How Global Economic News Affects AEJ Financial Markets

The release of information about activity, inflation, or other aspects of an economycan have a substantial impact on financial markets. In this piece, we crunch through

海外研报

2024年09月23日

BofA_A SmallCap Week Ahead Companies reporting – 23rd September to 27th September_20240919

>> Employed by a non-US affiliate of BofAS and is not registered/qualified as a research analyst under the FINRA rules.

海外研报

2024年09月23日

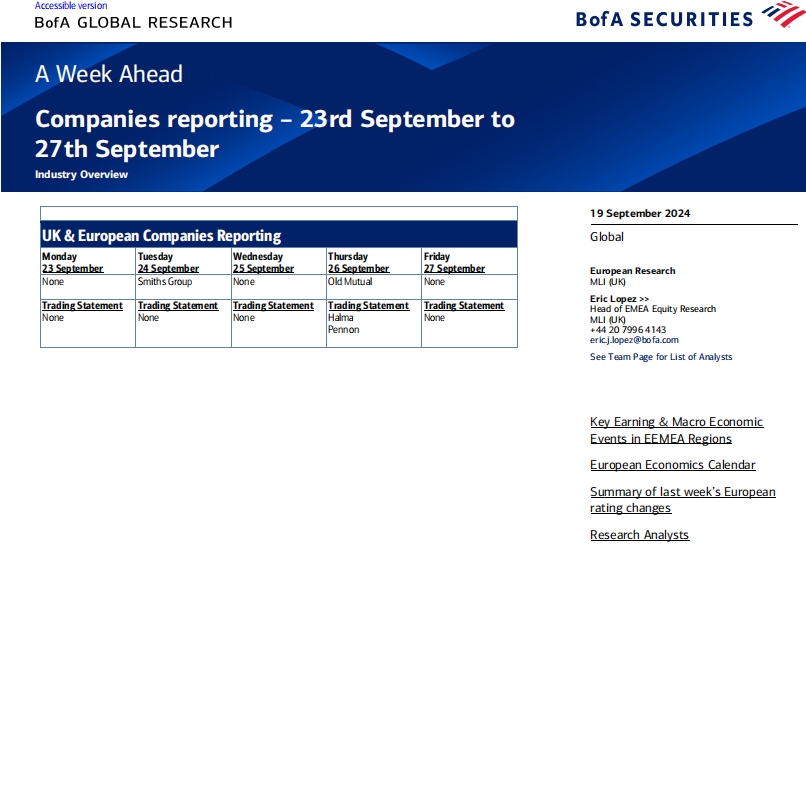

BofA_A Week Ahead Companies reporting – 23rd September to 27th September_20240919

under the FINRA rules.Refer to "Other Important Disclosures" for information on certain BofA Securities entities that take

海外研报

2024年09月23日

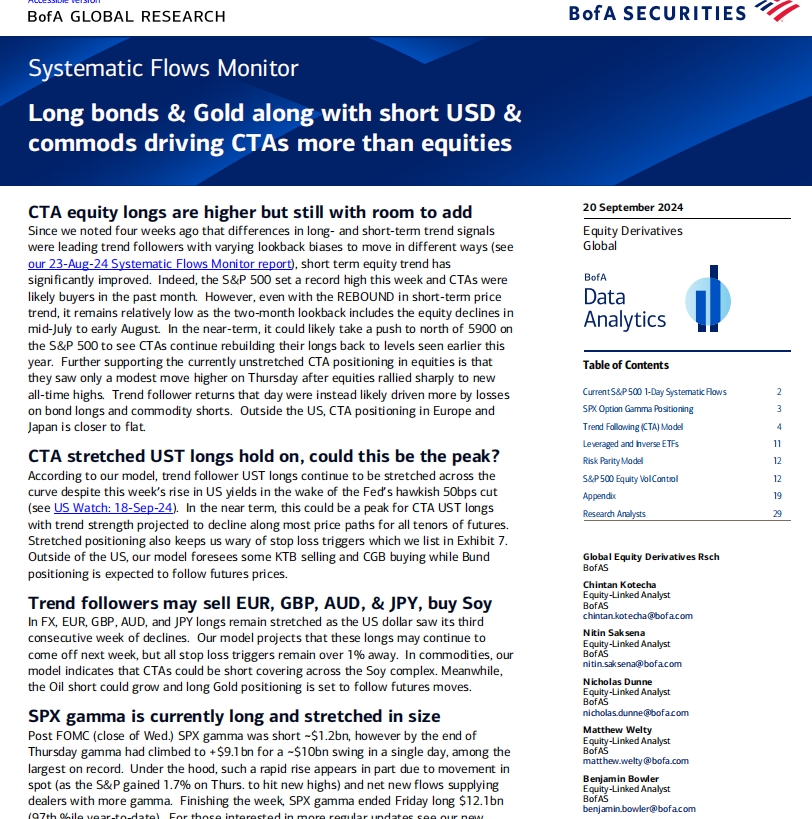

BofA_Systematic Flows Monitor Long bonds & Gold along with short USD & commods driving

CTA equity longs are higher but still with room to addSince we noted four weeks ago that differences in long- and short-term trend signals

海外研报

2024年09月23日