海外研报

筛选

BofA - Savita Subramanian - Quantitative Profiles Factors for the first Fed cut_20240916

Cut beneficiaries include Quality, Momentum, Cash returnOur economists expect the Fed to commence rate cuts at the Fed meeting this

海外研报

2024年09月19日

BofA Monthly HF Update August 2024

Equity L/S leads: YTD, Equity L/S leads at 10.7%, followed by Relative Value at 8.8%, then Multi-Strategy at 7.6%.1Most HF strategies generated

海外研报

2024年09月19日

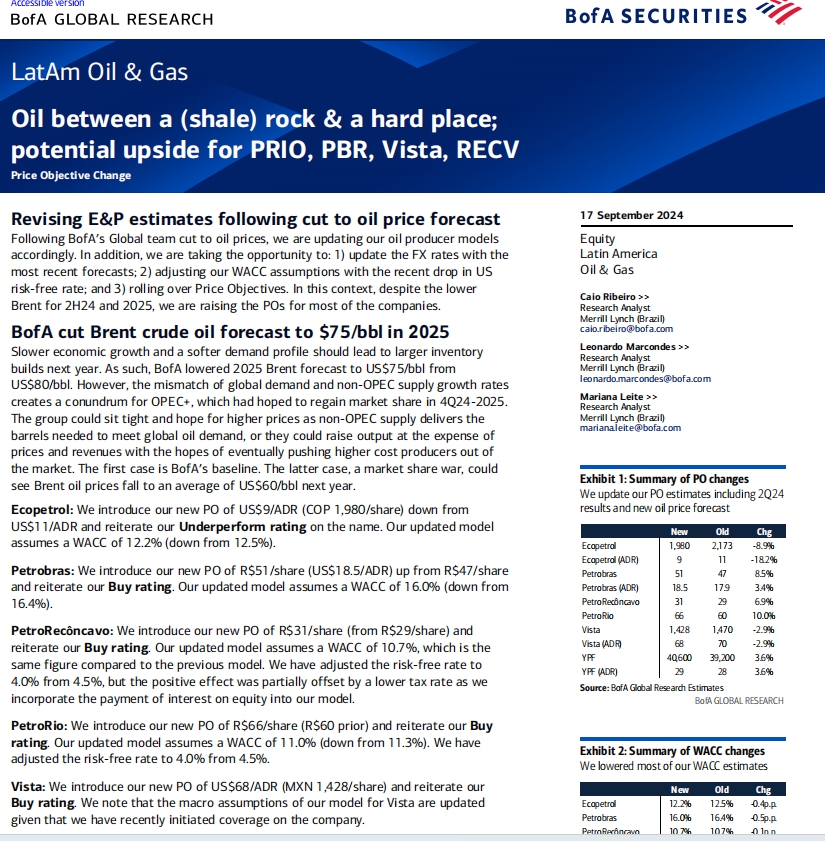

BofA_LatAm Oil & Gas

Revising E&P estimates following cut to oil price forecastFollowing BofA’s Global team cut to oil prices, we are updating our oil producer models

海外研报

2024年09月19日

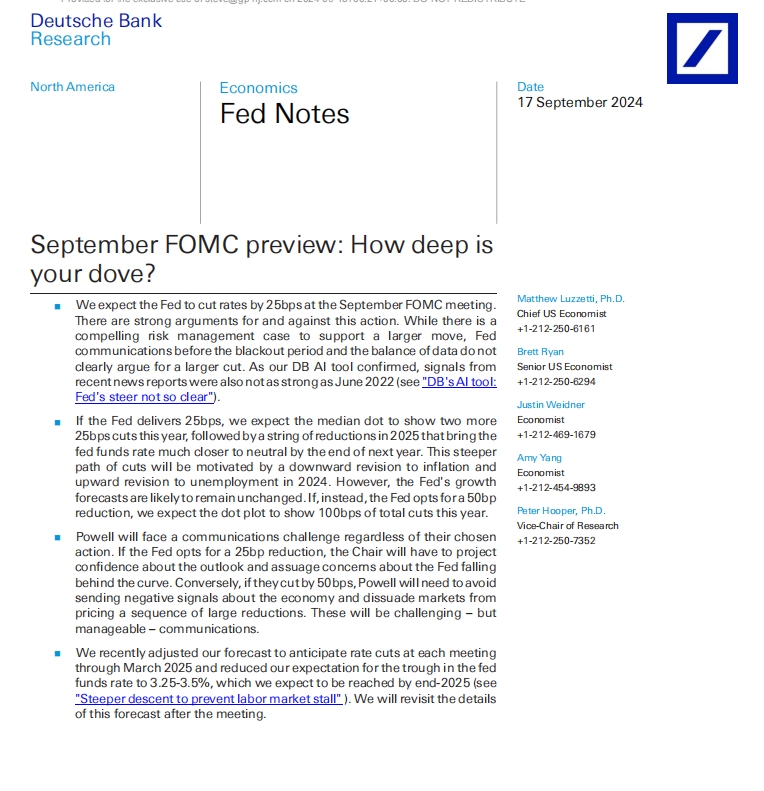

DB_September FOMC preview- How deep is your dove_20240918

We expect the Fed to cut rates by 25bps at the September FOMC meeting. There are strong arguments for and against this action. While there is a

海外研报

2024年09月19日

Deutsche Bank - Central Bank Digital Currencies & Cash_A long, quiet river

***Following the release of our new Future of Money chartbook, Part 1 on cryptocurrencies and stablecoins, last week, today we publish Part 2 on

海外研报

2024年09月19日

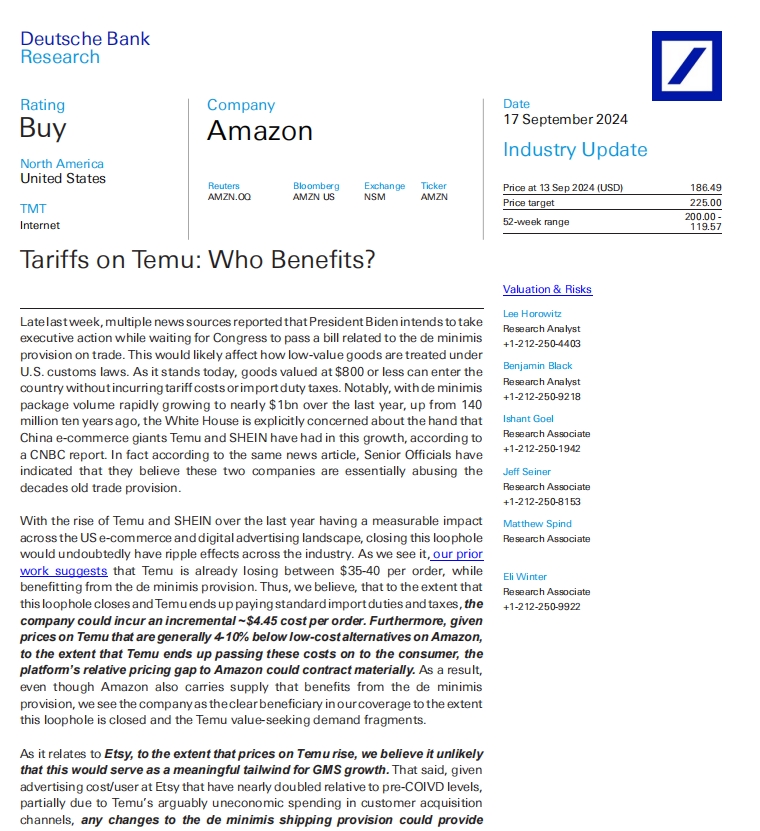

Deutsche Bank Research - Amazon - Sep 17

Late last week, multiple news sources reported that President Biden intends to take executive action while waiting for Congress to pass a bill related to the de minimis

海外研报

2024年09月19日

DB--Dividend Hike and Buyback Plan Underscore Shareholder Commitment

increase in its quarterly dividend to $0.83/sh (from $0.75/sh) on Monday after the close, along with a new $60bn share repurchase authorization with no set

海外研报

2024年09月19日

GS--A transition period for reserving: Initiate on Munich Re (Buy

Reinsurers have seen strong 2023 returns continue into 2024The reinsurance subsector’s RoE has been below its cost of equity in four of the last

海外研报

2024年09月19日

GS--Cross-checking views on inventory levels across end markets

Inventory levels across the industrial value chain, and their impact on thecapital goods companies’ top lines, have been an ongoing topic of discussion

海外研报

2024年09月19日

GS--Global Markets Daily: Historical Yield Curve Dis-Inversion Episodes and Cross-Asset Performance

In the past couple of weeks, the US 10s2s yield curve dis-inverted for the first ntime since July 2022 following a more dovish repricing of central bank cutting

海外研报

2024年09月19日