海外研报

筛选

Start Small or Begin Big?

attempted to look past recession fears, while the European Central Bank cut rates by25bps in its September meeting. The ECB in particular left its policy guidance for rate

海外研报

2024年09月15日

Asia--Macro_Weekly_Asia_local_markets_resilience_to_be_tested

The Fed is widely expected to begin its monetary easing next week. Amid divided views on the size and pace of US monetary easing, we expect three

海外研报

2024年09月15日

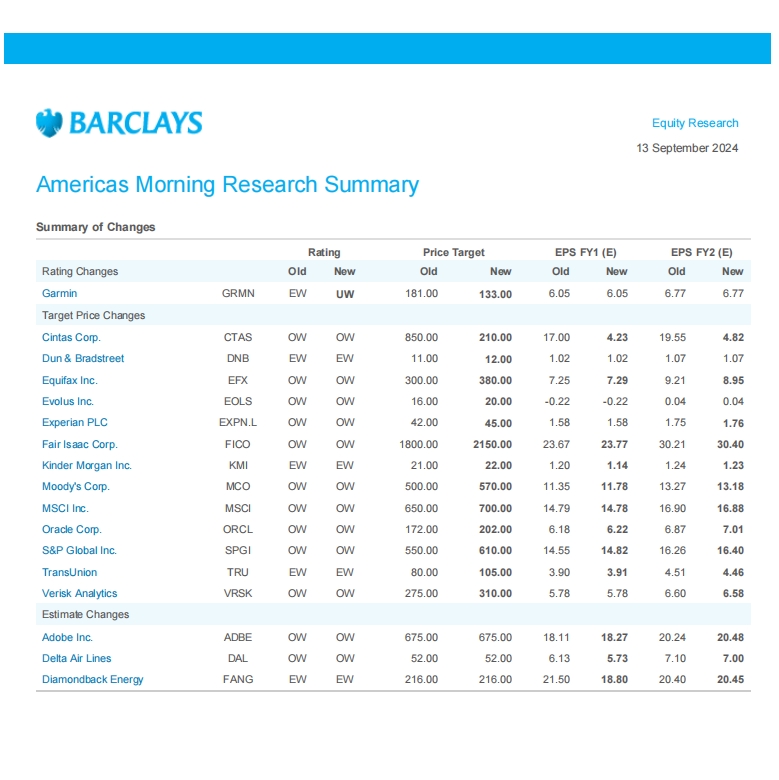

Barclays--Americas Morning Research Summary_20240913

This summary is compiled from research reports previously published by Barclays Equity Research. A full list of all publications is available on

海外研报

2024年09月15日

Barclays--European Morning Research Summary_20240913

This summary is compiled from research reports previously published by Barclays Equity Research. A full list of all publications is available on

海外研报

2024年09月15日

BofA - Hartnett - The Flow Show 3B Bulls_20240912

Scores on the Doors: gold 21.6%, stocks 13.6%, crypto 9.1%, HY bonds 6.9%, IG bonds 4.8%, cash 3.7%, govt bonds 2.2%, US dollar 0.3%, commodities -2.0%, oil -6.1% YTD.

海外研报

2024年09月15日

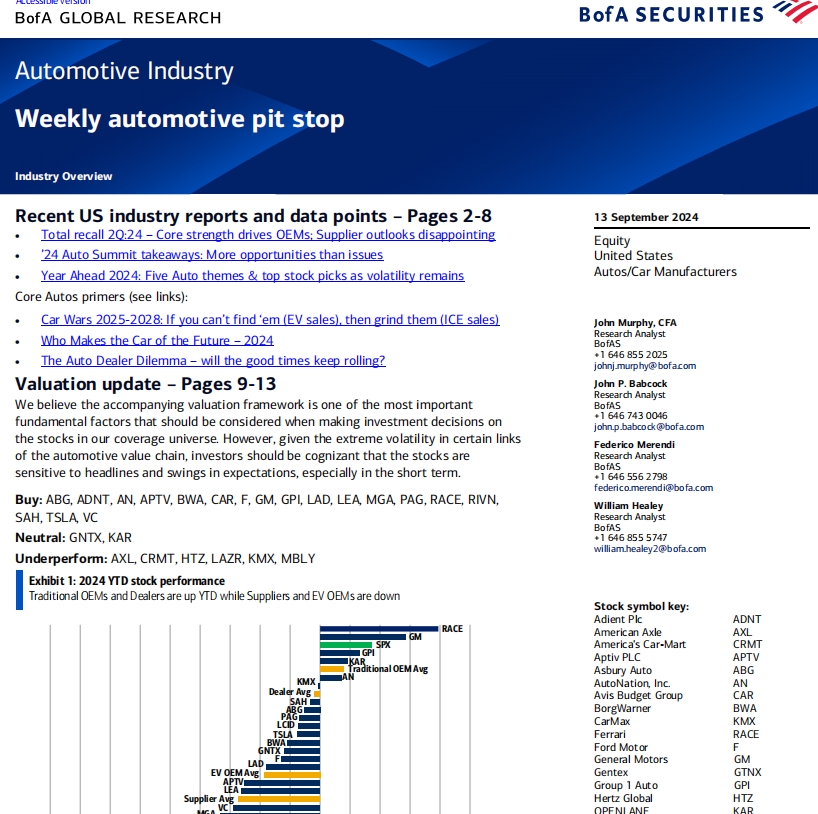

BofA--Automotive Industry Weekly automotive pit stop_20240913

Recent US industry reports and data points – Pages 2-8 • Total recall 2Q:24 – Core strength drives OEMs; Supplier outlooks disappointing•

海外研报

2024年09月15日

BofA--Global FX Weekly Powell s victory lap- Draghi s frustration_20240913

G10. US soft landing and Fed still main market drivers. Draghi shows the way in Europe. EM. More conservative Fed pricing to weight on EM FX.

海外研报

2024年09月15日

BofA_Macro Risk Digest So it begins_20240913

We estimate corporates in Europe and Asia collectively held around $1trn of FX deposits in 1Q 2024. An unwind could amplify USD depreciation, although more likely over the

海外研报

2024年09月15日

BofA--Stock Flash Bullish AVGO, LOW, PLTR and ROST. Bearish FERG and SCHW_20240912

Broadcom (AVGO): Bullish triangle breakout watchAVGO is a semiconductor devices stock that is on bullish triangle breakout watch. A

海外研报

2024年09月15日

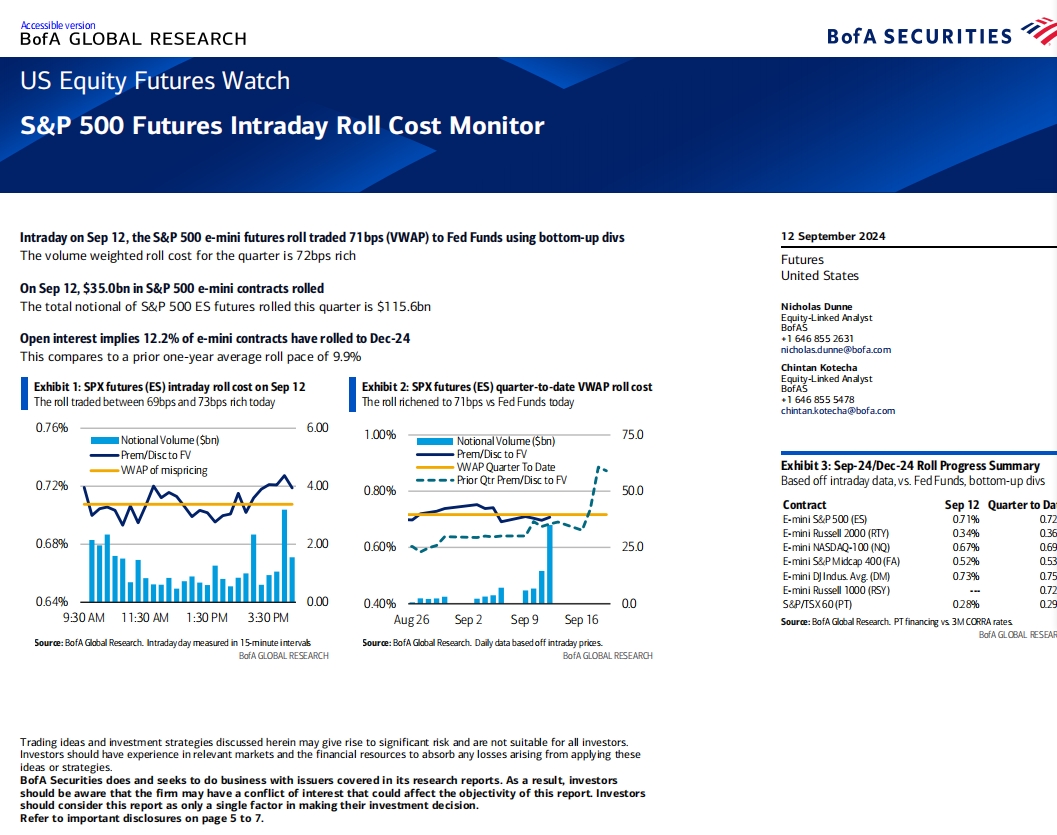

BofA--US Equity Futures Watch - S&P 500 Futures Intraday Roll Cost Monitor_20240912

Trading ideas and investment strategies discussed herein may give rise to significant risk and are not suitable for all investors.

海外研报

2024年09月15日