海外研报

筛选

FX Fair Value Update

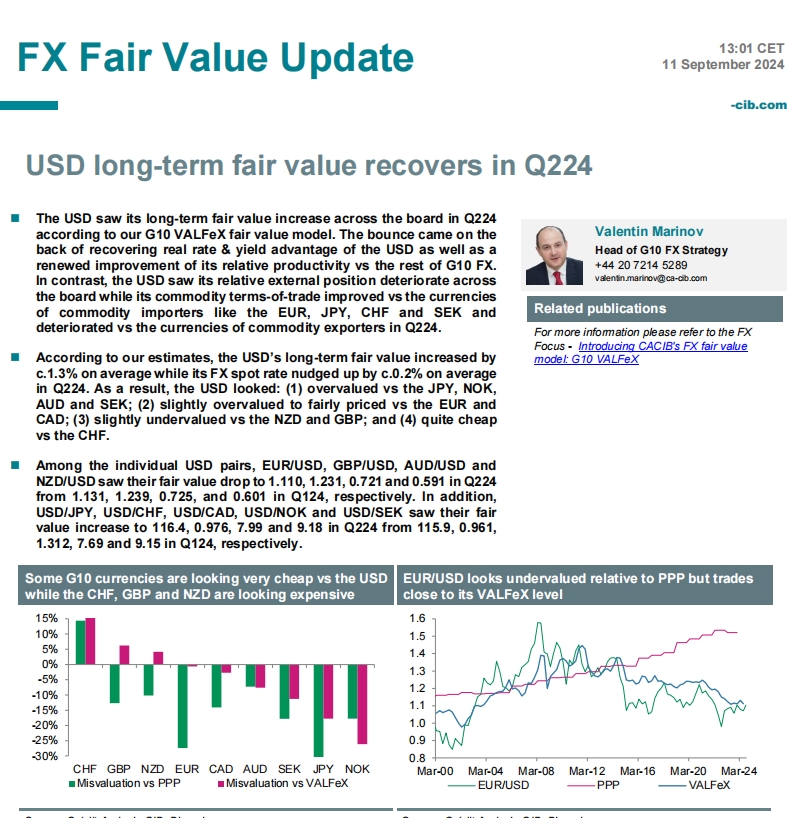

The USD saw its long-term fair value increase across the board in Q224according to our G10 VALFeX fair value model. The bounce came on the

海外研报

2024年09月13日

GS--Xometry Inc. (XMTR): Communacopia + Technology Conference 2024 — Key Takeaways

Presenters: We hosted Co-Founder & CEO Randy Altschuler and CFO James Miln atthe Communacopia + Technology Conference.

海外研报

2024年09月13日

GS--ADT Inc. (ADT): Communacopia + Technology Conference 2024 — Key Takeaways

Bottom line: ADT has streamlined the business over the past year to focus onresidential security monitoring with the divestiture of its commercial business and

海外研报

2024年09月14日

GS--Alphabet Inc. (GOOGL): Communacopia + Technology Conference 2024 — Key Takeaways

Bottom line: We highlight a few key takeaways from our conversation: 1) Publiccloud market remains in the early stages of growth & penetration driven by newer

海外研报

2024年09月14日

GS--Altice USA Inc. (ATUS): Communacopia + Technology Conference 2024 — Key Takeaways

Bottom line: We have three key takeaways: (1) Altice remains optimistic that itsstrategic and operational changes will lead to improvement and stabilization in core

海外研报

2024年09月14日

GS--Aptiv Plc (APTV): 2024 Communacopia + Technology Conference — Key Takeaways

Presenters: Kevin Clark, Aptiv’s Chairman & CEO as well as Joe Massaro, thecompany’s Vice Chairman & CFO presented at the conference.

海外研报

2024年09月14日

GS--ASML Holding (ASML.AS): Communacopia + Technology Conference — Key Takeaways

Presenters: We hosted Skip Miller, Head of Investor Relations, and Jim Kavanagh,US Investor Relations, at ASML, at the Communacopia + Technology Conference in

海外研报

2024年09月14日