海外研报

筛选

GS--Crown Castle International Corp. (CCI): Communacopia + Technology Conference 2024

Bottom line: We have three key takeaways: (1) Crown Castle remains constructiveon its domestic tower operations as its wireless carrier customers will need to

海外研报

2024年09月11日

DR--Labor market: Not enough chill to heat up cuts in September

Weather workers” series normalized after the spike in

海外研报

2024年09月11日

DR--Investor Positioning and Flows

Our measure of aggregate equity positioning was choppy through the week but remained modestly above average (z score 0.37, 65th percentile). Under the surface,

海外研报

2024年09月11日

DB--Poised to reshape multiple industries

In conjunction with our US Autos resumption of coverage, we take a closer look at Tesla's upcoming Robotaxi Day (10/10), advantages in autonomous driving, and

海外研报

2024年09月11日

DB--Navigating through uncertain times

We resume coverage of US Autos & Auto Technology (17 stocks) including automakers and suppliers. In the face of growing uncertainty about industry

海外研报

2024年09月11日

EW--Risk recovery and Fed cuts bodes well for EM outperformance

Macro focus: The incoming data over the past month, including the August employment report, clearly points to a slowing US economy with restrictive

海外研报

2024年09月11日

CA--FAST FX Fair Value Model

triggered any new trades. Most of the ten crosses covered by the model are trading within one standard deviation of their fair values. The FAST

海外研报

2024年09月11日

GS--Global Markets Daily: The Dollar After the First Cut (Rosenberg)

Historically, Dollar performance has varied widely around the start of the easing ncycle. Looking across seven Fed cutting cycles since 1995, we find that Dollar

海外研报

2024年09月11日

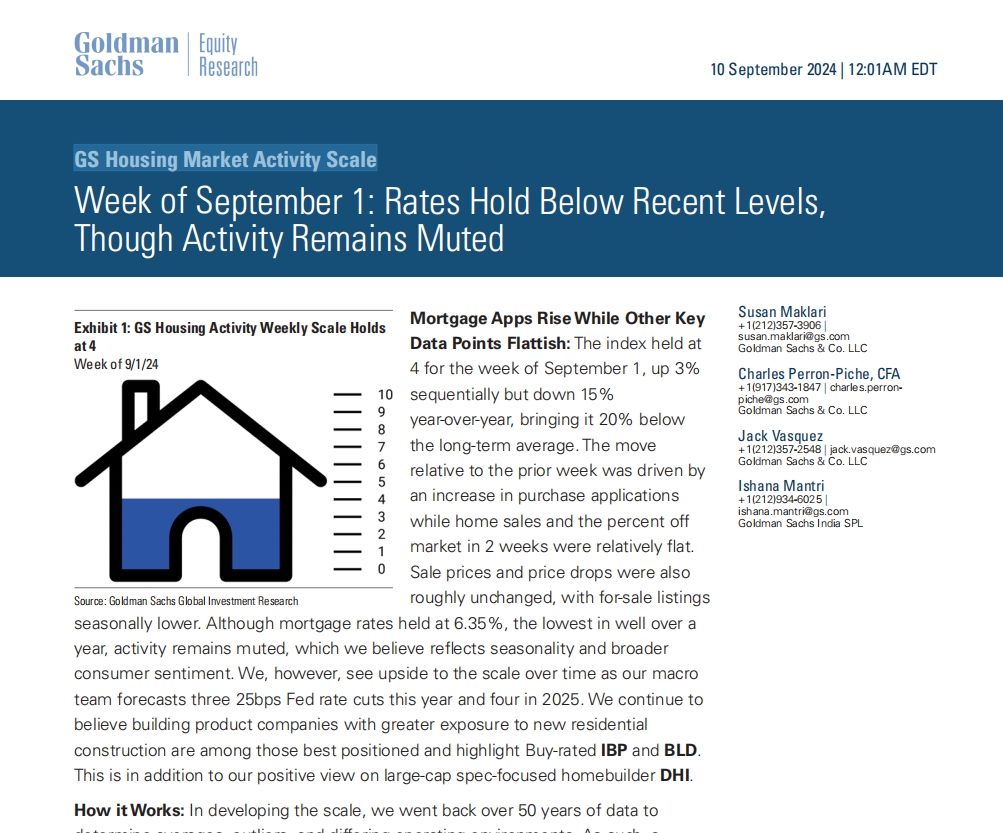

GS-- Housing Market Activity Scale

Mortgage Apps Rise While Other KeyData Points Flattish: The index held at

海外研报

2024年09月11日

GS--Jack Henry & Associates Inc

Presenters: Mimi Carsley, CFO & TreasurerModerated by: Will Nance, Payments and Financial Technology, Goldman Sachs

海外研报

2024年09月11日