海外研报

筛选

SALES & TRADING COMMENTARY (Not a product of MS Research) FOR INSTITUTIONAL USE ONLY

The market is struggling with challenges of a semiconductor selloff and broader growth slowdown (related, but not 100% the same) against a backdrop of September

海外研报

2024年09月06日

Final Destination--Global Daily

Yesterday, stocks were mostly down, but Nividia was up after refuting its DOJ subpoena story; oillower after an aborted rally; Treasury yields down as the US curve disinverted; and JPY up.

海外研报

2024年09月06日

Taiwan: August Inflation Inches Down

Taiwan’s headline CPI inflation inched down to 2.4% yoy in August from 2.5% theprevious month after three months of acceleration. The outcome was above

海外研报

2024年09月06日

Short long summer

Risks remain balanced for EUAs, although we think a move towards (and potentially below) our fair-value 3Q24 price of €70/t is most likely. We think the risks for this

海外研报

2024年09月06日

Macro & Strategy

In line with our Group’s vision to be the bank for Europe’s future, we continue to focus on product innovation and service excellence.

海外研报

2024年09月06日

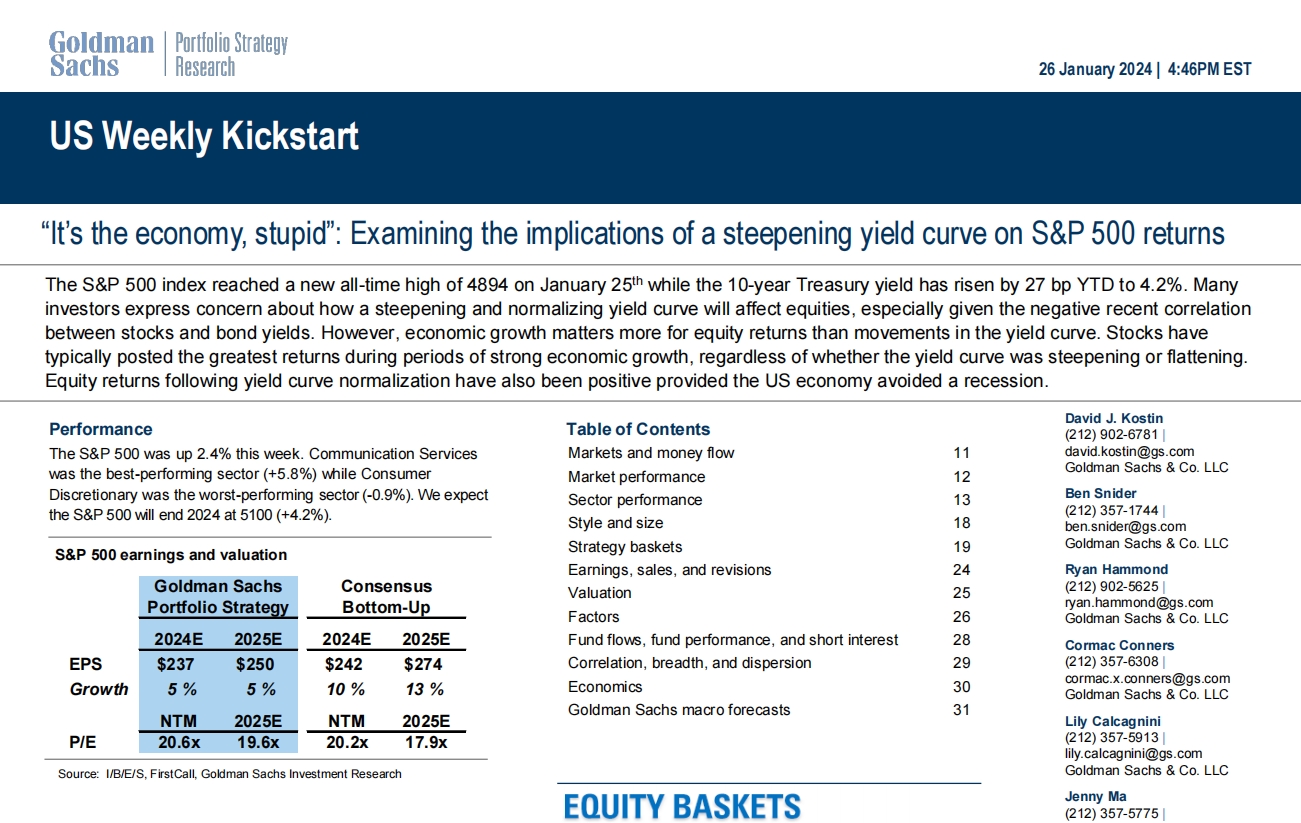

US Weekly Kickstart

The S&P 500 index reached a new all-time high of 4894 on January 25th while the 10-year Treasury yield has risen by 27 bp YTD to 4.2%. Many

海外研报

2024年09月06日

ADP Employment Below Expectations

BOTTOM LINE: According to the ADP report, private sector employment increasedby 99k in August, below consensus expectations, and employment in July was

海外研报

2024年09月06日

CitiFX Wire | Linear Trading

The market seems to still have an appetite to sell USD on the basis that unless Friday’s number is a super strongoutcome, then the August narrative can reassert itself, and the unwind of 2024’s dollar long overhang can continue. (For

海外研报

2024年09月06日