海外研报

筛选

Macro Insights Weekly Putting the inflation genie back in the 2% bottle

The market is watching closely for signs for US economic slowdown, pricing in about 100bps in

海外研报

2024年08月21日

Breaking with convention--Global Daily

Pity those having to make forecasts for the global economy right now. After all, they are having to do so less than 80 days from a US election in which two radically different policy platforms are

海外研报

2024年08月21日

Americas Transportation: Eye on Freight: “Big Three” Ports Grow Above Seasonality

Imports were positive YoY in July, up 43%, after June’s strong 20% growth andMay’s -3% growth. July’s values of 1,016,497 TEUs was above prior implied values of

海外研报

2024年08月21日

Americas Transportation: Railroads: Weekly Rail Carload Snapshot — Week 33

Total traffic results for US Class I rails under coverage imply carload growthat +6.9% YoY in week 33, an acceleration versus +4.3% YoY in week 32.

海外研报

2024年08月21日

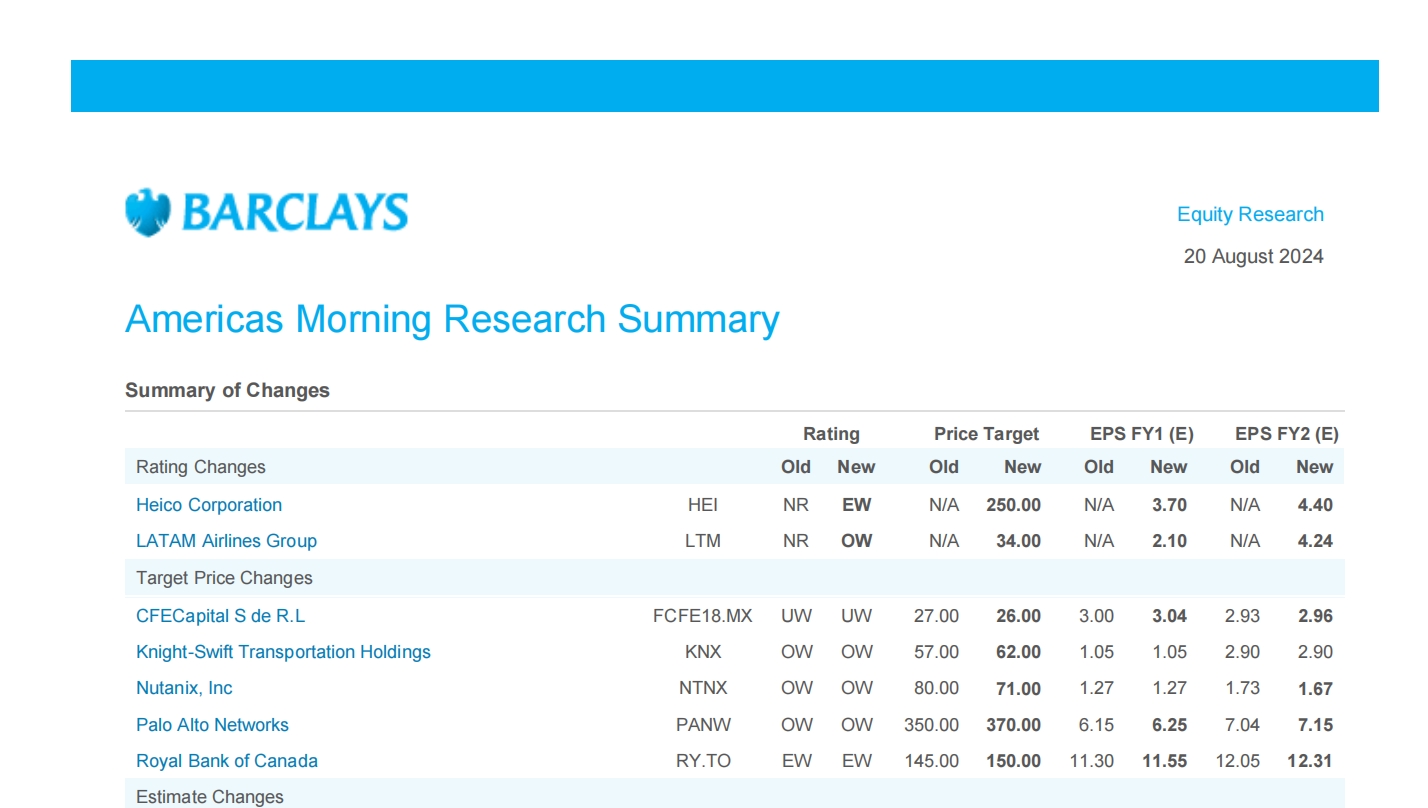

Americas Morning Research Summary

This summary is compiled from research reports previously published by Barclays Equity Research. A full list of all publications is available on

海外研报

2024年08月21日

Energy Sigma Another reset

Oil prices have recovered somewhat from the early-Augustselloff that coincided with another reset in speculative

海外研报

2024年08月21日

BofA Securities Equity Client Flow Trends Clients bought last week’s rally

2nd week of equity inflows: Last week, during which the S&P 500 rallied 3.9%, BofA Securities clients were net buyers of US equities (+$2.7B) for a second week

海外研报

2024年08月21日

Global Positioning in Stocks Trendy Industrials

Industrials are the flavour of the monthAs global equities rallied 1.5% in July, long-only funds globally increased active equity

海外研报

2024年08月21日

Interest Rates Trade Idea-Close: long TIPS 5Y breakevens

On 20 June, we recommended being long TIPS 5Y breakevens (BEs), as theylooked cheap to oil prices and nominal Treasury yield. At around 2.21% on

海外研报

2024年08月21日

Coal Tracker: Natural gas-driven coal rally has overshot fundamentals

In the past three weeks, the physical API2 price rallied to 123 USD/t, 21% upfrom its July 2024 low, while the Newcastle coal price rallied by 9% to 145

海外研报

2024年08月21日