海外研报

筛选

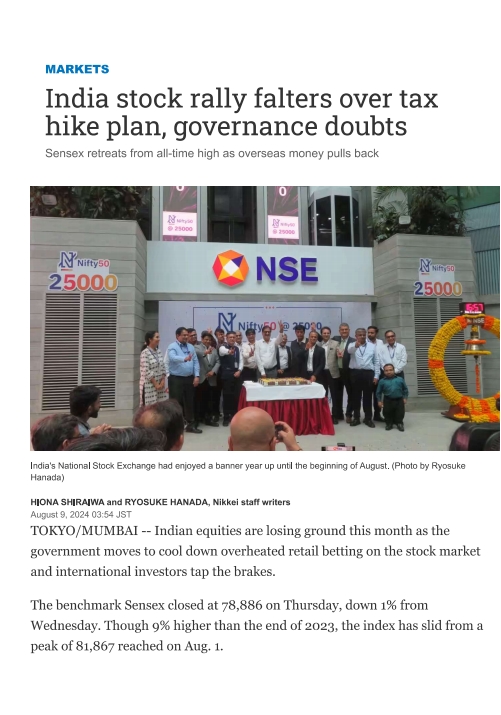

India stock rally falters over taxhike plan, governance doubts

HIONA SHIRAIWA and RYOSUKE HANADA, Nikkei staff writersAugust 9,2024 03:54 JSTTOKYO/MUMBAl -- Indian equities are losing ground this month as thegovernment moves to cool

海外研报

2024年08月09日

Hawkish policy statement raises food inflation concerns

The RBI MPC voted 4:2 to keep the policy repo rate unchanged at 6.50% at theAugust meeting, and retained the policy stance of “withdrawal of

海外研报

2024年08月09日

Slightly Lowering Our 2024Q2 GDP Final Tracking Estimate to +2.1% QoQ Annualized

We revise down our Q2 (April-June) 2024 real GDP final tracking estimate slightlyto +2.1% qoq annualized, from our previous forecast of +2.4%. Downward

海外研报

2024年08月09日

Equity Strategy

See the end pages of this presentation for analyst certification and important disclosures.J.P. Morgan does and seeks to do business with companies covered in its research reports. As

海外研报

2024年08月09日

INTERNATIONAL MARKET INTELLIGENCE:MORNING BRIEFING AUGUST 8.2024

OVERNIGHT BRIEFUS/EU trade: European Equities were higher (SXXP +1.5%, $X5E +2%). Almost all D1 baskatsrallied over +iz today as mean revarsion picked up momantum from the open after

海外研报

2024年08月09日

Overview – Retail Trading

For the latest data, including intraday updates, visit Investable AI/Data Analytics. • Since our Monday update, retail traders have reverted back to net buying

海外研报

2024年08月09日

Retail Radar Who bought the dip today?

For the latest data, including intraday updates, visit Investable AI/Data Analytics. • Retail participants were aggressive net sellers today, with much of the

海外研报

2024年08月09日

US MARKET INTELLIGENCE:MORNING BRIEFING AUGUST 8,2024

and VIX @ 28.43.US: Futs are off small with NDX unchanged, JPM FX Strategists see the carry unwind -75%complete, Pre-mkt, Mag7 and Semis are providing support, Bond yields are down 2-

海外研报

2024年08月09日

Market Intelligence: US Morning Update

Stocks in Asia were mixed, but with a negative bias, on Thursday. Mainland Chinaand Hong Kong markets ended flat, while Taiwan (-2%) and India (-0.6%) ended

海外研报

2024年08月09日

Higher Than Expected Jul Inflation Driven by Non-Core

Bottom Line: The July CPI printed slightly above expectations, driven chiefly bynon-core perishable food and regulated prices. Headline inflation printed at 1.05% in

海外研报

2024年08月09日