海外研报

筛选

Asia-Pacific Growth Monitor: Steady overall, SE Asia outperforming

This publication summarizes regional and country-specific growth data across nthe Asia-Pacific economies we cover. In most cases, the latest data points arefor August 2024.

海外研报

2024年09月06日

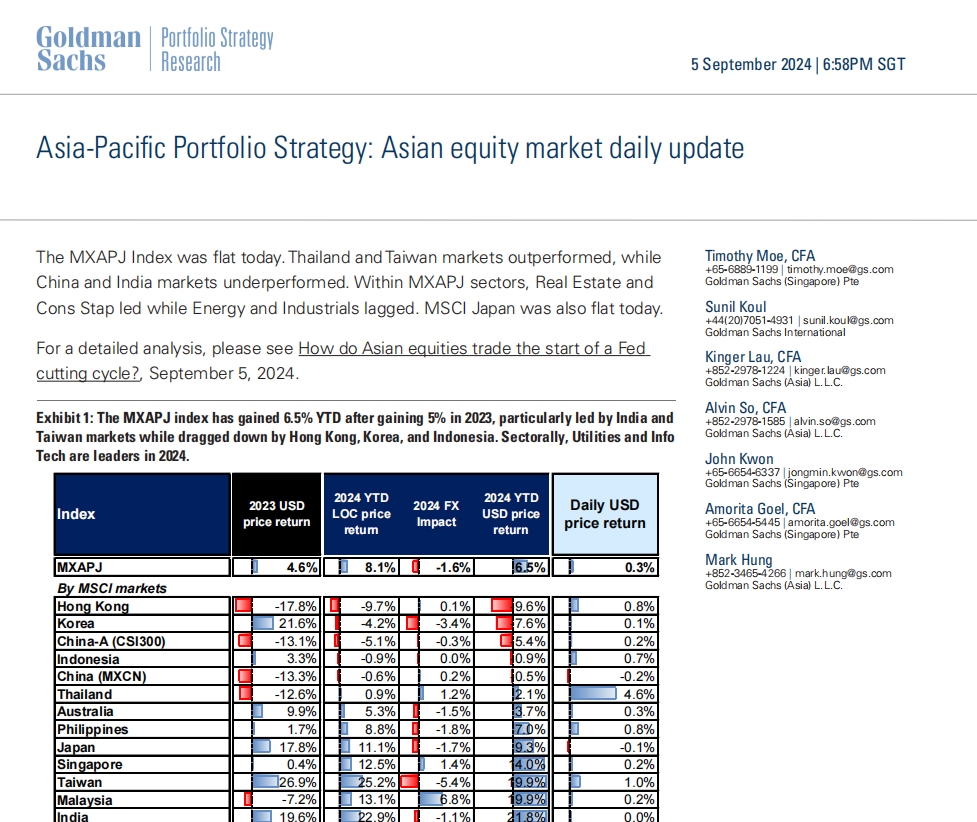

Asia-Pacific Portfolio Strategy: Asian equity market daily update

The MXAPJ Index was flat today. Thailand and Taiwan markets outperformed, while

海外研报

2024年09月06日

August employment preview: improved from July

We expect nonfarm payrolls to rise by +165k in August, bouncing back somewhat from the soft print of just +114k in July. If our forecast is on

海外研报

2024年09月06日

Morning Market Tidbits From one mandate to the other

An end to the sole focus on the inflation mandateFor this inflation forecaster, next week’s CPI report will be bittersweet. After a

海外研报

2024年09月06日

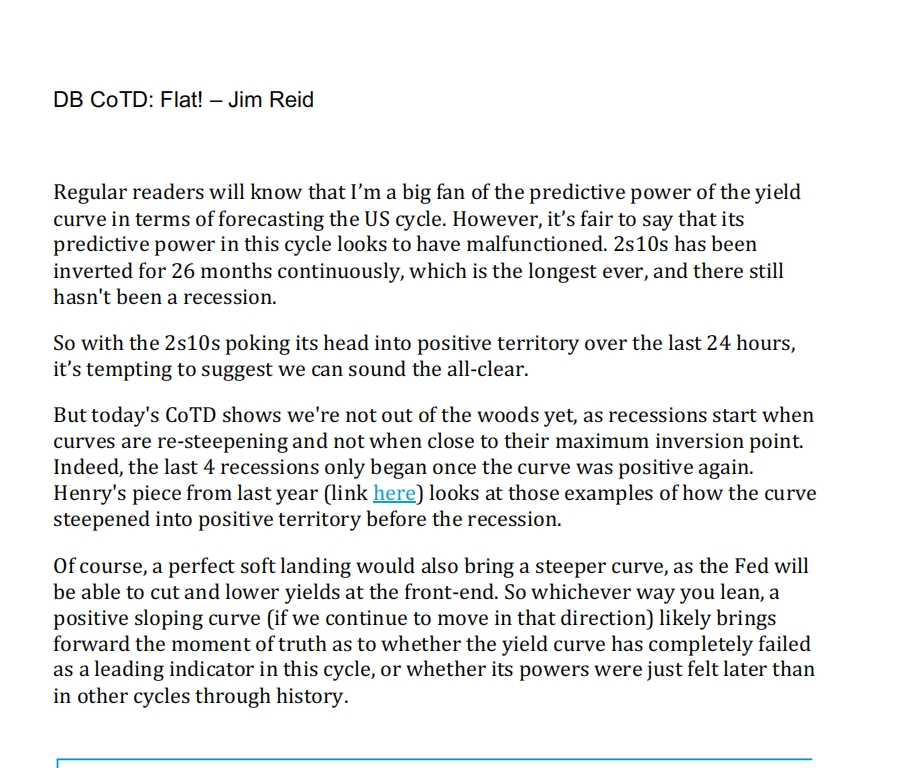

DB CoTD: Flat! – Jim Reid

Regular readers will know that I’m a big fan of the predictive power of the yield curve in terms of forecasting the US cycle. However, it’s fair to say that its

海外研报

2024年09月06日

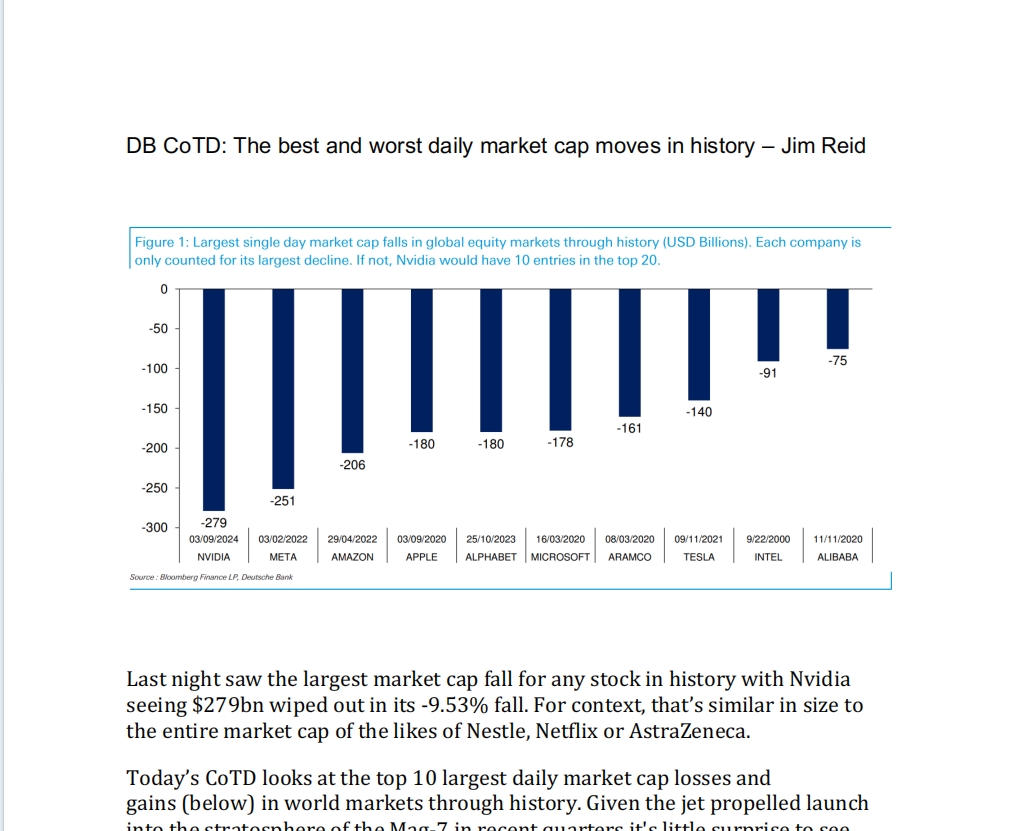

DB CoTD: The best and worst daily market cap moves in history – Jim Reid

Last night saw the largest market cap fall for any stock in history with Nvidia seeing $279bn wiped out in its -9.53% fall. For context, that’s similar in size to

海外研报

2024年09月06日

US SAAR moderates with Europe also soft, STLA US sales continue to decline

US SAAR moderates as incentives remain up - US SAAR was 15.1mn units inAugust, stepping down by -4.4% vs. July and broadly flat YoY at +0.6%. The print

海外研报

2024年09月06日

Global Retail Conference 2024 — Day 1 Takeaways

Day 1 of our 31st Annual Global Retailing Conference revealed a better-than-fearedand cautiously optimistic tone on the outlook for the consumer into 2H. This slightly

海外研报

2024年09月06日

AI: To buy, or not to buy, that is the question

The technology sector has generated 32% of the Global equity return and40% of the US equity market return since 2010. This has reflected

海外研报

2024年09月06日

GS UK Today: AI | Encore: Buy AstraZeneca, Wise

AI – to buy, or not to buy – The technology sector has generated 32% of the Global

海外研报

2024年09月06日