海外研报

筛选

Slash and Burn

Macro jitters and vol spike clear out an "overgrown"' equity rally. After a summer rallyfueled mostly by multiple expansion, recession fears are back and motivated LOs to cutequity exposure to 2021 lows. At the same time, Treasury futures positions

海外研报

2024年08月16日

Cross-Asset Weekly

The financial market turbulences this week have highlighted that (1) macro risks are shifting from inflation to growth, (2) carry trades are vulnerable to sharp reversals in late cycle ear.

海外研报

2024年08月12日

Weekly FX summary – 5 August 2024

quo on Wednesday. Mexico and India to stand pat on Thursday. China trade data on Wednesday and CPI on Friday.

海外研报

2024年08月08日

Outlook for public and private markets

Unless otherwise noted, information included herein is presented as of the dates indicated. Apollo GlobalManagement, Inc. (together with its subsidiaries, “Apollo”) makes no representation or warranty, expressed or

海外研报

2024年07月16日

From the Global Director of Research | North America

A guiding principle at Morgan Stanley Research is to enhance your investment process by delivering unique insights that

海外研报

2024年07月31日

Robust headline growth with underlying weakness

Indonesia’s 2Q24 real GDP growth printed at 5.05% yoy, a tad higher than our expectation of 5.04% and lower than the 5.1% recorded for 1Q24. While a weak deflator

海外研报

2024年08月08日

Navigating 2025 AI cloud investment

The Morgan Stanley tech team's median expectation is for NVIDIA-related stocks to grow 37% Y/Y and non-NVIDIA to grow 14%.

海外研报

2024年08月12日

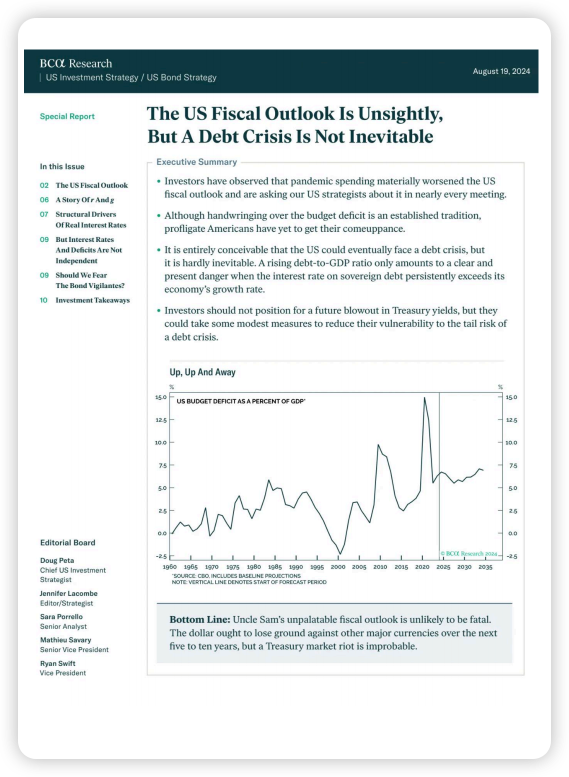

The US Fiscal OutlookIs Unsightly,But A Debt Crisis Is Not Inevitable

Executive SummaryInvestors have observed that pandemic spending materially worsened the USfiscal outlook and are asking our US strategists about it in nearly every meeting

海外研报

2024年08月20日

StoneX Strategy U.S. Landing Gear Engaged, Labor Data in Focus

StoneX Strategy U.S. Landing Gear Engaged, Labor Data in FocusA spate of recent data indicate that while the U.s. labor market has slowed, the economy has avoidedspiraling into recession

海外研报

2024年08月30日

GS--Communacopia + Technology Conference 2024 — Key Takeaways02

Bottom line: We have three key takeaways: (1) IBM sees solid underlying demandin infrastructure Software despite weaker discretionary spending (which is a

海外研报

2024年09月16日